Tackle customers love AWS Marketplace’s flexible payment schedule option. Here’s why you might too.

AWS Marketplace released its flexible payment scheduler in 2018 to simplify long-term contracts. Since then, Tackle has seen a growing number of independent software vendors (ISVs) leveraging this feature in Tackle when extending private offers to their buyers. In fact, 74% of Tackle AWS Marketplace ISVs who created a private offer within Tackle in the last 90 days added a scheduled payment to their private offers. This translated to 2,299 payments to be exact. That’s a lot of payments!

If you’re an ISV looking to grow your Marketplace business, but unsure how to structure your private offers or more reliably predict your Marketplace disbursements, here are three reasons why you should consider using the flexible payment scheduler.

1. Predict when and how much you can expect a disbursement to be from AWS Marketplace.

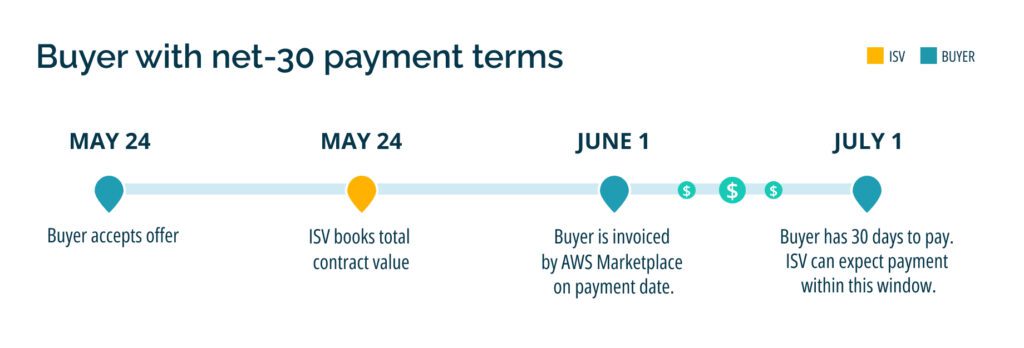

With a payment schedule, the buyer receives an invoice from AWS on a specific date you configure. For example, you set a payment date of June 1. The buyer then has 30 days (if on net-30 terms) to pay that invoice. You can predict payment to be received within that 30 day period, at the latest. It provides some consistency for when to expect disbursements for your Cloud Marketplace revenue. Finance teams love the ability to better predict Marketplace revenue!

Note: With the flexible payment scheduler, your buyer must be on invoicing terms with AWS Marketplace, which is either net-30 or net-60. They cannot use a credit card to pay for a subscription with a payment schedule.

2. Set payments to suit your buyer’s budgetary needs while booking multi-year contracts at offer acceptance. Want to pay one big payment upfront and smaller payments later? No problem.

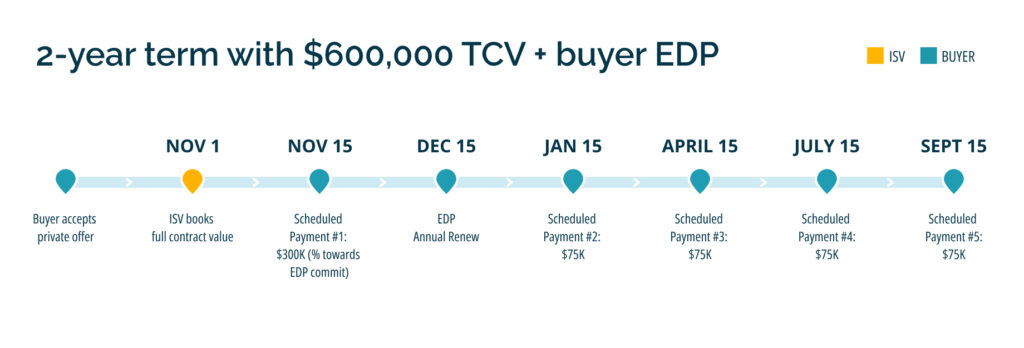

Imagine it’s fiscal year-end and a buyer tells you that they still have committed cloud spend available. They would like to use the rest to put towards their subscription. While it won’t cover the whole thing, they’re happy to make smaller payments in the new fiscal year. How would the ISV structure that private offer?

You guessed it, with a payment schedule! The payment scheduler allows you to set custom payments, no matter how big or small, at any frequency. You can set a large upfront payment to be due on offer acceptance, which taps into that buyer’s cloud commit for the current fiscal year. Then in the upcoming fiscal year, you can structure smaller monthly or annual payments like you might normally do.

Payment schedules are a win-win for both the buyer and the seller. As a seller, you can provide your buyer the flexibility they need to accommodate budgets or a cloud commitment burndown. Simultaneously, you gain the ability to book the full contract value upfront on a multi-year contract once the private offer is accepted, regardless of the payment schedule.

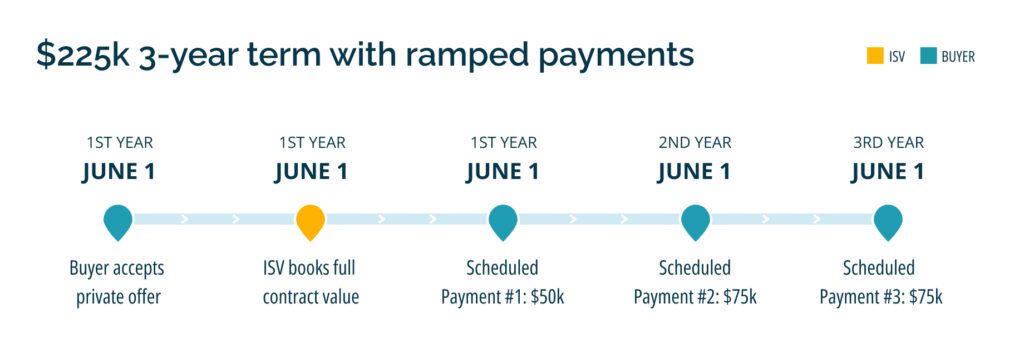

3. Structure a multi-year subscription with ramped payments.

Imagine you have a buyer who wants a three-year subscription contract. Per this contract, these “ramped deals” pay a little more each year than the previous. For example, $50,000 in the first year, $60,000 in year two, and $75,000 in year three. How would you do that through AWS Marketplace? Is it even possible?

Of course you can! With a payment schedule (as you can see is the trend!). You can take advantage of the flexible payment scheduler to truly meet your buyer where they are, offering you and your sales team a wide range of flexibility when it comes to structuring how your buyer will pay.

Bonus: Add a payment schedule to your channel partner private offers (CPPOs) to give your resellers the same benefits you get from a payment schedule.

When selling through a reseller on the AWS Marketplace, you can use a payment schedule to set the exact payment amounts you will receive from the resale deal. When your reseller extends a private offer to the buyer, they simply add their margin to each payment you, as the ISV, already set. This gives you more control over the payment dates and payment amounts you can expect.

This also gives your reseller peace of mind by getting to take advantage of all of the same benefits you get by using a payment schedule on direct deals: forecast disbursements, meet the buyer according to their budget, and set up long-term contracts with flexible payment terms.

Are you ready to start transacting with a payment schedule? Schedule your payments through Tackle!

Next time you structure a private offer on the AWS Marketplace, think about using a payment schedule! Our most successful customers take advantage of this and have found great success with their Marketplace selling motion.

Next time you structure a private offer on the AWS Marketplace, think about using a payment schedule! Our most successful customers take advantage of this and have found great success with their Marketplace selling motion.

With our customers in mind, Tackle has made it even easier for you to build a payment schedule with many equal payments by adding a tool to the private offer workflow that allows you to break down a total contract amount into as many equal payments as you need for your private offer. When creating a private offer in Tackle, select your AWS listing and select the payment schedule payment model option. Add your product dimensions and the quantity of each that your buyer is purchasing. Then, in the payment schedule section, click “Create payment schedule.” Enter the total contract value, the date of first payment, and the frequency of payments and we’ll provide you with an evenly distributed list of payments, which is perfect for those 12, 24, and 36-month deals!

Happy selling!