Learnings, predictions, and insights into the state of Cloud Marketplaces in 2022

Jump to a Category

INTRODUCTION

NOW OPEN: Contribute to the 2024 State of Cloud GTM survey!

Want the latest report? Get the 2023 State of Cloud GTM here!

We’ve seen phenomenal motion in the evolution of Cloud Marketplaces over the last three years. For the third year in a row, Tackle surveyed both B2B software sellers and buyers about their participation in the Marketplaces, the value they get from the Marketplaces, the roadblocks they face, and the reasons they believe Cloud Marketplaces have the potential to become the revenue channel of the future.

This year has been monumental as we’ve seen Cloud Marketplaces evolve from transaction vehicles to become a leading revenue channel for companies of all sizes and industries. Listing and transacting through the Marketplaces has become tablestakes and now ISVs are figuring out how to integrate Marketplace into their GTM by creating a Cloud go-to-market system.

As we face a difficult economic environment, everyone is looking for more avenues to win deals and ISVs are generating more revenue through Marketplace at a faster rate as they lean in to the many benefits of cloud selling. 44% of sellers expect to transact more than 10% of their revenue through a Cloud Marketplace in the next year, indicating the definition of success with Marketplaces is growing. Just a few short years ago, it was about doing a handful of deals, now ISVs target percentages of revenue. Many Tackle customers see 20% of their business flowing through Marketplaces within 3 years post-launch, and the top performers are seeing as high as 50% of new business.

A great example of this success is Seeq, they started selling through AWS Marketplace and Microsoft commercial marketplace in 2019. By 2021, approximately 20% of Seeq’s total ARR was transacted through these two Marketplaces, a 215% year over year increase.

We had quite a bit to reflect on this year, going all the way back to the survey data we’ve collected since 2020 and leveraging the huge volume of content and data from analysts, the media, venture capital, enterprise leadership, and more. This year’s report includes:

Key learnings, such as:

- Cloud budgets are durable as buyers increase spend with the Cloud Providers

- Data, Marketplace, co-sell are synergistic as part of a flywheel cloud go-to-market motion

- Sales leaders and field sellers have to adapt to this new way of selling

- Enterprises companies have unique challenges to unlocking scale with Cloud GTM

As well as predictions to keep in mind as we head into next year:

- We expect to see as high as $15B in Marketplace throughput by the end of 2023 and $50B by the end of 2025.

- Sales, Marketing, and Alliances have to work together as an organization to lean into partner-led growth.

- We will see significant growth in line of business purchasing through Marketplace in the coming year.

- Discovery will become a bigger focus and both the Cloud Providers and Tackle will innovate to bring buyers and sellers closer to the point of purchase.

SURVEY METHODOLOGY

In late summer of 2022, Tackle surveyed individuals representing software sellers and buyers across a broad range of categories in order to get a pulse on the interest, usage, successes, and challenges of Cloud Marketplaces as a sales channel. Titles of these individuals included senior directors, managers, vice presidents, senior vice presidents, C-level executives, and company founders.

More than 50% of this year’s survey respondents work in organizations that sell business applications or data products. We also had survey respondents from companies selling infrastructure, DevOps, and machine learning represented. Individuals working for enterprise, growth-stage, and startup companies each made up an even third of the respondents.

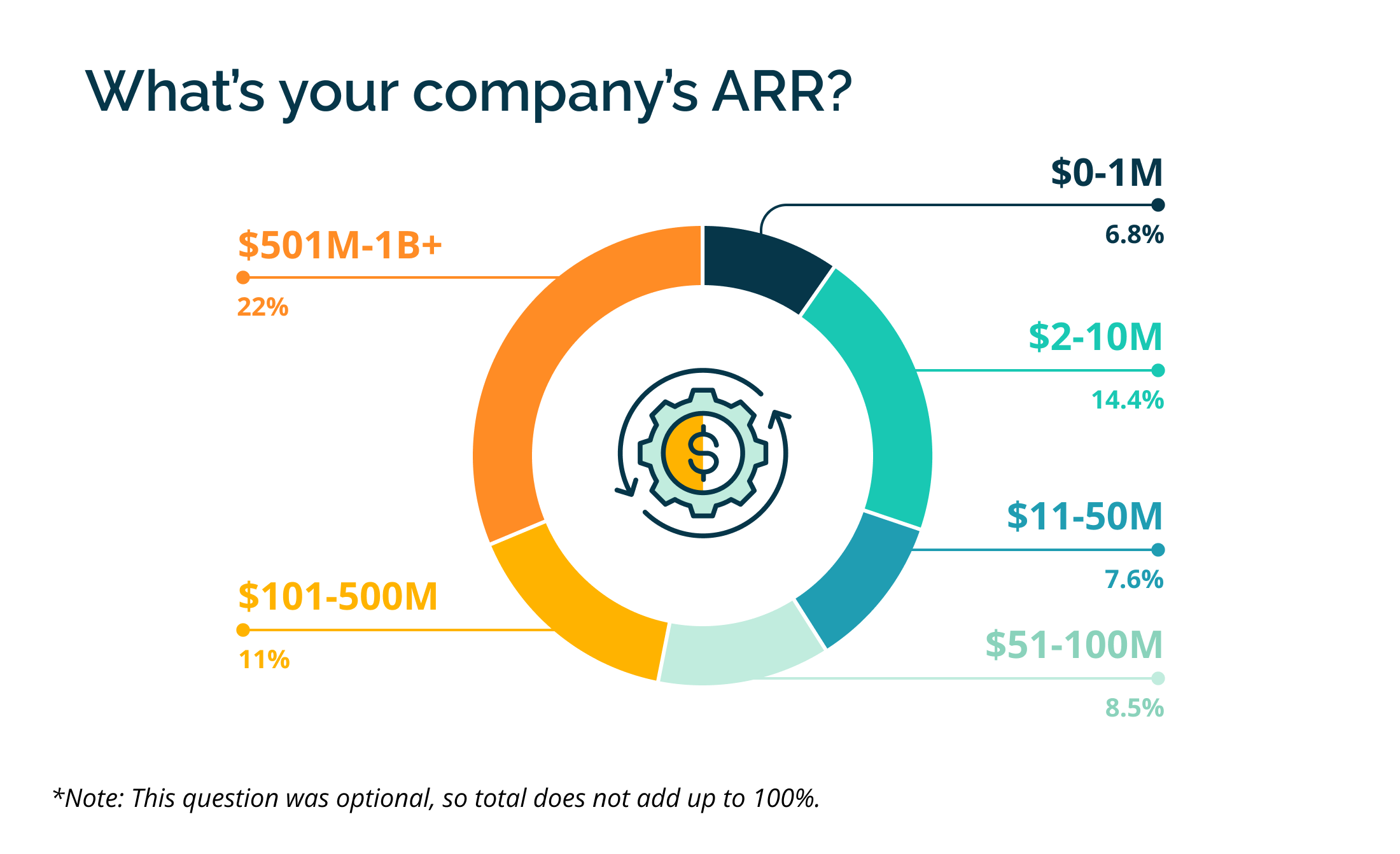

We saw respondents from each level of ARR, with a particular concentration from those in the $101-500M and $501M-1B bands.

JOHN’S FOREWORD

Connect with John on LinkedIn or Twitter.

When we started Tackle, we knew we wanted to change the way that software was sold, but it was such a HUGE problem statement, we had to figure out where to start.

Marketplaces were the no brainer starting point for us in 2016 because we believed the clouds represented a systemic change to the way that technology and businesses operate. We had yet to see sales enter the cloud era, but we knew Marketplaces were the initiation point of this selling transformation and over the last six years we have seen a massive acceleration in this movement.

Just like we are still in the early days of cloud, we are still in the earliest days of Marketplaces and the opportunity is evolving. We see massive dollars flowing through the Marketplaces but we still have less than 5% of the nearly $700B in B2B software spend flowing in this way. The dollars are growing more than 100% year over year, far outpacing the 37% YoY core cloud growth rate, but the numbers for overall cloud and B2B software are so big that we are seeing massive budget dollar expansions in both areas even though the growth rates are lower. All of this is fuel for Cloud Marketplaces as the cloud budgets and enterprise B2B software budgets become one.

It has been amazing to be part of the shift in this movement. In 2018, we were trying to convince people Marketplaces were a thing. Today, everyone acknowledges that ecosystems and Marketplaces are the future and they need to figure out how to be part of this future. We have only just begun to see how selling and buying will evolve as ecosystems and Marketplaces blend together and this will continue for years to come.

Marketplaces have become the center of how ISVs go-to-market with the Cloud Providers, but this go-to-market is bigger than just Marketplace. In last year’s report, we started to talk about Cloud GTM as the program an ISV runs to launch, sell, and scale their business with the Cloud Providers. Through our work helping hundreds of ISVs transact more than a billion dollars worth of deals, we continue to expand our understanding of what a world class Cloud GTM looks like.

AWS, Microsoft, Google Cloud, and Red Hat have invested massively to bring this future to life and these investments are really starting to compound. The cloud budget is the most durable budget during an economic downturn and more buyers and sellers than ever are taking advantage of this.

In 2020, new sellers would often launch on a Marketplace and then begin the work of getting their Cloud GTM going. Today, sellers are coming with buyers in hand—ready to leverage their committed cloud spend agreements—and tools are available to help sellers identify demand sooner so as they are launching they have buyers ready to go.

One of Tackle’s customers went from 0 to 45% of new and expansion revenue flowing through the clouds in 18 months. Another customer went from 0 to 45% of revenue flowing through the clouds in less than a year. These are not tiny startups—in both examples, these are hyper growth 100M+ ARR companies. While these results are not the norm, they show the art of the possible when you make the right investments in a Cloud GTM.

So what did these companies do to drive that kind of success and set the new normal for Cloud GTM?

1. They built their value proposition for the cloud buyer and defined why their product + cloud = the best experience.

These companies developed a world class product experience that delivers value to their users who leverage cloud. They are integrated with core cloud services and this combination is both unique/differentiating to them as a software company and delivers incremental value to joint customers.

If you aren’t doing this already, you are risking relevance in the future. You have buyers who will want to use your product and buy you from all of the hyperscalers so you will need to get good at this and hone your “better together” story for each cloud.

2. They invested sales team resources in Cloud GTM to scale their co-sell and Marketplace motions FAST.

These are specialized sellers that speak cloud and can help enable the organization to learn to sell in this new way. Discovery via Marketplace is still in its infancy (see our predictions for the future though) so you have to work the system to find success. Redirect the investment you would have spent building and maintaining the plumbing and point those resources to scaling your Cloud GTM to accelerate your revenue growth.

3. They leaned on the experts to build their Cloud GTM.

Everyone has a finite number of engineers and product people. Would you rather focus on building what makes your products better with the clouds or building software to sell software through the Cloud Marketplaces? Tackle’s Platform and team exist to make it simple at every step of the journey and support you not just as you launch but as you scale and sell.

This is the art of the possible—this is what great looks like. But this isn’t about doing a deal, it is about building a scalable Cloud GTM complement to your revenue system.

We are excited to launch our third edition of the State of the Cloud Marketplace Report and to evolve this report next year to become the State of Cloud GTM.

LOOKING BACK, LOOKING AHEAD

With three years of data now under our belts, we’ve seen predictions made in previous years come to fruition. In our first year, 2020, we focused on benchmarking how the Cloud Marketplaces were being used by sellers and buyers. We believed then that ecommerce would be a critical leg of the go-to-market stool for B2B and that the Cloud Marketplaces were the first real digital commerce channel.

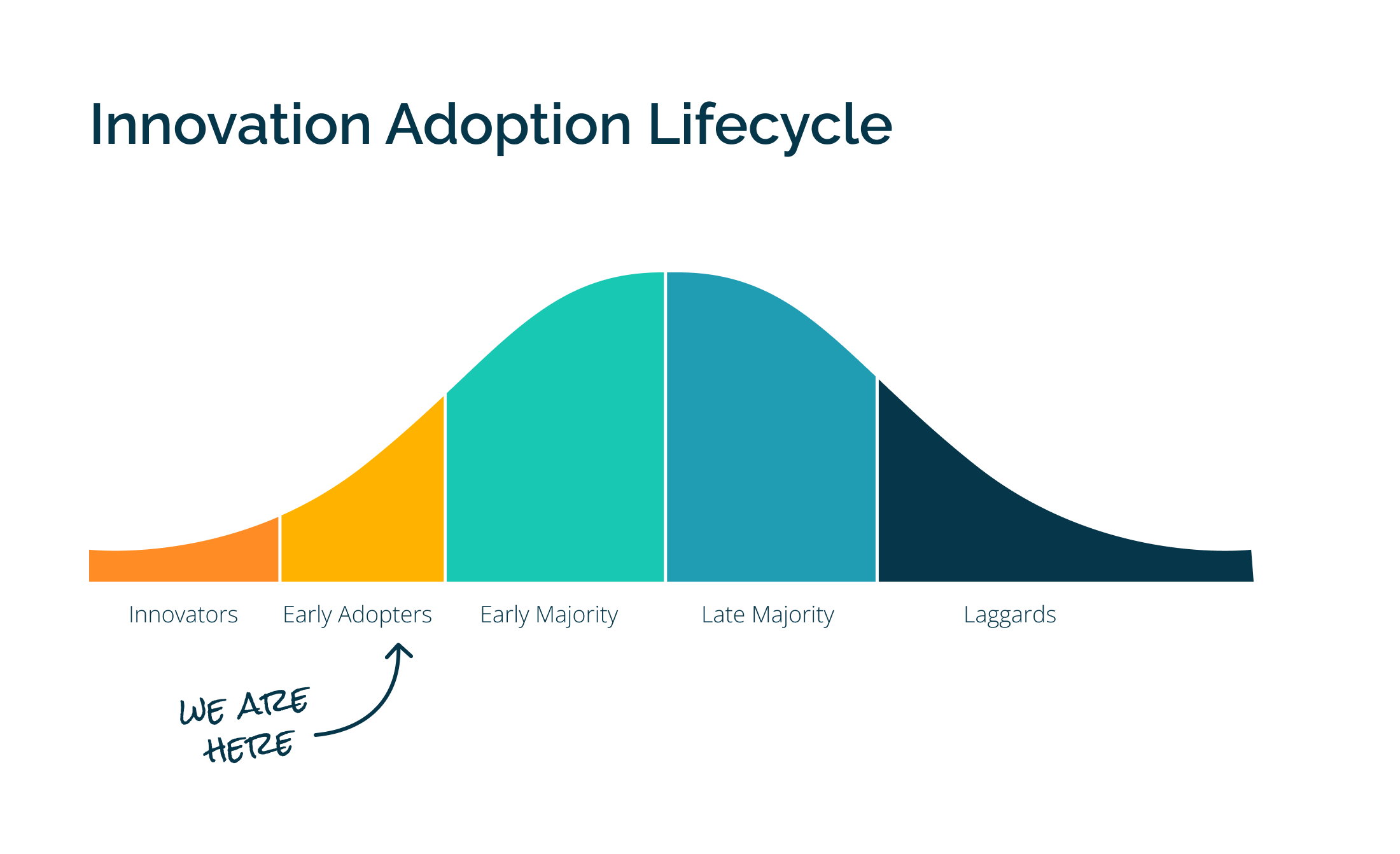

In 2021, we found that the uptake on Cloud Marketplace adoption had shifted from an early adopter pattern to a mainstream part of go-to-market systems. This year, it’s clear that, more than ever, the clouds represent a massive opportunity to drive significant revenue for B2B organizations and become the center of the modern go-to-market system.

Here are some of the predictions we’ve made over the years and have seen come to life:

1. More sellers will cross the Marketplace “chasm,” initially spurred by the great cloud migration and ecommerce boom of 2020.

Marketplace usage isn’t just a channel for risk-takers and bleeding edge innovators anymore. The last two years have brought the more conservative early majority of users to the Marketplaces as well, as both buyers and sellers. Back in 2020, we initially predicted that Marketplace would outgrow its status as a “risky” sales channel, and the thousands of ISVs we’ve seen embrace Marketplace since are proof that the success that’s been had by early adopters has been heard around the world.

2. More sellers will use multiple Cloud Marketplaces.

In 2020, almost half of the surveyed sellers said they planned to expand their presence to additional Cloud Marketplaces over the 12 months that followed. This year, as the pool of ISVs grew, 76% of sellers reported planning to expand their presence to one or more additional Cloud Providers over the next year.

Making products available on multiple Cloud Marketplaces is indicative of shifts in buyer behavior. Organizations are branching out from listing on just one Cloud Marketplace to support customers that are investing in committed cloud spend agreements with more than one Cloud Provider.

3. A change in cloud budget ownership is still on the move.

Last year, we learned that the owner of an ISVs cloud budget was starting to make a move from being housed in the IT department to living under the CFO. Because cloud budgets are seeing significant investment and are unlocking the opportunity for non-technical departments to leverage that budget for software purchases, the CFO takes a vested interest and works with the procurement team to maximize the value they get from that budget.

Procurement and finance are still learning how to leverage these budgets.

4. Cloud Marketplaces will exceed $10B in throughput by the end of 2023, and $50B by the end of 2025.

Last year, we predicted that Cloud Marketplaces would grow rapidly over the next five years, exceeding the targets forecasted by Forrester and Canalys. Marketplace has become mainstream and more and more sellers are beginning to see it as a long-term business investment that’s critical to their revenue goals.

Cloud Marketplaces continue to generate more revenue year over year. Bessemer Venture Partners noted that in 2021, Marketplace transactions grew an estimated 70% to $4 billion, which is 3x faster growth than the public cloud at large. Our data indicates this is slated to grow with 21% of ISVs expecting to generate more than 20% of total ARR from Cloud Marketplace sales in the next 12 months.

That said, we’re on track to hit (and potentially exceed) these numbers, and the $50B milestone might arrive even earlier.

Finally, like we predicted last year, more buyers are coming to Marketplace, more budget is being allocated to the clouds, and more sellers are following the money, evident in the fact that 83% plan to put more or significantly more focus and investment on Marketplace as part of a Cloud go-to-market strategy this year.

The positive sentiment around Marketplace has grown and will continue to build as organizations in all stages of growth are looking to invest in ways to sell software that require less overhead, drive their business goals forward, and help them reach new buyers and budgets.

Let’s dig into the learnings from this year’s survey to help paint the picture of how things have taken shape over the last year.

LEARNING 1: CLOUD BUDGETS ARE DURABLE—EVEN IN ECONOMIC UNCERTAINTY

Cloud budgets are a key driver for Marketplace buying, and cloud sellers are well-positioned to attach to these budgets to generate new revenue despite economic turbulence.

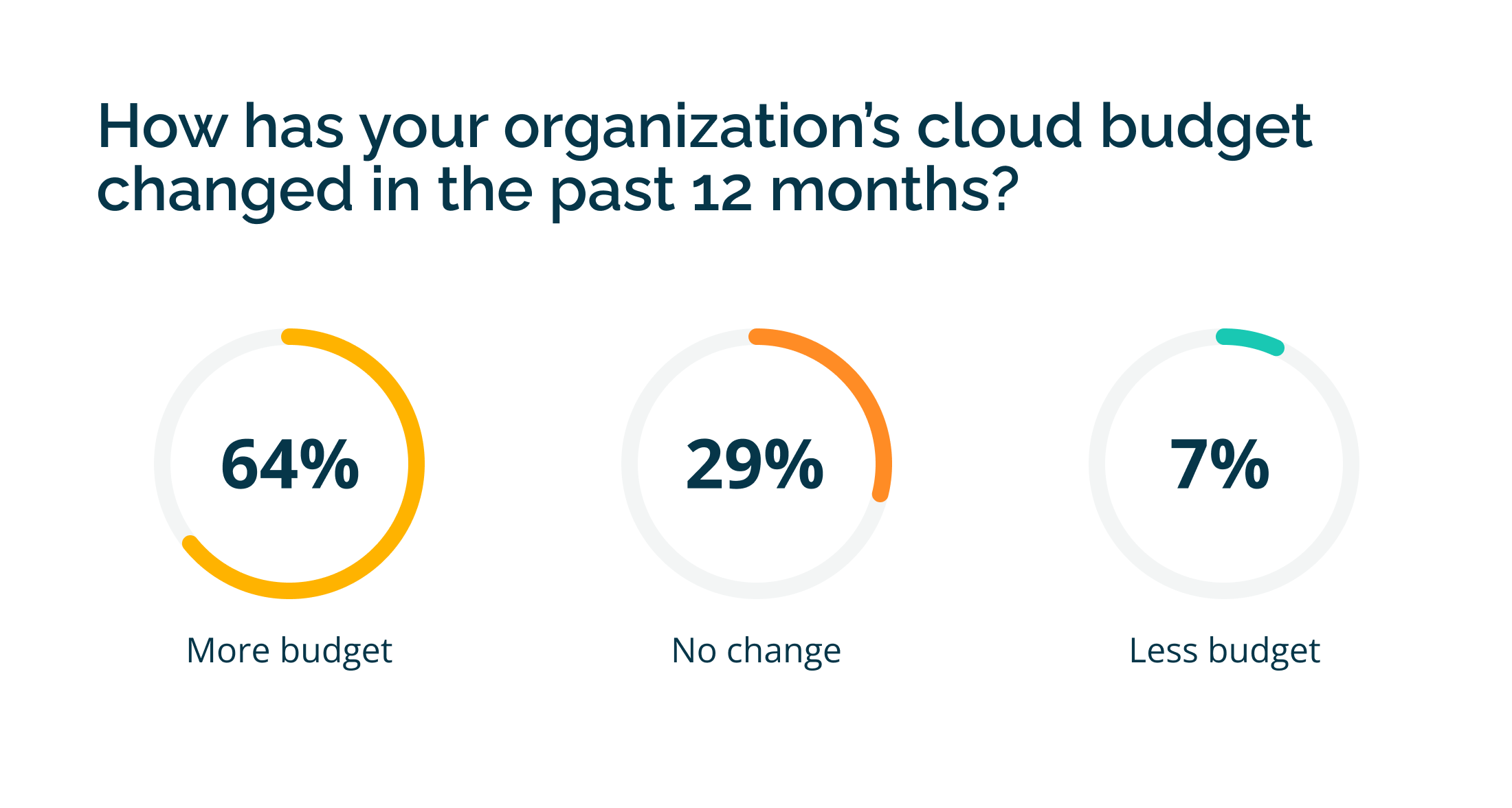

The economy has changed drastically over the last few years, and even more dramatically this year. Despite the volatility, buyers’ cloud spend continues to grow: An estimated $90 billion will be added to the total yearly cloud spend by the end of the year (IDC)—the highest annual growth rate since 2018. Over two-thirds of our survey respondents said they allocated significantly more to their cloud budgets this past year. As we predicted last year, as more buyers buy through the Marketplaces, they invest more budget with the clouds, and smart sellers are quick to figure out how to attach to this growing budget.

Particularly during times of economic unpredictability, sellers need as many routes to market to reach potential buyers as possible. In addition, the market has shifted from a period of “growth at all costs” to a focus on efficient growth. We’ve seen consistent cloud spend increases despite the varying state of the economy and 68% of buyers said they will increase investments in cloud budgets in 2023, expanding the massive opportunity for sellers to access a buyer’s committed cloud spend and leverage Marketplaces to do so with less overhead.

Just over 40% of surveyed buyers stated they have had an enterprise agreement—a spend commitment which can be burned down through purchases of cloud services and/or third-party software through the Cloud Marketplaces—with at least one Cloud Provider for at least one year. These commitments are typically multi-year agreements, so even in years where economic conditions might otherwise deter organizations from spending on software, buyers with enterprise agreements are motivated to burn down their committed cloud spend through both first-party cloud services and third-party software purchases on the Marketplaces.

This was the case for CircleCI. “Marketplaces were becoming the go-to mechanism for procurement because customers commit to cloud spend and the more they spend, the larger discount they get,” said Larenzo Goodman, Senior Manager, Resellers, Cloud Alliances and Marketplace Partnerships at CircleCI. “We’ve seen a lot of our customers look across their stacks to see what they can obtain through a Marketplace to increase their cloud spend.”

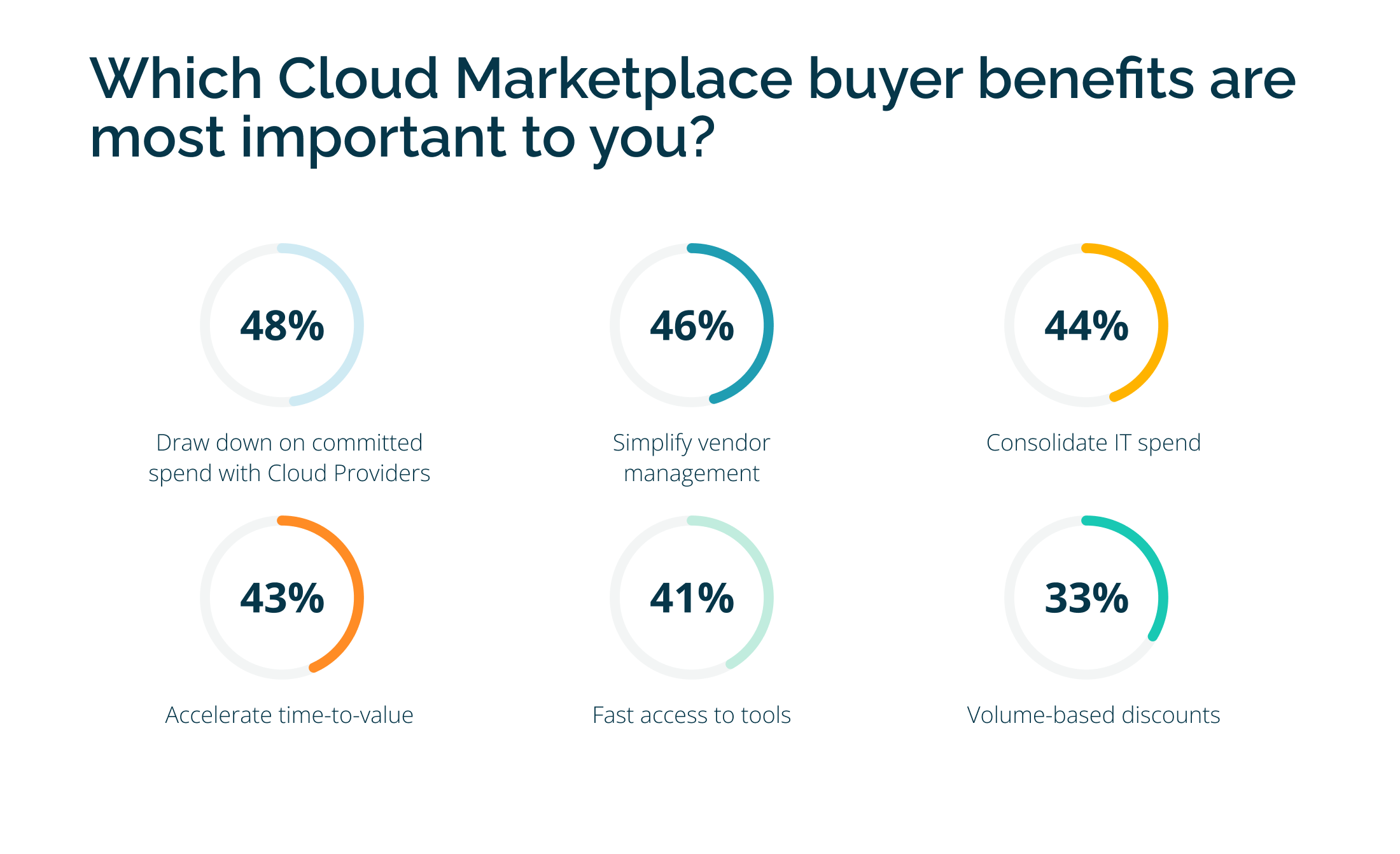

In 2021, sellers’ main goal for Cloud Marketplace was enabling buyers to buy where they had allocated spend, and it was a top priority again this year. Buyer and seller priorities are still matching well here, as nearly half of this year’s surveyed buyers cited draw down on committed spend with Cloud Providers as the top reason they choose to leverage the Cloud Marketplaces for enterprise software purchasing.

In addition, 40% of sellers said they listed on Marketplace due to customer demand, a 48% increase over last year. In sum, Marketplaces are the way to meet buyers where they want to transact and capture cloud dollars—growing 37% year over year—that sellers cannot afford to ignore, especially when efficiency is the name of the game.

Buyers choose to purchase through the Marketplaces for other reasons as well. In our survey this year, buyers cited:

- 46% The simplification of vendor management—The procurement process is consolidated on Cloud Marketplaces.

- 44% Consolidation of IT spend—Buyers want everything to be on one bill.

- The acceleration of time to value (43%) and faster access to tools (41%)—Time spent on processes that would otherwise be undertaken outside of a Marketplace transaction, such as a procurement process or legal discussions, is mitigated.

LEARNING 2: DATA IS THE MISSING LINK FOR MARKETPLACE & CO-SELL SUCCESS

Marketplace and co-sell offer complementary value props that support seamless transacting and scalable deal flow, and data is the key to unlocking their combined magic.

Co-sell is the opportunity for ISVs to partner with a Cloud Provider to convert new or existing buyers in a way that benefits both parties. For ISVs, co-sell is a way to extend their reach to new buyers by joining forces with the clouds.

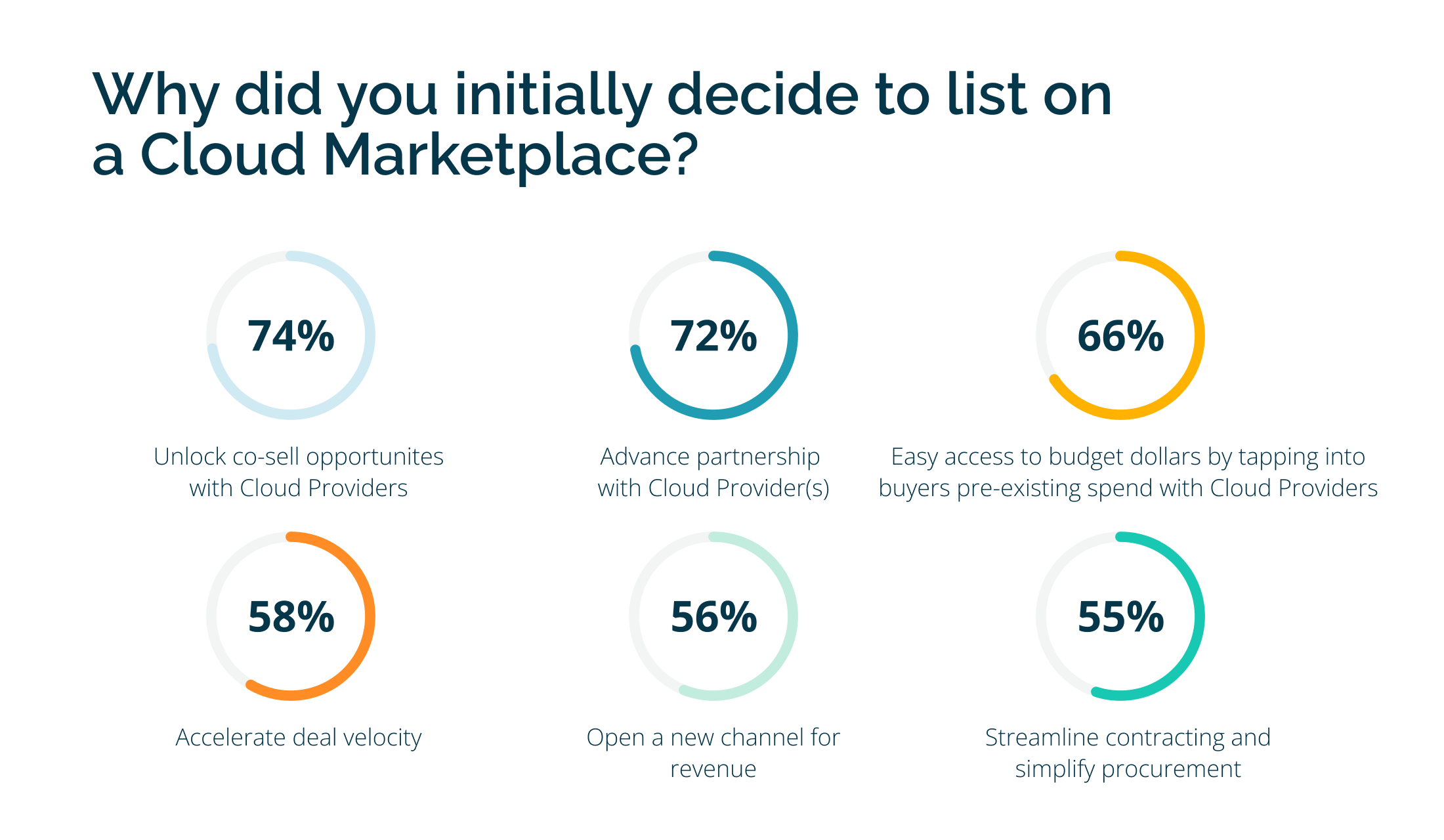

Unlocking co-sell opportunities was cited as the number one reason why sellers want to sell on Marketplace in 2022. While Marketplace doesn’t unlock cloud co-sell directly, the two are synergistic when an organization invests in both. Marketplaces provide a transaction mechanism that makes selling much more seamless while the main value proposition of co-sell for ISVs is to build their “better together” story with the clouds to accelerate the right deals.

While 84% of ISVs said driving co-sell with the Cloud Providers is important or very important to their business priorities in the next 12 months, many have been doing co-sell activities without data as a guide. Most either end up taking a shotgun approach—registering every deal in their pipeline and hoping something comes of it—or taking an overly targeted approach and only registering deals they know will close, but missing out on the true value of co-sell.

Forty percent of sellers said more than 15% of their Marketplace deals have been assisted by co-sell in the last year. However, 38% also said they have neutral or no confidence in their ability to know if prospective buyers want to purchase this way. Data is key to help go-to-market teams make strategic decisions about the right deals with which to build their Cloud GTM.

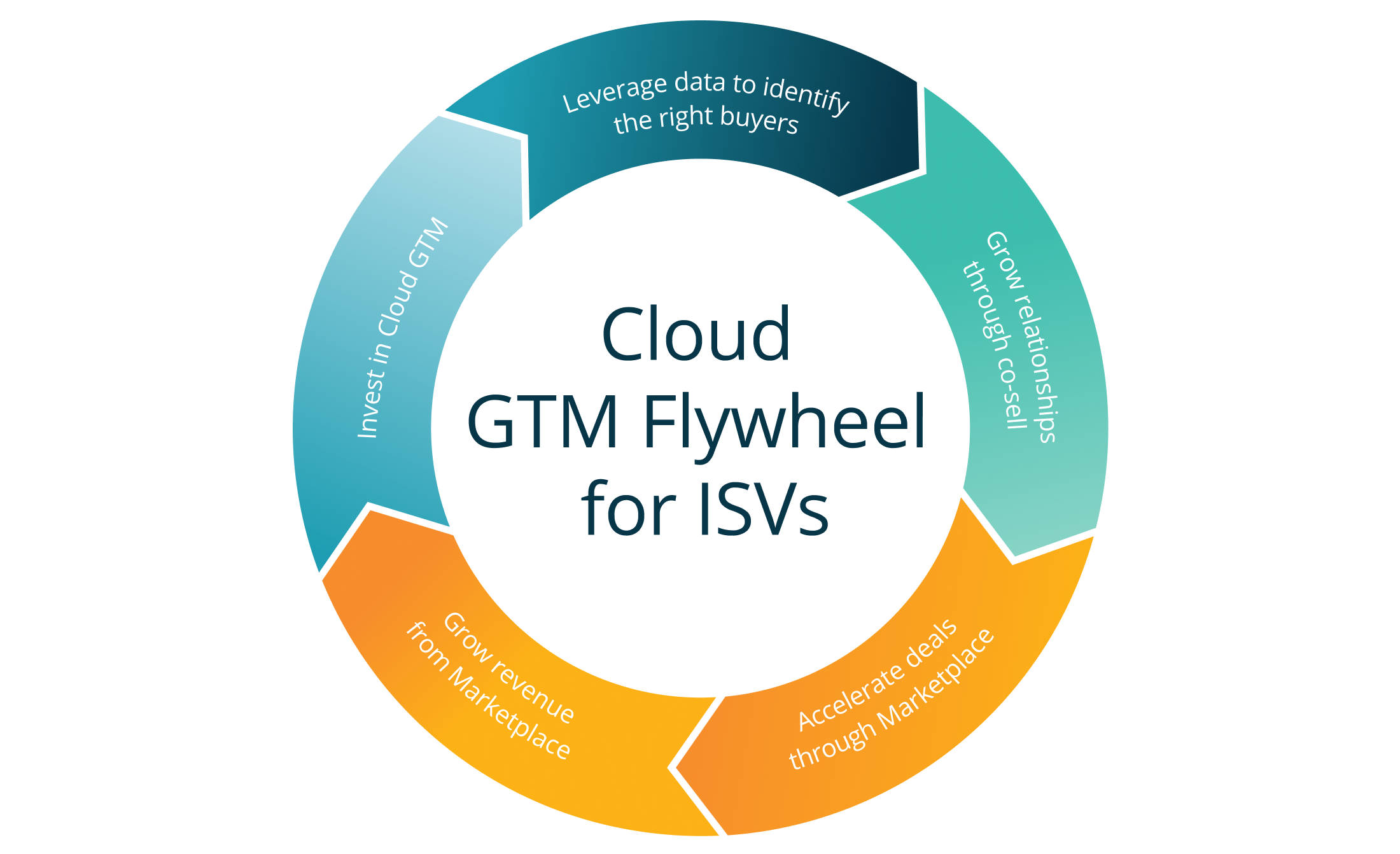

There are three ingredients to a successful Cloud go-to-market.

- Deciding who to target – Data gives you the opportunity to assess your pipeline and understand which accounts are most likely to buy from the Cloud Providers so you can build your Cloud go-to-market focused on the best-fit accounts.

- Leveraging co-sell – With co-sell, plan and collaborate with Cloud Partners on targeted accounts to show buyers how your solution fits into their current ecosystem. Successful co-selling helps you strengthen access to new buyers, new budgets, and build meaningful, mutually beneficial relationships with the Cloud Providers. When combined with Marketplace (more on that in the learnings), Cloud GTM execution and scalability becomes a reality.

- Transacting – Marketplace gives you the vehicle through which to execute those deals in a way that fits with the way B2B buyers want to buy: leveraging cloud budgets, fewer bills and vendors, and to buy from ecosystems they trust, like Microsoft, AWS, Google Cloud, and Red Hat.

As a system, the Cloud go-to-market works as a flywheel to:

- Fuel sellers’ with data on the right buyers to target

- Leverage that data to register valuable co-sell opportunities and drive growth

- Accelerate the speed at which opportunities close by leveraging Marketplace

- As Marketplace revenue grows, the investment in keeping the flywheel spinning grows

This is an area that is growing and evolving rapidly. Last year, we predicted that Cloud Marketplaces would not race to zero on fees, but would invest in co-sell motions and partner programs that create more value for ISVs. We’ve seen that happen. In 2021, both Microsoft and Google Cloud reduced their listing fees from as high as 20% down to to 3%. Earlier this year, AWS announced that it is bringing its Partner teams and Marketplace teams under one organization—called AWS Partner Organization—to give sellers a more streamlined experience with its people, programs, and technology. This is another way that the Cloud Providers are also prioritizing bringing co-sell and Marketplace together.

Having an integrated and seamless platform to handle each of these phases and requirements is key here—point solutions will create disparate systems that don’t allow for your Cloud go-to-market to operate at scale. Tackle is investing heavily into this area and we’ll be sharing some exciting updates in early November that will change how sellers scale and operate with the clouds.

LEARNING 3: SALES LEADERS AND FIELD SELLERS HAVE TO ADAPT TO THIS NEW WAY OF SELLING

Cloud GTM requires new skills of sales teams and leaders. Those that aren’t able to learn the ins and outs of cloud selling and how to “speak cloud” with their buyers will struggle for relevance.

Buyer demand is teeming and the opportunity for sellers is clear but sales leaders, field sellers, and operational teams need more support to be able to lean in. Cloud selling is a new skill for salespeople, and we hear sales leaders from our customers are starting to target salespeople in their hiring processes that already have Cloud go-to-market strategy skills.

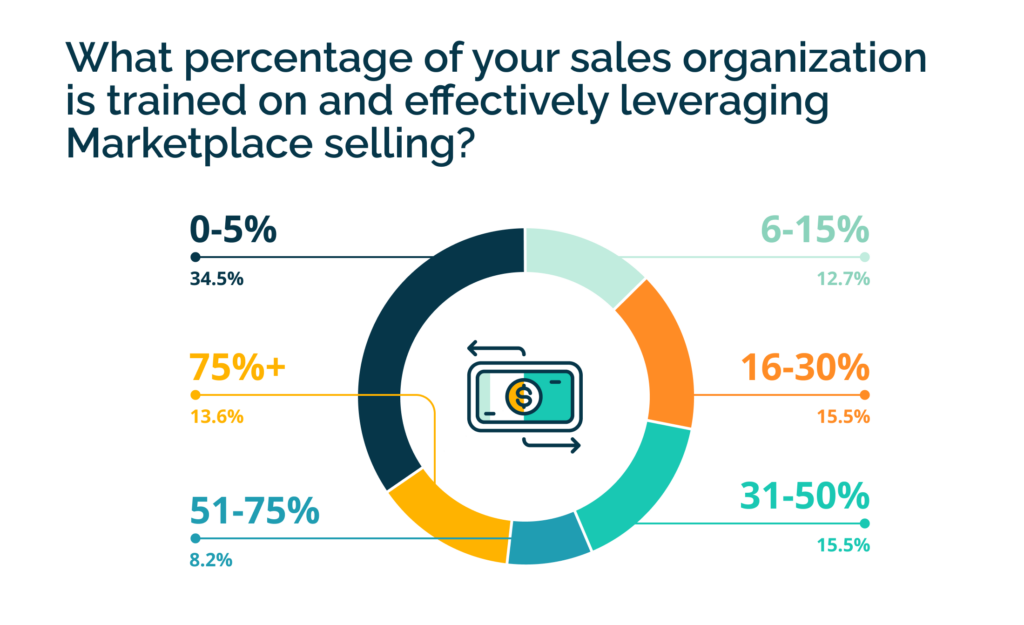

Just over a third of our survey respondents said that more than 31% of their sales organization has received proper training and are effectively leveraging Marketplace as a revenue channel. This indicates that companies are starting to understand the impact of properly investing in their B2B sales teams’ knowledge and skills for selling on Marketplace. On the other hand, 35% said less than 5% of their sales team has been properly trained and is effectively leveraging Marketplace. There are clearly some gaps to fill to help sellers develop the skills they need to sell in this new landscape.

The sales comp question: Changing seller habits and behaviors is a requirement of this motion. We’re encouraged to learn this year that 64% of ISVs have a comp neutral model, up from 54% last year, meaning they compensate Marketplace deals the same as direct deals instead of penalizing salespeople for leveraging Marketplaces. Comp neutrality is a necessity for driving adoption of Marketplace from the field.

Tackle customer Incorta puts a huge value on transactions through the Cloud Marketplaces and incorporated new programs to encourage its sales team to leverage this path to purchase with buyers. They have adopted a neutral compensation model. “Our reps don’t lose any of their commission or quota retirement and now they’re starting to regularly close deals in Cloud Marketplaces,” says Stephen Campbell, VP of Technology Partnership, Incorta. As a result, Incorta shortened their sales process by at least four months and is experiencing 100% revenue growth year over year even while its Cloud Marketplace offerings are still in their infancy.

Sales training and comp adjustments are necessary steps to helping sales teams adapt to new ways of working with both buyers and with partners. Ongoing training and education is mission-critical to success.

The Alliances + Revenue relationship

Supporting a scaling Cloud go-to-market motion requires a deeper relationship between ISV revenue and alliances teams.

As they scale, ISVs implement dedicated or specialized Marketplace teams. This year, we learned 91% of sellers plan to put the same or more focus and investment into building an internal Cloud go-to-market team in the next 12 months. In total, 58% of respondents said they have some version of a specialized Marketplace team in place already, up slightly from last year. Currently, of those respondents:

- 25% have a Marketplace deal desk – a cross-functional team at an ISV that ensures high volume, high value, or complex Marketplace deals are executed and signed. Sits in operations.

- 34% have a dedicated Marketplace sales team – a team of ISV field sellers who work in partnership with the Cloud Providers’ field sellers for mutual benefit. Sits in the sales org.

This is an important moment in the evolution of the Marketplace and Cloud go-to-market journey. Alliances and revenue teams have to work in tandem to be successful selling with and through the clouds. These specialized teams operate within the revenue organiziation, outside of the typical purview of an alliances team, which tells us there has to be lock-step alignment between these two functions to scale a successful Cloud GTM.

LEARNING 4: ENTERPRISE SOFTWARE COMPANIES HAVE PROVEN THEIR EXPERIMENTS WITH MARKETPLACES BUT THE CHALLENGES TO UNLOCK SCALE ARE UNIQUE WITH LARGER COMPANIES.

Enterprise organizations are all on a journey to SaaS and cloud to enable their product portfolios, but this challenge brings with it years, in some instances decades, worth of customer relationships, business models, and product architectures to consider before they can evolve toward Cloud GTM.

Universally, we hear from our largest customers that they see a time where they will sell larger portions of their portfolios via the Cloud Marketplaces, but they need additional support to make this happen, including support for channel, pricing and packaging for large product portfolios, and tooling to bring the system together. Without it, it’s much harder for big companies to adapt.

Building a roadmap for cloud enablement and SaaSification of their portfolio

Most large companies started with the low-hanging fruit as they kicked off their Marketplace journey—typically through acquiring a company that operates as SaaS or in a more cloud-native way where they can test the waters on how co-sell and Marketplace can work for their business. This kind of work has been done over the last five years with a high level of success.

But then what? How do they integrate that model into the rest of the business? This is where the work gets trickier. SaaSification and cloud transformation are complex topics, especially if you have a large array of customers that are already getting value from your products. Enterprises need to build in commerce transformation with cloud into their cloud and SaaS transformation initiatives to not only modernize the way their software operates, but also the way it’s sold. The good news is you can map commerce transformation into the early phases of your cloud transformation to show some quick wins and build momentum toward a broader adoption of Cloud GTM.

Pricing and packaging is usually a major part of the transformation journey as all ISVs are looking at how to evolve toward more cloud-native pricing (contract + consumption or pure usage-based). It’s key to consider your Cloud GTM as you do this pricing and packaging work to ensure your newly envisioned pricing fits into the future state of multi-channel ecommerce via the Cloud Providers.

Distributed vs. centralized decisions about Cloud GTM

We also see large portfolio companies debating whether to centralize decisions about their Cloud GTM or leave it as a business unit by business unit decision. Most portfolio companies start with business unit led decision-making which has been key to building early momentum, but can be problematic as you scale especially if they approach it as a build vs buy solution. You end up with inconsistencies in the way your Cloud GTM operates in each unit, which limits your scale.

In addition, we found that 61% of enterprise sellers plan to put more or significantly more investment into Cloud Marketplaces as a go-to-market channel this year. For enterprises, the question is do they invest more as individual business units or does the entire organization invest more as a whole?

The simplest example of this is when a company wants to integrate Cloud GTM into its CRM system. If you’ve solved for Marketplace business unit by business unit, this will prove to be a nearly impossible task and CRM is just the tipping point for a lot of these companies. You need to align with marketing automation, finance systems, pricing processes, and ERP. Having many bespoke Cloud GTM solutions that try to map into the core operating environment of an enterprise will slow adoption and cause unnecessary complexity.

SURVEY VOICES: “At Dell Technologies we put our customer first in everything we do—customer satisfaction is incredibly important,” said Kris Carrara, Senior Director for Global Sales Strategy and Business Development at Dell Technologies. “Marketplaces are key to our commitment to offer customers greater flexibility and choice as they develop new applications and modernize existing ones.”

The Channel + Marketplace dilemma

For most of our large customers, channel + Marketplace becomes an important discussion. In companies that are being born cloud and Marketplace native, the Marketplaces are their channel, but in most at-scale companies, they have a large established channel that they are considering as they scale their Marketplace business.

This year, 55% of enterprise respondents said they view channel partners as complementary to Marketplace and 30% said they view channel partners as neutral to Marketplace. This sentiment indicates that sellers don’t see channel partners and Cloud Marketplaces as an either-or choice—they want both. For sellers in the enterprise segment, 80% of their Marketplace deals had some level of channel partner involvement over the last year, and this group expects 83% of Marketplace deals will have some channel partner involvement in the next year.

In order to build out this environment in which Cloud Marketplaces and channel partners can coexist, each of the major Cloud Partners—Google Cloud, Microsoft, and AWS—are creating programs that improve the integration of the two. Since only 5.5% of respondents said they saw channel partners as competitive to the Marketplace motion, the sentiment of sellers favors utilizing these channels in tandem, but there’s still more to come on the evolution here as programs like Microsoft’s CSP program and AWS’ CPPO program expand.

LEARNING 5: WE FOCUS A LOT ON SELLER SUCCESS AT TACKLE BUT NOT EVERYONE WILL SUCCEED IN THIS NEW MODEL. WHAT HAVE WE LEARNED FROM THEIR FAILURES?

About 15% of companies who attempt to launch a Cloud GTM fail in their first year. This number is higher than it needs to be and we continue to do everything we can to help align seller expectations with reality and set sellers up for success as they build out their Cloud GTM.

Some of these learnings are truly independent of ISV size, but some are very specific to companies of certain sizes.

The number one reason why companies fail to launch is they treat this as a tactical departmental solution instead of a strategic long-term commitment. We can’t help but recall the early days of cloud transformation. A single user or group of users would experiment and fail with cloud and say “this wont work for us.” Building a Cloud GTM is new, different, and requires commitment and investment, teaching your sellers to sell in new ways, as well as helping your buyers understand the value proposition. This is a decade-long transformation and those that treat it like the revenue “easy button” will fail to launch.

The second reason—they don’t sell anything. This often ties back to treating it tactically – but revenue solves most business problems and this is true of Cloud GTM as well. If we have all of the customers who are seeing wild success with Marketplace, why would they not sell anything? First, they never actually treat it like a strategic channel. If it’s a back room experiment with your partner team, it is set up to fail. Second, there is not an executive owner and a tiger team committed to making it successful. Third, they give up at the first sign of resistance.

Here’s how some common challenges break down by company size:

Startups – Less than $25M in ARR

You don’t have product market fit so identifying your value prop for cloud buyers is harder.

Because your teams are still small and likely stretched, you don’t have an owner who is committed to making cloud selling successful (not launching, but actually selling)

You have set unrealistic expectations for the cloud co-sell motion and/or aren’t consistently investing into this strategic channel.

You lack experience and knowledge of how to make it work so you spin your wheels guessing, researching, trying, and failing.

Growth Companies – Greater than $25M in ARR

This is the segment we have seen be most successful

Ownership often falls to the Alliances team, which is a good start, but scaling Cloud GTM requires involvement from the entire GTM system.

Knowledge of how to effectively engage with the Cloud Providers and learn the ins and outs of Marketplace and co-sell is often a gap at this stage.

Resourcing for successfully scaling a Cloud GTM is hard to come by in a growth stage company as you are focused on scaling and differentiating your product.

Enterprises – $100M+ in ARR

Thinking too big and trying to solve for everything at once rather than working toward incremental gains.

Unwilling to rethink their existing channel models so they end up staying stuck with outdated models that buyers stop responding to.

Getting ground up in the operational backend and overengineering processes and operations.

Letting every line of business go at it alone, causing inconsistencies and incompatibilities with the systems that make your entire business run.

What are the 4 things everyone can do to avoid being part of the 15%?

Think strategically. This new channel can easily be 10%-20% of your revenue over a few years time. How do you build your plan with that first goal in mind.

Set realistic expectations for Year One and a strategic point of view around your multi-year journey. Most ISVs find success in the first year with less than 5% of total revenue flowing this way, and top performers build an incremental path to significant year over year growth.

Have a tiger team who is committed to making it successful. Once your tiger team nails what good looks like, invest in your Cloud GTM team to scale co-sell and Marketplace selling.

Don’t build custom partner programs with the Cloud Providers. Marketplace + co-sell are the partner programs that have become standardized and give you front-door access to the Cloud Providers.

2023 PREDICTIONS

We’ve seen how much Cloud Marketplaces have evolved in the last year, as sellers are moving beyond simply listing on Marketplace for the reduction in the transactional friction experienced with traditional sales channels. It’s a promising and exciting time for revenue transformation!

Now, our favorite part: the future! These predictions that follow are based on insights from this research, data collected from analyst reports, and our conversations with buyers, sellers, customers, partners, and cloud stakeholders across the industry.

1. We could see as high as $15B in Marketplace throughput by the end of 2023 and $50B by the end of 2025.

As we see companies continue to adopt Marketplaces and they are able to target their efforts with high-quality data, there is more opportunity for success with Marketplace than ever before. With global software spend predictions topping $750B and cloud spend growing at more than 35% next year, we think revenue driven through Marketplace could exceed our original prediction of $10B and reach as much as $15B in the next year. Especially as cloud and software budgets continue to converge, we still believe Marketplaces will become the fastest growing cloud services over the next five years.

We are also bullish about the fact that if you’re not selling through the clouds in the next year, you might not survive the next few years. Those ISVs not in Marketplace will lose to competitors who support their buyers preferred way to buy.

2. Sales, Marketing, and Alliances have to work together as an organization to lean into partner-led growth.

Historically, Alliances teams have owned the cloud relationship, but as the dollars get real, the C-Suite is paying attention. We see savvy Revenue, Alliances, and Marketing leaders joining forces to align on this as a GTM motion and ensure that partner-led initiatives are a part of their growth plan for 2023. The ISV relationships with the Cloud Providers and other ecosystem partners are no longer just an Alliances team responsibility—Sales and Marketing are working to ensure the joint success of these programs and allocating budget and resources to align their plans around them.

In addition, with the cloud, a new era of selling, partnering, and marketing has come to the forefront and new skills are being prioritized in all of these functions. Sales, Alliances, Marketing, and Executives all need to get certified in this new way of executing and leading in the partner-led Cloud GTM era.

3. We will see significant growth in line of business purchasing through Marketplace in the coming year.

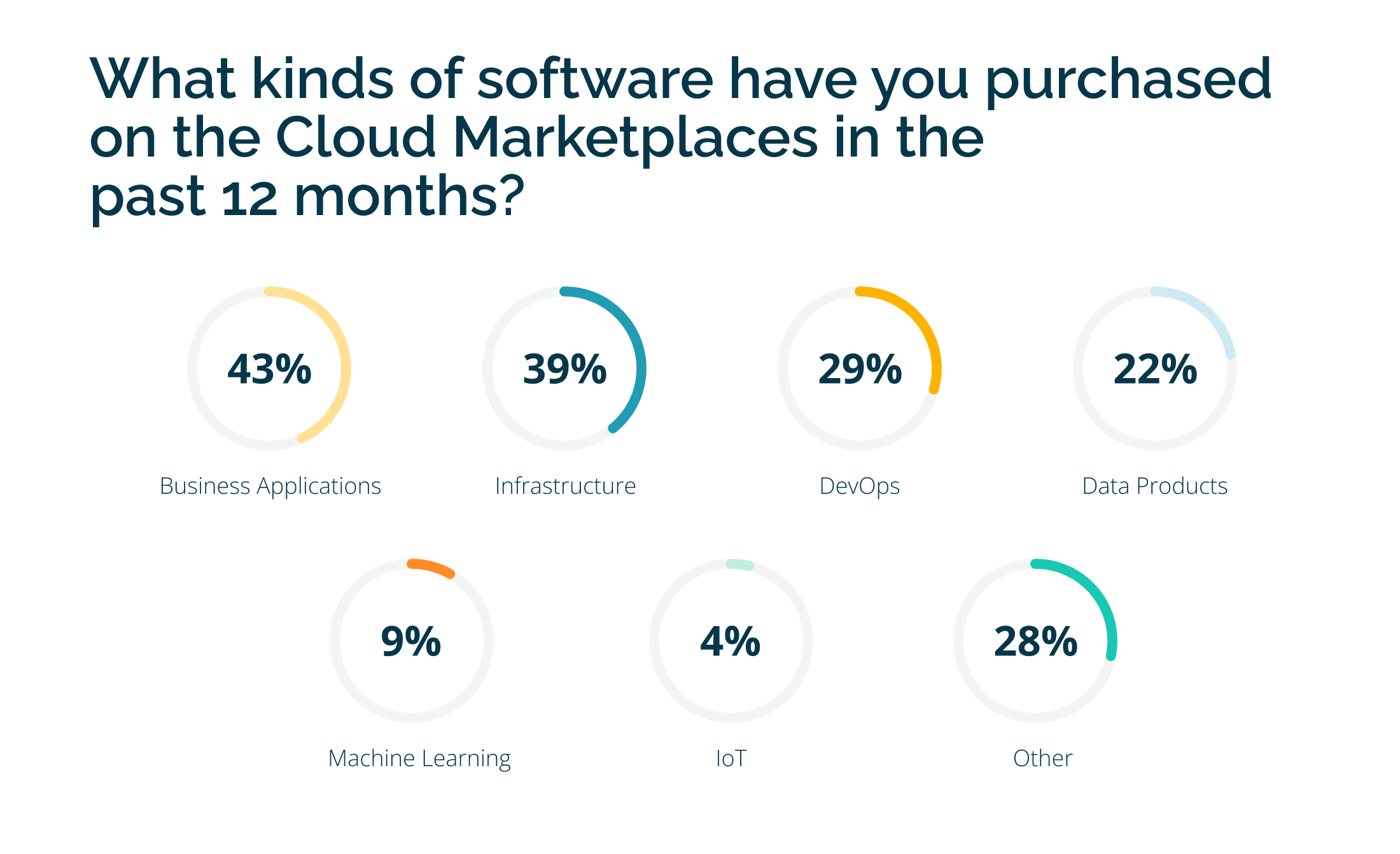

Marketplace strength has historically been in infrastructure and devops software but this year, a whopping 42% of buyers said they’ve purchased business applications through one of the Cloud Marketplaces in the past 12 months. We have recently seen companies like Anaplan, Amplitude, Brightcove, Fullstory, G2, Mixpanel, Outreach, SalesLoft, Salesforce, and more start selling through Marketplace and we anticipate seeing more MarTech, Sales, and Customer Success software companies selling here in 2023 as buyer demand for this grows.

4. Discovery will become a bigger focus and both the Cloud Providers and Tackle will innovate to bring buyers and sellers closer to the point of purchase.

Similar to how we saw private offers bring Marketplace purchasing closer to the way buyers buy, we expect to see a focus on solving for bringing Marketplace closer to the point of discovery. Sellers looking to scale their Marketplace business want to enable more workflows beyond private offers and provide both a bottoms-up and enterprise purchasing workflow powered by the Marketplaces. We expect 2023 will bring new pathways to bridge this gap.

CONCLUSION: MARKETPLACE IS PART OF A LONG-TERM CLOUD GO-TO-MARKET STRATEGY

The most important thing to remember as we see the next phase of ISVs develop a Cloud go-to-market motion is that Marketplace really is one part of a long-term business strategy. The end goal is not getting listed in Marketplace; it’s integrating Marketplace into the way you do business.

For those of you just starting out, doing 1-5% of total revenue through Marketplace is normal in the first year as you figure out how to talk to your customers about using Marketplace as a channel and learning the ins and outs of how cloud selling works. With the right deals flowing in, strong co-sell motions, and enablement from partners and solutions, scaling cloud revenue happens even quicker.

All in all, ISVs have gotten pretty comfortable with the first phase of the Marketplace story: getting listed and learning how to transact. What we’re seeing now is a new phase all about companies learning to scale and integrate Marketplace into a Cloud GTM system.

Questions organizations should ask themselves to set their expectations for scaling their Cloud GTM are:

- Propensity to buy—Is our buyer likely to buy through the Cloud Marketplaces?

- Propensity to sell—Are there one or more people who wake up and think about our relationships with the Cloud Providers?

- Do we see a path to doing over 5-20% of our revenue on the cloud?

- Are we able to scale along with the Cloud Providers?

If you’re just starting out or if you’re ready to scale, check out The Complete Playbook to Cloud Marketplaces. It’s a free resource, totally ungated, and full of our tried and tested best practices on how to launch, scale, and optimize your Marketplace strategy.

Tackle is ready to meet ISVs where they are in this journey as we help companies leverage data to generate revenue through co-sell, set up their teams and organizations for success, and help ISVs drive efficiency in a turbulent economy. Throughout the rest of this year and beyond, expect more from Tackle:

- More platform capabilities to enable launching your Cloud GTM and scaling it seamlessly

- More data on buyer and seller patterns

- More case studies and stories of seller succeeding, as well as community engagement opportunities to learn from each other

- More events to help connect

- All with the focus on helping you drive more revenue through the clouds.

The top point of friction with Cloud Marketplace selling for ISVs this year was a lack of internal resources or bandwidth. It is for this exact roadblock that Tackle exists—to eliminate the hurdles of listing, learning to transact, and scaling an organization’s presence on Cloud Marketplaces. We exist to help you transform your business for the cloud era and we are just getting started. Speak with one of our Marketplace experts about how Tackle can help simplify and maximize your Marketplace strategy.

Have questions or comments about this report, interested to have Tackle debrief you or your team on our findings, or want to be emailed when new Tackle research is available? Reach out to us at marketing@tackle.io.