Trends, predictions, and expert insights into the role of Marketplaces in the Cloud GTM

Jump to a Category

Survey Methodology

In summer 2021, Tackle surveyed senior leaders representing software sellers and buyers across multiple industries.

About half of respondents held titles in Alliances, Channel, and Partner Management. Others included product/development, operations, finance, IT, marketing, and the C-suite. Most respondents identified their industry as either security or technology (AI, machine learning, etc.). Other categories included business applications, education, financial services, retail, manufacturing or industrial, media and entertainment, storage, telecom, government, and healthcare and life sciences.

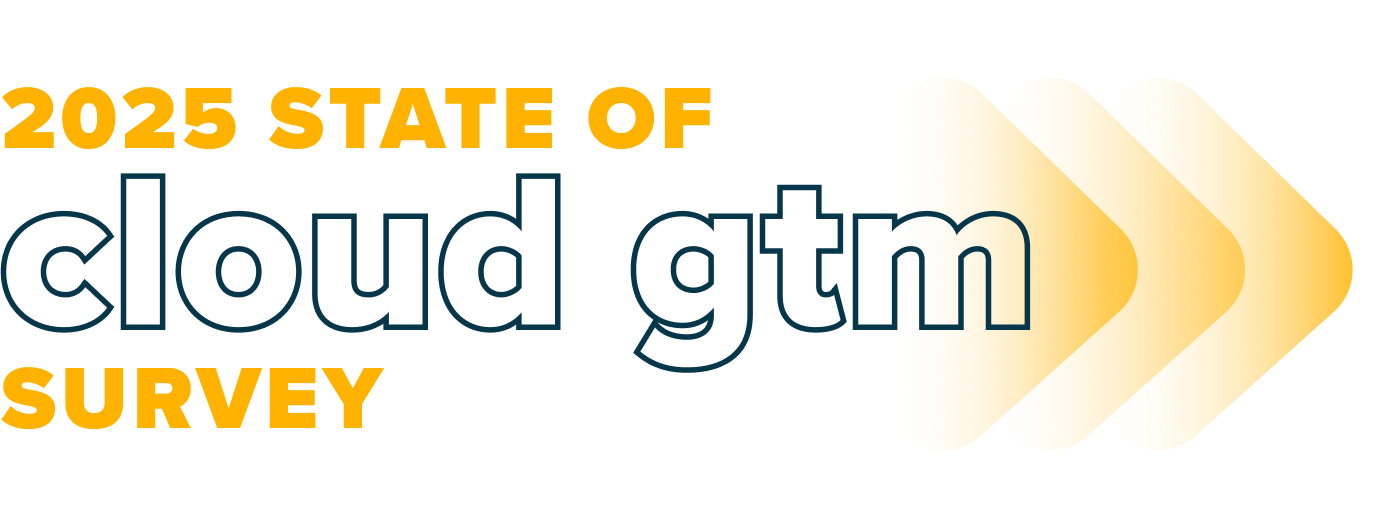

Respondents represented six annual recurring revenue (ARR) segments, from less than $1 million to more than $1 billion.

Foreword from John Jahnke, CEO at Tackle

Connect with John on LinkedIn or Twitter.

I’m thrilled to share our 2021 State of Cloud Marketplaces Report. First off, I want to thank everyone who responded to our survey this summer—both sellers and buyers as well as the entire Tackle team who contributed to bringing this report to life. We have long felt that Marketplace is a movement that transcended company size and it is exciting to see the wide distribution of company sizes that participate in this research from seed stage up to decacorn status.

Needless to say, a lot has happened in the last 12 months. So much has changed in every facet of our lives, and the business world is no exception. Cloud adoption is happening in every corner of the world and the Cloud Providers continue to invest aggressively to capture the ever-expanding market. We started this research three years ago out of necessity, when there was very little coverage of the Cloud Marketplaces and it is exciting today to see Forrester, Gartner, IDC, Canalys, and others investing more time to track not only Cloud Marketplaces but digital selling more broadly as a movement.

On all fronts, the Cloud Providers are deepening and expanding their Marketplace resources, programs, and service enhancements, as well as experimenting with fee structures to find the right balance of investment, incentive, and cost. Satya Nadella, CEO of Microsoft, spoke about Azure Marketplace in his Microsoft Inspire keynote for the first time ever this year, showcasing the company’s investment in its partner ecosystem.

Buyers are buying more than ever and our data reinforces that once buyers try Cloud Marketplaces, they look to repeat. You’ll read later that 83% of buyers said they are likely or extremely likely to purchase through the Marketplace in the future.

And we saw sellers respond with more aggressive moves towards Marketplace adoption, as 67% of our survey respondents said they plan to invest more into Marketplace in the next year. Sellers want to sell where buyers want to buy and we are seeing more and more sellers show up to the Marketplaces with a buyer in hand and launching their Marketplace business with an immediate transaction.

Throughout 2020 and the first eight months of 2021, we also have started to see a bigger movement around a digital selling form as companies adapt to a cloud-first world. Bessemer released their 2021 State of Cloud Report and talked about how product-led growth, usage-based pricing, and Cloud Marketplaces are all emerging as key elements of future go-to-market systems. We’ll hear from Bessemer Venture Partners later in the report, specifically about the VC point of view around Cloud Marketplaces.

Product-led growth and usage-based pricing are complex to implement and execute on from a business model and product standpoint. Cloud Marketplaces are emerging as the best first step as businesses evolve towards the future of digital selling. Sellers can complement direct selling motions, leverage the strength of your cloud partnerships, experiment with usage-based metrics, and even enable bottoms-up purchasing. As we’ll reveal in this report, sellers can tap into the rapidly growing cloud budgets and draft on large cloud migration initiatives as well as take advantage of a once-in-a-lifetime tech stack refactoring towards the clouds.

Options exist to make embracing the Cloud Marketplaces a buy vs. build decision and the more we hear from our customers and prospects the more it confirms our theory that no one wants their product and engineering teams to have to build software to sell software. Cloud Marketplaces offer an accessible, flexible option for companies to launch and scale a Cloud GTM, and this is applicable for large software companies looking to align with the clouds down to new startups looking to build their GTM systems by drafting the giants.

Before we continue, there are a few terms in this report that I think are important to explain. First, the term Cloud Marketplace or Marketplace refers to the platform for selling software that is provided by one of the Cloud Providers.

Second, Cloud GTM or cloud go-to-market is the program a software company or seller builds around their Cloud Marketplace listings. Your cloud go-to-market includes people, processes, technology, and is a cross-functional initiative that involves alliances, sales, product, and marketing at a minimum.

We are at the dawn of a new GTM age and if one thing is certain, it’s that there will be more ways to go-to-market in the future than ever before—whether it’s sales-led, marketing-led, product-led, tops down, bottoms up, or most likely a combination of all of these. Sellers who build the muscle around incremental GTMs now will be able to bring each and every one of them to life. In the future, sellers will help buyers buy digitally and Cloud Marketplaces are a key part of this story.

Purchasing behaviors have changed forever and buyers expect consumer-grade experiences in their business lives. They want to discover, trial, and even purchase software in a very low-touch, tech-forward way. There are clear patterns and experiences that B2B can learn from our consumer lives to eliminate friction, scale sales more efficiently, and help buyers get value faster.

We are excited to share the findings from our research with you and look forward to continuing to innovate on behalf of all of our customers and the ISV community to launch and scale your Cloud GTM.

Looking Back, Looking Ahead

In last year’s inaugural State of Cloud Marketplaces Report, Tackle set out to benchmark how buyers and sellers alike were leveraging Marketplaces and how they envision the future of Marketplace for their organizations. We merged our findings with other expert insights and industry data to highlight realities and made predictions for software companies considering or actively selling on Cloud Marketplaces.

Our overarching takeaway was that ecommerce will dominate the future of B2B software sales, with Cloud Marketplaces as a linchpin in modern go-to-market (GTM) strategies.

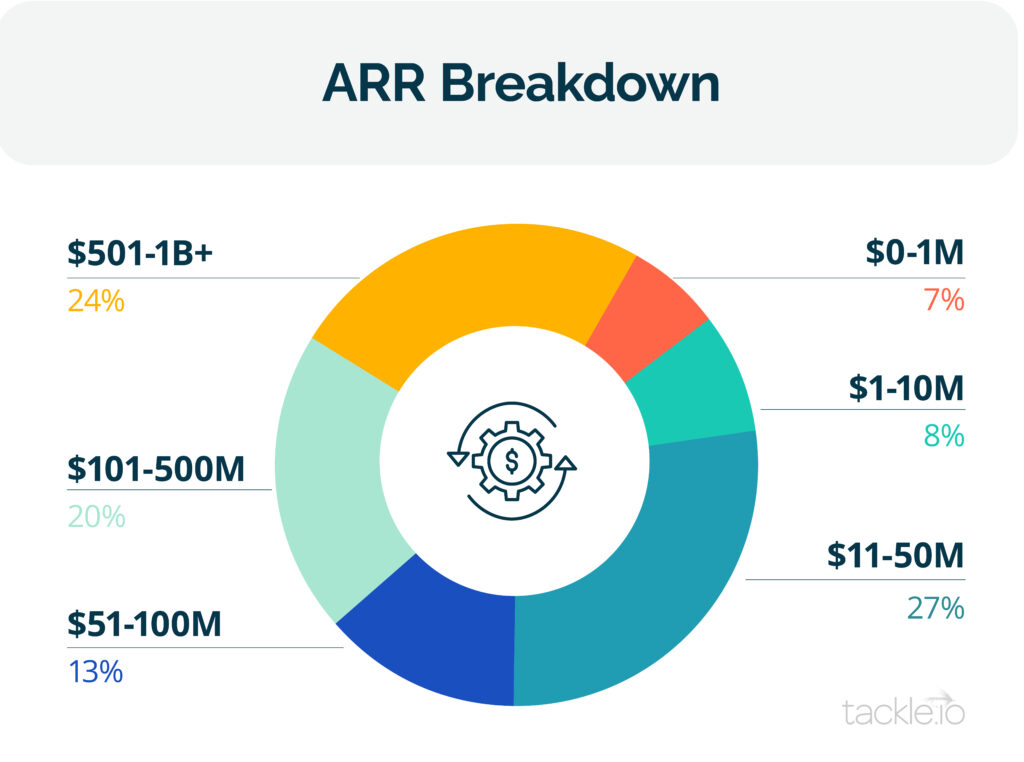

By and large, our predictions last year hit the mark, and we’ve continued to see rapid growth for this channel. One significant shift we saw this year: 43% of buyers say their top reason for purchasing through Marketplace is taking advantage of their committed spend with Cloud Providers. This is up from 20% last year (a 115% increase), and is a key signal that buyers continue to look to the Marketplaces to ease procurement and centralize budgets.

In 2021, 61% of buyers said they had purchased software through one of the Cloud Marketplaces in the last year—a 39% increase over 2020. The needle will continue to move, as 83% of buyers said they are likely or extremely likely to purchase through the Marketplace in the future, representing a 12% bump from the previous year.

Where Buyers Buy today

In 2021, buyers distributed their Marketplace purchases among the big three as follows*:

- 63% AWS

- 33% Azure

- 29% GCP

*Note that buyers were able to select more than one Marketplace so the total is more than 100%.

…and Why Buyers Buy

More buyers in 2021 pointed to benefits that help their bottom line*:

- 43% Take advantage of committed spend with Cloud Providers

- 42% Accelerate time to value

- 36% Simplify procurement

- 32% Standardized contracts

- 32% Fast access to tools

*Note that buyers were able to select more than one option so the total is more than 100%.

This year, 67% of survey respondents said they plan to invest more in Marketplaces as a GTM in the coming year. When asked to rank their top priorities for Marketplace, 82% of software sellers chose enabling buyers to buy where they have their cloud budget, a perfect match up against buyer priorities.

Survey Voices: “The value [of Marketplace] is amazing because we want to provide our customers with the best experience. Giving them the ability to tap into committed cloud spend opens the door to larger deals and more opportunities to work with the customer.”

As a bonus, more than a quarter (27%) of sellers responding to Tackle’s survey said they listed on Marketplace at their customers’ specific request.

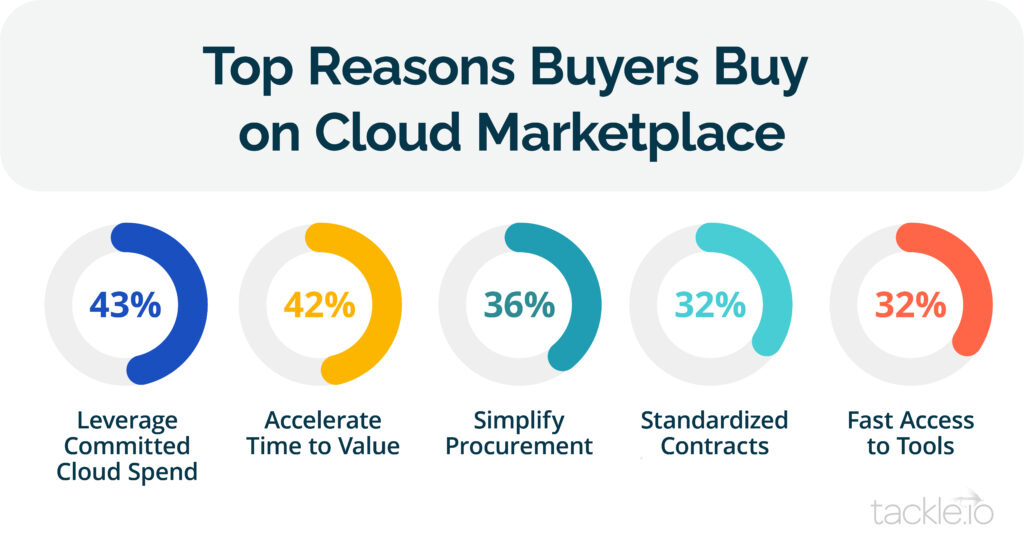

Where Sellers Sell

The 2021 survey indicated a growing interest among sellers across the three leading hyperscalers, showing where sellers are listing their products to meet their buyers. This is not an indication of dollars or number of offers transacted in a Marketplace.*

- 68% AWS

- 50% Azure

- 40% GCP

*Note that sellers were able to select more than one Marketplace so the total is more than 100%.

As sellers want to sell where buyers want to buy, they are diversifying their Marketplace focus to stay ahead of buyer expectations. We found that 63% of sellers say they plan to expand their Marketplace presence to additional Cloud Marketplaces in the next 12 months.

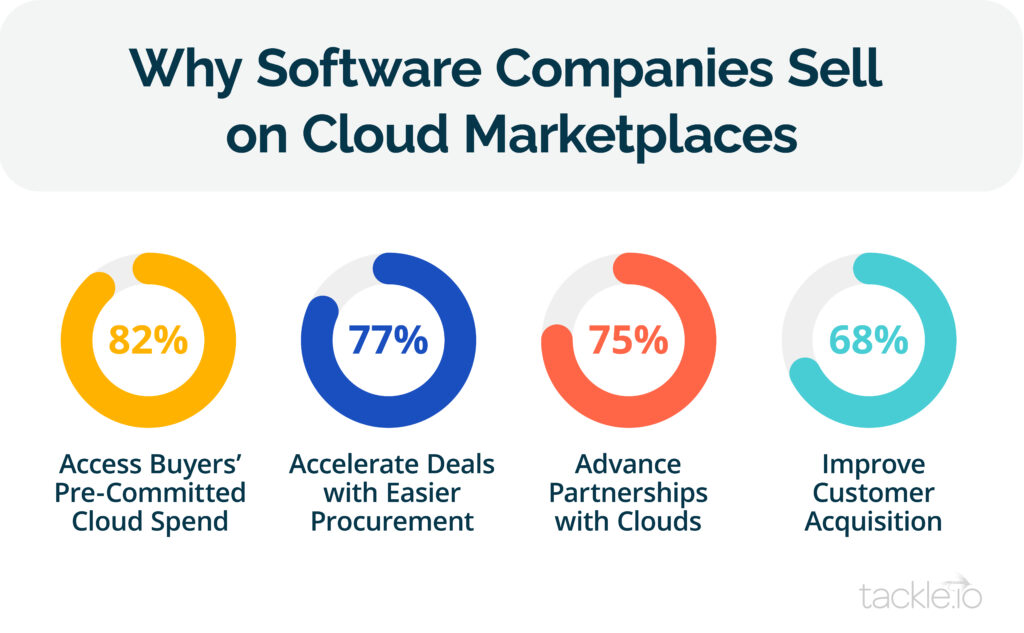

Why Sellers Sell*

- 82% Access to buyers’ pre-committed cloud spend

- 77% Accelerate deals with simplified procurement

- 75% Advance partnerships with the Cloud Providers

- 68% improve new customer acquisition / complement a bottoms-up selling motion

*Note that sellers were able to select more than one Marketplace so the total is more than 100%.

Crossing the Chasm

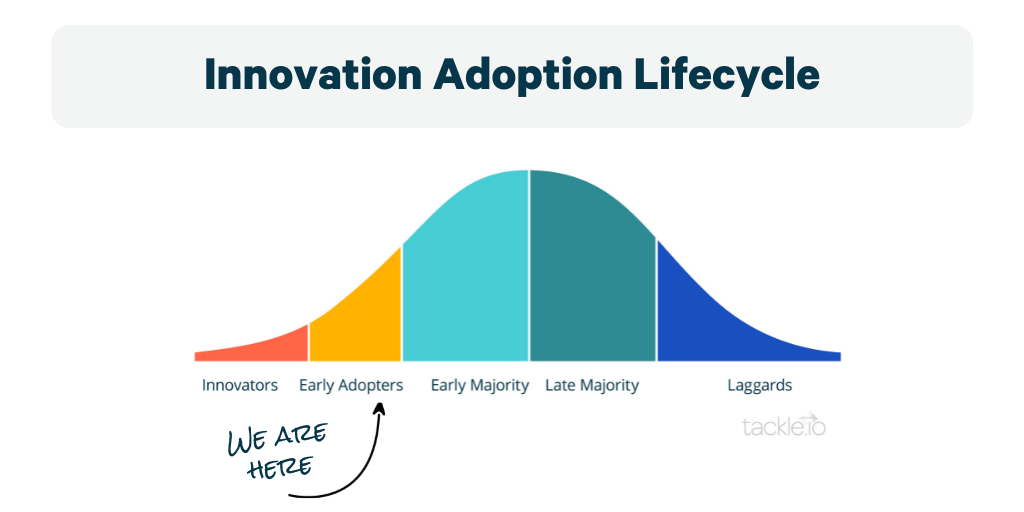

We projected last year that more sellers would cross the chasm into the world of Marketplaces to meet buyers where they (and their budgets) already are. We’re seeing that prediction really come alive this year.

In 2019, Forrester estimated we hit 100,000 software companies worldwide and that that number would grow to one million by 2027. If we estimate 50,000 of them are of material scale and that there are still only single-digit thousands of sellers in the largest Marketplaces, then we are at less than 3% adoption from a seller perspective today. If this adoption rate mimics the growth rate in software companies, then we are set for a dramatic 5x+ increase in Marketplace sellers by 2027.

This year’s takeaway? The uptake on adoption of Cloud Marketplace buying and selling is clear and has shifted from an early adopter pattern to a mainstream part of GTM systems.

The Venture Capital Perspective on Cloud Marketplaces, from Bessemer Venture Partners

One of the more unique dynamics we have seen over the last year is the interest the venture capital community has been taking in Cloud GTM. Nailing software distribution is one of the hardest parts of scaling a post-product market fit software company. Burning $1 of capital for each dollar of ARR earned is considered world-class with many companies spending 2 or even 3x that! The cost of acquiring a customer is often the greatest expense as you scale and being able to tap into the cloud budgets is rapidly becoming a secret weapon of investors to help more companies scale efficiently.

Here is some additional perspective from our partner at Bessemer Venture Partners:

“As early-stage investors and board members, we at BVP have seen Cloud Marketplace selling explode across our portfolio over the past 4 years. This has now become a common topic of discussion at the board level in our early stage B2B SaaS companies. In the early days of the Marketplace movement, companies were not thinking about a Marketplace strategy until a large buyer expressed interest in purchasing through their Cloud Provider. But more recently, we are seeing executives, and often other VC board members, proactively recommend that companies integrate with a Marketplace, after seeing other portfolio companies have success accelerating large deals through this channel. Investors are quick to share best practices across their early-stage portfolios, and the movement towards Marketplace selling is a prime example of a practice that has expanded from once being a niche channel to now being touted by many top investors as an essential component of go-to-market infrastructure for any B2B SaaS business.

45% of the 2021 Forbes’ Cloud 100 companies now actively sell on at least one of the three main Cloud Marketplaces, compared to 35% last year.

Two of the other strongest trends that have caught investors’ attention in recent years have been the push to product-led growth and usage-based pricing. We at BVP have long been believers in the value that these strategies provide, as they can help to dramatically reduce customer acquisition cost (CAC) payback times and increase net revenue retention—arguably two of the most important metrics for B2B SaaS companies—as we highlighted in our annual State of The Cloud Report this year. We believe that Cloud Marketplaces are fundamentally linked to these trends, and that by investing in Marketplace infrastructure early on, it not only helps companies accelerate sales cycles and streamline sales operations from day one, but it also sets a strong foundation for digital selling.

Over the coming years, we expect to see Cloud Marketplaces become the default fulfillment channel for product-led-growth companies. In addition, as B2B software companies increasingly shift to pay-as-you-go pricing models, it is only natural for these services to be purchased through the major Cloud Providers, where buyers already have their largest consumption-based budgets. Today there are a few Marketplace sellers that are pioneering extremely efficient GTM models around these concepts, largely by building out complex custom sales infrastructure from scratch. We think that the next generation of best-in-class SaaS companies will follow suit by leveraging best-of-breed tools to integrate with Cloud Marketplaces, drive leads to these channels, and fulfill deals with flexible pricing and payments options. These companies will benefit from faster CAC payback, higher net revenue retention, and, most importantly, happier customers.”

Entering a New Era of Cloud Marketplace: the Cloud GTM Era

This year, there is an underlying theme around maximizing value for both buyers and sellers. Companies everywhere are focused on scaling efficiently. In this year’s report, we learn how buyers are leveraging the Marketplaces to make the most of their growing cloud contracts, channel partners are ushering in a cloud-forward value proposition, and seller’s are investing heavily into go-to-market infrastructure that drives higher value at lower costs.

Let’s unpack the data and trends and explain the key learnings we took away from this year’s survey.

Learning 1: Enterprise buyers are integrating Marketplace usage into their cloud discount programs and agreements

Between 20–40% of cloud companies are coming up for renewal on their first-generation enterprise cloud agreements, most of which were signed before Cloud Marketplaces were on their radar. Now, both cloud buyers and sellers are factoring Marketplace spend into their negotiations.

We reported earlier that the top reason for buyers purchasing through Marketplace is taking advantage of their committed spend with Cloud Providers. According to Gartner, public cloud spend will hit nearly $400B in the next year, a 20% increase over 2021.

But as companies evaluate their spend in the coming year(s), they will look for opportunities to create efficiencies while still being able to take advantage of the volume-based discounts offered by the Cloud Providers. Integrating software procurement into their cloud budget is one major part of that consideration.

Cloud enterprise agreements represent a significant driver for Marketplace procurement. In our survey, we found that 77% of our buyer respondents have some sort of enterprise cloud agreement (EA) in place and of those, 90% say they plan to purchase via Marketplace in the future. This tells us that with each renewal of these massive cloud agreements, the likelihood of Marketplace being included increases. (If you’re a buyer with an enterprise agreement and you haven’t leveraged burndown on your committed spend to purchase software through the Marketplaces yet, you’re missing out on some serious value.)

Survey Voices: “[Marketplace] is a purchase vehicle that customers understand and can easily execute.”

For sellers, that means larger budgets are opening up that are earmarked for cloud spend, and buyers will benefit from leveraging that spend on Marketplace purchases. We see this as an acceleration of a new budget flywheel for all software companies to tap into (more buyers = more budget = more sellers = more buyers).

This finding also dispels the myth that enterprise buyers don’t purchase via the Marketplaces. In reality, companies with committed cloud spends are incentivized to buy this way—some are even requiring it as it also simplifies procurement, legal, finance, etc in otherwise largely complicated processes. It’s kind of like having a credit card that rewards you with travel points; the benefits are there for the taking and smart buyers are well on their way to making the most out of them.

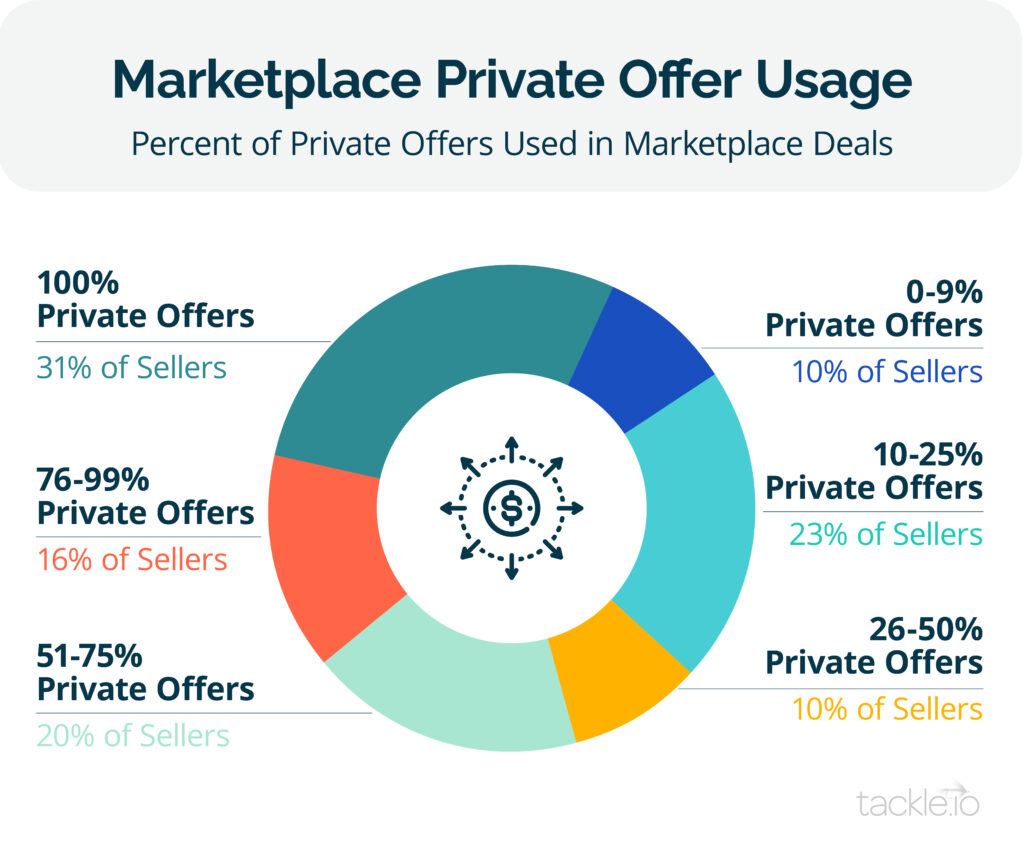

Private Offers make enterprise Marketplace selling a no-brainer

A great example here is Private Offers. Private Offers have clear advantages and are often the easiest way to start selling with Cloud Marketplace. They help sellers get as close to a direct sale as possible while still reaping all the buyer benefits Marketplace has to offer (leveraging of cloud spend, consolidation of billing, standard contracts for legal, easier procurement).

According to our survey, nearly 60% of Marketplace sellers expect to do more than half of their Marketplace business through Private Offers—21% of those anticipate using Private Offers exclusively. While some sellers are still catching on, we expect Private Offers will become the primary method for closing enterprise deals through the Marketplaces.

Read here about how CrowdStrike leverages Tackle to scale their Private Offer volume.

Learning 2: As cloud spend increases, it’s igniting a change in ownership, and that’s enabling new types of buyers to leverage it.

A prevailing myth says Marketplaces are the domain of technical buyers like developers, engineers, and operations only. Statistics (and a shift in budget ownership) tell a different story.

Historically, cloud budgets have lived with technical teams like IT, and non-IT departments like sales and marketing had their own departmental budgets for software. As companies go all-in on cloud, though, departmental budgets are shifting toward ownership within enterprise procurement.

Survey Voices: “This is highly visible within our C-suite … and is gaining more traction. Our reps are proactively asking us for the ability to transact all solutions through the Marketplace.”

When ownership of the cloud budget makes this move, the CFO takes a vested interest and works with the procurement team to maximize the value they get from that budget. This eliminates the departmental view on spend and democratizes access by placing it at the highest level of the organization.

This also dispels the myth that only certain kinds of buyers can or will purchase through Marketplace. In fact, 58% of our survey respondents with roles in marketing, sales, and operations said they had purchased software through a Cloud Marketplace in the last year, compared to 38% with those roles in our 2020 survey. Of those buyers, 67% used Azure/Appsource, 33% used AWS, and 33% used ArrowSphere. All of them said they were likely or extremely likely to purchase this way again.

This reallocation of budget in combination with increasing budgets that are earmarked for Marketplace is a huge win for sellers because they have a route to access pre-committed budget dollars and can close deals faster.

The savviest of sellers are finding inroads to procurement teams and leaders to tap into cloud budgets at its source. Cloud-forward sales leaders should guide sellers to engage in that discussion very early on in the discovery phase of the sales cycle to determine if Marketplace is an accessible option.

Check out our blog on 3 questions to ask to identify the right opportunities for Marketplace.

Learning 3: Channel partners and channel-friendly sellers see Cloud Marketplaces as a differentiator.

Continuing with the theme of maximizing value, channel partners have a unique opportunity with Marketplace. Cloud Marketplaces can offer a beacon for the channel that enables them to evolve.

For sellers, efficient payback of customer acquisition is the name of the game; it’s a big reason why they are embracing the Marketplaces themselves. That means when it comes to the financial view of channel partnership, it’s about the value of the dollar.

68% of Marketplace sellers in our survey told us that “improving new customer acquisition and complementing a product-led growth strategy” was one of their top goals for their Marketplace strategy, indicating many are looking to drive more efficiency from their go-to-market. Companies moving toward a lower cost GTM are unlikely to accept high-margin deal splits that cost more than they appear to be worth.

That’s not to say that the channel is value-less by any means—making it easier for software buyers to buy is a necessary role. But it does mean as channel partners look to differentiate in an efficiency-driven market, they need to either provide massive value to the seller or reduce the cost of transaction (or both). Channel players can’t compete in the margin game anymore; there has to be value-add and resellers that don’t adapt will struggle to stay relevant.

In our survey, we learned that 70% of respondents selling on Marketplace today are leveraging resellers/MSPs. Half of those say channel partners will be involved in at least 30% of their Marketplace transactions in the coming year. However, over a third of respondents said they are not clear how Marketplace fits into their existing channel strategy. There’s an obvious disconnect here but we’re starting to see early channel adopters recognize the need for change.

Canalys predicts that nearly a third of all Marketplace purchases will flow through partners by 2025.

Cloud Providers are sweetening the pot too by recruiting partners and developing and expanding programs that fuel more channel partner sales. Just one example is AWS’s Consulting Partner Private Offers (CPPO) program, which allows third-parties to sell on behalf of companies on the AWS Marketplace and present Private Offers—all with automated billing and deal splits. But all the hyperscalers are actively thinking about the role of the channel in Marketplace success.

Canalys is predicting that by 2025, nearly a third of all Marketplace purchases will flow through partners. These early signs point to what will be a rapid escalation in the channel + Marketplace model. The earliest adopters are already leaning in with a transaction-assistance approach, and as more investment and sophistication comes to fruition here, we see an interesting path for channel partners to take on their journey with Marketplace. It’s at least a few years out but you can see what we’re thinking in the predictions at the end of this report.

Learning 4: Cloud Marketplaces have shifted from an alliances-only charter to a company-wide GTM strategy.

The opportunity of Marketplace success reaches well beyond any one team, with significant impact on and benefit to sales, operations, finance, legal, product, and leadership.

Cloud Marketplaces are not just seen as another channel for Alliances teams to pursue in a vacuum, but as an enabler of a cloud-driven GTM strategy to accelerate substantial revenue company-wide. As a result, companies are building teams that drive the Cloud GTM forward and this is being noticed at the highest levels of leadership.

CrowdStrike CEO George Kurtz is an outspoken advocate for the Cloud Marketplace as a revenue driver. During an April 2021 investor meeting, Kurtz emphasized that CrowdStrike’s ARR generated through the AWS Marketplace grew by 650% in the past fiscal year. He also noted a 300% increase in Marketplace transaction volume during that time, partly thanks to deals closing almost 50% faster.

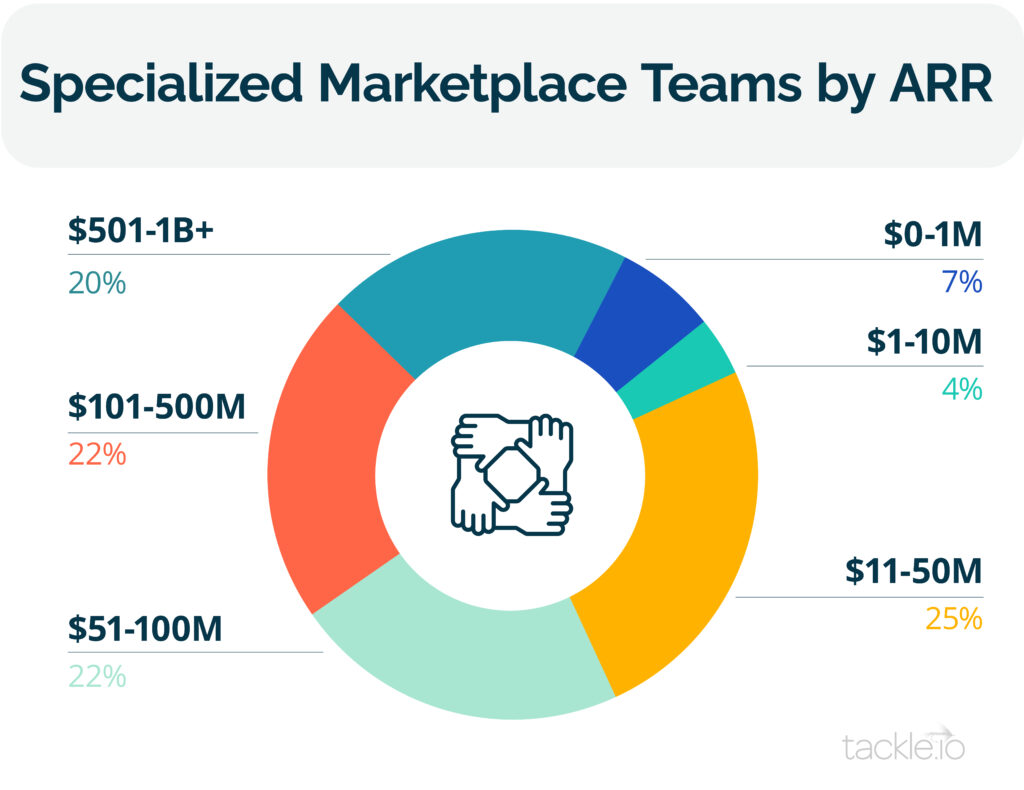

According to our survey, 54% of sellers say their Alliances, Channel, or Partners team currently owns their Marketplace sales strategy—and that number increases when we look at scaling and at-scale companies (above $11M in ARR). That’s bang-on what we would expect—for companies that have reached the scale at which they have formed an Alliances team, it makes sense for that team to lead the cloud relationship.

Marketplace success is not a one-department show. It requires strategic alignment across departments, of which sales is just one of the players.

One way we are seeing companies succeed with Marketplace selling is by layering on specialized operational teams. More than half of our respondents (56%) said they have implemented some version of a specialized Marketplace sales team, whether that’s a sales overlay team (14%), a Marketplace deal desk (20%), or a wholly dedicated Marketplace sales team (22%). These companies also expect Marketplaces to account for a higher percentage of revenue in the next 12 months. However, it’s important to note that it’s significantly more likely to find these specialized Marketplace teams in scaling and at-scale organizations.

The Compensation Correlation

Tackle’s survey confirmed some pretty obvious assumptions about how much a company’s sales compensation strategy influences the performance of its Marketplace initiatives. Getting field sellers to engage in Marketplace selling is critical to its success and that means compensating fairly to ensure they aren’t negatively impacted.

We typically recommend organizations take a neutral approach to compensation for field sellers. Companies that offer neutral compensation see more activity and more success than those that have their field eat Marketplace fees:

- 68% expect Cloud Marketplaces to account for up to a quarter of revenue in 2022

- 63% plan to add at least one additional Cloud Marketplaces in the next year

This is because neutrality removes the decision for the seller altogether and allows them to take the route that is easiest for their buyers without a negative impact on their own compensation.

So Who Owns It?

With so many required hands to make Marketplace a successful channel, how can companies centralize the sprawl? Our Chief Cloud Officer, Sanjay Mehta, said it perfectly in a blog he wrote about Shaping the Future of Cloud:

“In a typical company, everyone is looking at different parts of these decisions through different lenses. Among heads of revenue, product, marketing, channel, finance, alliances, and sales operations, who’s the logical owner for transforming the business? Time and time again I’ve seen the struggle: when everybody owns something, the reality is nobody owns anything.”

We’re starting to see some early indicators even just by a quick LinkedIn search of some formalized titles in this area, and we predict that companies will look to roll this up into the C-Suite. Splunk is a great example of this, having appointed its first Chief Cloud Officer, Sendur Sellakumar, in July of this year “to oversee Splunk customer cloud transformation, acceleration and go-to-market strategy. …Sellakumar’s leadership will extend across Splunk’s product, engineering, strategy, sales, partner, and customer success teams to drive cloud growth.”

We expect many companies will adopt this role as sellers get clearer on the impact of cloud on the way they do business.

Predictions for 2022 and Beyond

Now that we’ve uncovered just how much Cloud Marketplaces have evolved in the last year, there’s a clear movement taking shape. At Tackle, we see so much more in store as Marketplaces pave the way for an integrated Cloud GTM.

Tackle’s leadership team is making a few big predictions for the not-so-distant future. We’ve based these predictions on insights from this data, analyst data, as well as continued frequent conversations with buyers, sellers, customers, partners, and cloud stakeholders across the industry.

Prediction: Cloud Marketplaces will exceed $10B in throughput by the end of 2023 and $50B by the end of 2025.

- We’ve seen research from analysts like Canalys and Forrester with some great forecasts on this but we estimate the growth of Cloud Marketplaces will exceed their targets much faster.

- While the numbers we’re estimating are HUGE, they are still only a fraction of the broader B2B software sales.

- We believe Marketplaces will accelerate to be one of the fastest growing cloud services over the next 5 years.

Prediction: Companies will start to consider Marketplace as a launch-pad for a bottoms-up selling motion.

- In our survey this year, 42% of buyers said a top reason they purchase through Marketplace is because it accelerates the time to value they receive from the software they purchase (up from 27% in 2020). Buyers want to leverage Marketplace to get faster access to the tools they need without a complicated purchasing process; and this makes sense as buying behaviors today favor low-touch purchasing and fast, easy access to software.

- As mentioned in John’s foreword, the Cloud Marketplaces are a best first step for companies looking to execute on a product-led or usage-based strategy. These bottoms-up motions are complex and difficult to get right on their own, but the flexibility and innovation happening within the Marketplaces open the opportunity for low-risk experimentation.

- We expect companies in the coming year will evolve their Marketplace strategy to fit a larger variety of GTM models, and user-centric offerings will start to become more common. Consumption-based pricing and free trials will be where sellers find their footing here. Most companies will start with one way of selling through Marketplace to start with but as they build the Marketplace muscle and scale, they will experiment with targeted packages and listings for specific buyer types.

Prediction: Channel partners that learn to differentiate with Marketplace will start on a new journey.

- As we mentioned in Learning 3, early Marketplace adopters in the channel are recognizing some big potential to transform traditional reseller models to meet buyers where they are.

- The Marketplace journey for the channel is just getting its legs today with resellers assisting with Marketplace-driven transactions. In the long-term though, we foresee a trajectory where resellers will shift from transaction and deal assistance to offer services-enhanced deals, the bundling of services + product, and eventually develop their own private Marketplaces with curated stacks of their products + services.

- This will require additional innovation from all sides—buyers, resellers, and the clouds themselves but we’re seeing signs pointing in that direction.

- We expect to see some more creative moves from distribution partners regarding Marketplaces in 2022 and beyond.

Prediction: Cloud Marketplaces will not race to zero on fees but will invest in co-sell motions and other partner programs that make value creation the storyline.

- Microsoft took a huge step this year when it reduced the fees it charges ISVs from 20% to 3%, giving sellers much higher profit margins on their Marketplace business.

- As the cost of doing Marketplace is evolving, we’re seeing the value increase dramatically. In our survey, 45% of Marketplace sellers said high Marketplace fees are a gap in the seller experience.

- Realistically, the Marketplaces are unlikely to dip much lower on these fees but they will continue to innovate in ways that add more value to sellers and sellers will be more willing to pay higher premiums on high-value. All companies are thinking seriously about the efficiency of their go-to-market as they scale. Particularly as the movement toward efficient growth builds, sellers will double down on channels that deliver the most bang for their buck.

Prediction: New and niche Marketplaces will come online and those that don’t nail incentives for sellers, buyers, and the Marketplace platform will fail.

- Forrester has estimated that we’ll see hundreds of vertical and niche Marketplaces enter the picture in the coming years, but that there will be a much smaller subset of winners who take most—those that strike the right balance between innovation, cost, and incentive.

- Any new Marketplace players that come on the scene need to be able to answer the question of how their buyers and sellers get value out of the equation. Removing friction is good; unique and differentiated value for buyers, sellers, and the platform providers are best.

- Marketplaces that don’t strike this balance for both the buyer experience and seller experience will not succeed and we expect to see early casualties (or at least a few walking dead) emerge in 2022.

- In addition, winning Marketplaces will create sub-Marketplaces to invite more niche purchasing experiences, like the AWS Data Exchange and Snowflake’s Data Marketplace as well as Microsoft’s Teams Marketplace.

Conclusion

Cloud Marketplaces have made their mark in the last year and have made the jump across the chasm when it comes to adoption. Year over year, there has been significant growth and innovation in the Marketplace space with more buyers buying, more sellers selling, and larger investments on the horizon from the Cloud Providers, sellers, and buyers. We are still in the early years of a decade+ long transformation of the way that software is both bought and sold and we look forward to deeply analyzing and innovating on behalf of all software companies for years to come.

Check out The Complete Playbook to Cloud Marketplaces. It’s a free resource, totally ungated, and full of our tried and tested best practices on how to launch, scale, and optimize your Marketplace strategy.

Cloud Marketplaces are the future of B2B commerce. Make sure you’re there to take full advantage. Speak with one of our Marketplace experts about how Tackle can help simplify and maximize your Marketplace strategy.

Have questions or comments about this report, interested to have Tackle debrief you or your team on our findings, or want to be emailed when new Tackle research is available? Reach out to us at marketing@tackle.io.