Learnings, predictions, and insights into the state of Cloud Marketplaces in 2023

Jump to a Category

INTRODUCTION

NOW OPEN: Contribute to the 2024 State of Cloud GTM survey!

Written by John Jahnke, Sanjay Mehta, Nicole Wojno Smith, Adam Boyle, and Erika Childers

After three years of publishing the State of Cloud Marketplace Report, we’re thrilled to elevate this research into the industry’s first and only report focused on how software companies are driving efficient routes to market with the Cloud Providers. Welcome to Tackle’s 2023 State of Cloud Go-to-Market (Cloud GTM) Report.

As software sales through Cloud Marketplaces eclipse an expected $15B this year, it has become clear that software companies leaning in to this new sales motion prioritize Cloud GTM to drive business transformation. They’re making intelligent, data-driven decisions on when and where to co-sell with the clouds in an effort to drive brand strength, deal-level support, top-of-funnel growth, and ARR. They are prioritizing Marketplaces as the preferred way to transact with customers and including existing traditional channels to nurture long-standing relationships and to leverage expanded market reach. Co-sell and Marketplaces are inextricably linked and, in tandem, are critical to building a successful partnership with the clouds that ultimately benefits your business, your buyers, and your partners.

This is a tectonic shift for the software industry. In this report, we’ll highlight several ways the Cloud Providers are signaling that investment in Cloud GTM is an investment in meeting your buyers and your partners where they are. As buyer appetites increasingly prefer to purchase this way, ISVs will have access to growing budgets through committed cloud spend agreements and, in partnership with their Cloud Partners, reach new customer opportunities. With so much of the cloud landscape seeing new and exciting changes over the last year, we can’t wait to dig into this year’s report.

In this year’s report, you’ll find key learnings such as:

- Cloud Marketplaces have created a path for revenue transformation

- Marketplace and co-sell go hand-in-hand

- Executing on Cloud GTM, particularly at-scale, doesn’t come without its challenges

- Cloud GTM is a strategic, long-term, company-wide commitment—not a tactical or departmental initiative

- Cloud GTM success is a journey, not a destination

As well as predictions to keep in mind as we head into 2024:

- We will see as high as $15B in Marketplace throughput by the end of 2023 and $100B by 2026.

- Over the next few years, finance leaders will get on board with Cloud GTM being one of the most efficient revenue channels in their business.

- Five years from now, every seller in a software company will know how to win with cloud.

- Incentives for ISVs to engage in cloud partnerships through go-to-market activities will crescendo before they phase away.

- Customer demand to purchase solutions including multiple products and services will drive innovation from the channel.

In further setting the stage for this year’s report, we would be remiss not to mention the economic downturn of the last year. It’s been a tough one for the technology industry—budget cuts, layoffs, slowed software spend, tech stack consolidation. Winning new business has been harder, renewals and budgets have been challenged. It seems like we’re starting to head cautiously into the light with efficient growth as a key heading for nearly all companies, in contrast to the growth at all costs mindset we saw in years prior. The clouds have offered additional avenues to win for sellers as buyers’ cloud spend has remained relatively resilient.

The total B2B cloud market is predicted to grow 21.7% to total $597.3 billion in 2023. – Gartner

When asked about the primary hurdles of the past year, software sellers noted operating challenges around sales productivity, operational efficiency, and delivering on revenue commitments. We see these challenges as strong reasons why ISVs are looking to new channels and opportunities like partnerships, ecosystem-led strategies, and Cloud GTM.

To solve for these operating challenges, nearly two-thirds of respondents see “advancing cloud partnerships” as a key business driver and one of their top priorities in the coming year. With this lens in mind, let’s get into the data, learnings, and predictions from this year’s State of Cloud GTM survey.

SURVEY METHODOLOGY

In summer 2023, Tackle surveyed individuals representing software sellers across a broad range of categories in order to get a pulse on the experiences, successes, and challenges of ISVs engaging in Cloud GTM activities, including Cloud Marketplaces and co-selling. Titles of these individuals primarily included those in the Cloud Alliances function (50%) and those in Channel/Partner Management (25%), as well as individuals in Product/Engineering, Sales/Revenue, and Operations.

The majority of this year’s survey respondents work in organizations that sell business applications (32%), infrastructure (20%), or data products (17%). We also had respondents from companies in security, DevOps, and machine learning.

We saw respondents from all levels of ARR, with a particular concentration from those in the $101-500M and $501M-1B segments, which maps well to the business segments we see thriving most in this route to market.

JOHN’S FOREWORD

Connect with John on LinkedIn or Twitter.

It has been a hard year for almost everyone in go-to-market roles. Deal cycles are long, buying committees have grown, budgets have been cut, sponsors have left, priorities repeatedly shifted. Leaders and sellers lost their jobs as demand slowed and the ability to predict and control revenue decreased. This has been one of the hardest years in software that I have seen since the dot-com bust. The good news: over the last quarter or two, it certainly feels like things have stabilized, and I believe we are starting to turn a corner. Sellers are closing opportunities, customers are moving priority initiatives forward. It isn’t easy but there is light. Does this mean we return to growth at all costs (hopefully not) or that people will go back to unrealistic growth expectations in their plans? The answer is no.

2023 is the year that software sales has changed forever, and I believe it will be a better future because of it.

For the first time in a long time in software, growth expectations are as reasonable as they have ever been and, as companies start to get into their planning season for next year, most companies are planning to return to growth and investment. It will not be at the levels we saw in 2021 or what people thought they could do in 2022-2023, but it is at a much more realistic level of growth, which will create better, more efficient, more consistent companies, as building at 30-50% growth year over year is MUCH more reasonable than 100%+.

It has been a slog to get here and we might not be at the destination yet but the storm clouds are breaking, there is sun on the horizon, and the new world looks very different than the old. A new world focused on value and a fair exchange of dollars for value. A world where old ways of doing things are being shed for new and more efficient ways. The historical norms of selling over the last 20 years are being challenged in ways that were not before imagined. AI is changing the way we work, product-led growth is changing the way people get started with products. Companies throwing free resources at customers to help them adopt is changing as companies can no longer afford to operate this way, self-service, faster time to value, and both product and ecosystem-led business substrates are mandatory.

So if software selling and buying has truly been changed forever, what does that mean for founders, builders, and GTM leaders?

- We will have to work harder to delight our customers – As there is more scrutiny on spending, customer expectations will be higher than ever.

- We’ll have to be more efficient than ever – Growth at all cost is no longer an option!

- Innovation and experimentation will need more focus – When efficiency is a priority, justifying experimentation becomes more difficult.

- It might take longer to build a company – The road to ‘at scale revenue’ when operating with efficiency is longer.

- Buyers will flock to the leaders and to strength – In capital-constrained environments, the leaders in markets win based upon quantity of investment and durability of the company

- New challengers will need to be better than ever (10x) – Based upon capital scarcity and a flight towards stability, it only raises the bar on challengers.

But when we nail this, we will build once-in-a-generation companies that delight customers and new and seamless ways with world-class efficiency.

This is a big change coming—an enterprise transformation—in the way that revenue systems work. We are in the earliest days of this transformation and most business operations will need to change to enable this next generation of growth, which includes sales-led, marketing-led, product-led, ecosystem-led, and cloud-led.

Cloud GTM is part of the story. It isn’t the whole story but I’m so excited for us to share our research with you as we continue to lean into cloud-enabling all software company GTM systems.

LOOKING BACK, LOOKING AHEAD

With four years of data now under our belt, we’ve seen predictions made in previous years come to fruition. In our first year, 2020, we benchmarked how the Cloud Marketplaces were being used by sellers and buyers and made a few very early predictions for the future. We believed then the Cloud Marketplaces were the first real digital commerce channel for B2B software, and we still do.

Over the last two years, the uptake on Cloud Marketplace adoption has grown significantly. For innovators and early adopters, Marketplace became a key part of their go-to-market systems and it has grown to represent a significant revenue opportunity. This year, we’re seeing companies think more comprehensively about how Marketplace is just one piece of a larger Cloud GTM strategy that also includes co-sell and using data to identify the right cloud buyers.

Here are some of the predictions we’ve made over the years that we’ve seen play out:

1. Cloud migrations will bring buyers to Marketplaces.

Back in 2020, we predicted that buyer interest in procuring software through the Marketplaces would grow significantly as companies migrated their products to cloud infrastructure and placed what is likely their largest budgets with the Cloud Providers. As ISVs understood the benefits of leveraging their cloud budgets to purchase software via the Marketplaces, interest increased. This year, meeting customer demand was a top reason for transacting through the Marketplaces, growing 28% over last year and a whopping 88% since we first asked this question in 2021.

We also continue to see Marketplace buyers of all types. Business Applications ISVs made up a third of our respondent pool this year, about the same as last year, indicating companies selling to non-technical buyers are still finding success here. This highlights a great evolution in the market and a very positive sign for acceptance of Marketplace as a primary B2B channel.

2. Channel partners that learn to differentiate with Marketplace will start on a new journey.

In 2021, we noted the most innovative channel leaders were starting to figure out how to transform their traditional models to meet cloud buyers where they are. In this year’s research, 63% of survey respondents had some sort of channel partner involvement in their Marketplace deals over the last year, telling us there have been some strategic moves from the channel as the Cloud Providers have rolled out programs like AWS’ CPPO and Microsoft’s MPO to assist the channel in leaning in.

3. The Cloud Marketplaces will not race to zero on fees but will invest in co-sell motions and other partner programs that make value creation the storyline.

While frequently a consideration in initiating a Cloud GTM motion, Marketplace listing fees are too commonly seen as a “tax” to the ISV versus a transaction fee proportionate to the value provided in this route to market. Responses to this sentiment from the top Cloud Providers have varied, but there’s no doubt the trend line in listing fees has been on a steady decline over the last decade. In 2021, we predicted that, instead of eliminating fees completely for sellers, the Cloud Providers would continue to build up their incentives and programs to drive higher value to account for those costs. From the research below, you’ll see that ISVs agree the value of cloud partnerships has grown over the last two years.

4. Sales, Marketing, and Alliances have to work together as an organization to lean into partner-led growth.

We’ll talk quite a bit in the report about how multiple functions across the org need to band together to create a successful and sustained Cloud GTM strategy and motion. We’ve seen that breaking down silos and fostering collaboration between these departments has led to increased sales as well as a more streamlined sales motion. We know Cloud GTM activities like Marketplace, co-sell, and the data that informs it have the ability to accelerate deal velocity. Generating revenue faster is a cornerstone of efficient growth. And when all parts of the go-to-market system lean in, everybody wins.

5. We could see as high as $15B in Marketplace throughput by the end of 2023 and $50B by the end of 2025.

Last year, we predicted that as much as $15B would flow through the Cloud Marketplaces by the end of this year. We can’t wait to see where the market lands.

We expect Tackle’s 550+ customers to transact nearly $3B through Marketplace in this fiscal year, up 100% year-over-year. Among our 550+ customers are many of the top performing sellers across AWS, Google Cloud, and Microsoft. That’s great growth in more normal market conditions, and really pretty phenomenal in today’s macro economic reality. Primary growth drivers include operational improvements from the clouds to support at-scale motions, sales teams rallying around co-sell, and buyers getting increasingly savvy in leveraging the Cloud Marketplaces to purchase more of their software stack with cloud-committed contract dollars. All of this is coming together to drive larger deals, improved win rates, and faster procurement cycles.

Earlier this year, Canalys noted: “Despite economic turbulence weighing down on public cloud growth, Marketplace momentum is likely to gather pace in 2023, thanks to [the ability of enterprise customers to “burn down” their upfront committed cloud spend with the hyperscalers using Marketplace purchases]. With many enterprises now scaling back cloud adoption to cut costs, shifting more of their software and cybersecurity purchases to the hyper scalers’ Marketplaces is an attractive way to hit their cloud commitments.”

You’ll also see a revised prediction on this stat later in the report.

LEARNING 1: CLOUD MARKETPLACES HAVE CREATED A PATH FOR REVENUE TRANSFORMATION

Every year we ask respondents why they invest in selling on the Cloud Marketplaces. One of the biggest changes in sentiment this year compared to last year’s report (and every year prior for that matter) is that the number one reason for selling this way is to advance partnerships with Cloud Providers. This shift from tactical benefits like “access to buyers’ cloud budget dollars” and “unlocking co-sell” (which are still highly valued) indicates a movement that puts cloud partnerships at the center of a new and dynamic revenue channel with global appeal. Marketplaces are transforming the shape and focus of go-to-market organizations, the mix and makeup of revenue contributing channels, and the importance of partnership teams in the C-suite.

As you can imagine, companies at different stages have different goals when it comes to Marketplace beyond growing their cloud partnerships. For companies with less than $10M in revenue that are finding product-market fit and often have internal teams that are stretched for resources, their top goals included meeting customer demand, simplifying contracting and procurement for their buyers, and opening a new channel for revenue.

For companies with $11-$100M in revenue, Marketplace ownership usually falls to the Partner team and top goals included accelerating deal velocity, simplifying contracting and procurement for their buyers, and becoming eligible for Cloud Provider incentives for Marketplace sellers as they look to scale this channel.

For companies with revenue over $100M in ARR, they are trying to operationalize this across multiple functions in the business, and top goals for Marketplace selling included taking advantage of Cloud Provider incentives, accessing their buyers’ cloud budgets, and meeting customer demand.

Cloud GTM can be a powerful route to market for ISVs, validated by the fact that many respondents identified strengthening their cloud partnerships as important to their business goals. A survey respondent in a Cloud Alliances role at a $1-10M business applications startup said: “Selling with and through [our Cloud Partner] has enabled us to take advantage of partnership programs we wouldn’t have access to if we weren’t transactable through the Marketplace, which in turn has led to new opportunities for marketing and going after new accounts jointly.”

By building stronger relationships with the Cloud Providers, sellers can engage in more effective solution-oriented conversations with current and new buyers through co-sell and access to Cloud Provider funding and programs, contributing to higher sales productivity and more efficient revenue generation. As their Cloud Provider relationships grow, ISVs will reach new tiers for partner development that bring added incentives. Some of those programs and incentives include:

- Requires ISVs to undergo Foundational Technical Review (FTR), have 10 partner opportunities qualified through the AWS Customer Engagement (ACE) Program, a minimum of 20 launched opportunities with $30,000 in AWS monthly recurring revenue (MRR), and at least two 2 publicly referenceable customers.

- Incentives include a PDM (Partner Development Manager), Account Manager support, eligibility to participate in activities that help drive awareness with the AWS Sales teams, prioritized access to the AWS co-sell support team, reduced listing fees for AWS Marketplace, and more.

Google Cloud’s Partner Advantage program

- At the Premier tier, requires an annual business plan (recommended), a minimum of qualifying consumption or bookings, and a book of customer success stories.

- Incentives include Partner support, eligibility for marketing campaigns and co-branding opportunities, Partner discounts, and deal registration.

Microsoft’s Azure IP co-sell program

- Requires ISVs to list their solution as a transactable offer and sell directly on the commercial marketplace, meet or exceed a billed revenue of $100,000, and have a published quality co-sell bill of materials, including an offer one-pager (with customer wins) and offer pitch deck.

- Top-tier incentives include Microsoft seller support with a PDM (Partner Development Manager) and Account Manager, go-to-market resources, and campaign eligibility.

Show Me the Money

44% of sellers said they expected to transact more than 10% of their revenue through a Cloud Marketplace in the next year

What matters most about these partnerships for most ISVs is how it contributes to accelerating revenue growth. Last year, 44% of sellers said they expected to transact more than 10% of their revenue through a Cloud Marketplace in the next year. This year, 26% said they expect this level of revenue contribution through the Marketplaces in the next year. This lowered expectation has certainly been influenced by the economic turbulence of the last 12 months and we see a few other areas that may have contributed to this year-over-year gap:

- Aggressive expectations – Year 1 goals for many ISVs from last year may have been outsized based on their maturity. As you’ll see later in this report, nailing this motion in a way that drives a double-digit percentage contribution to revenue takes time and we think perhaps some ISVs, while seeing early success, haven’t quite hit the 10% contribution yet.

- Added complexity – As you grow to higher levels of revenue contribution, scale increases complexity. It requires more focused and highly aligned cross-functional teams, a scalable operations model, and, in the best cases, more frequent co-sell interaction with the Cloud Providers.

- Lack of maturity – If process, automation, enablement, and alignment don’t rise at the same time as revenue expectations, continuing to see revenue lift is a challenge. Many ISVs who expected to see 10%+ of total revenue flow through Marketplace may not have kept up operationally to sustain that level of revenue generation. Behavior change takes time, and the factors internal to your organization can cause friction in building a new Cloud GTM muscle if not anticipated and carefully considered.

We expect this trend to rebound as the market stabilizes this year and as the paths to revenue from Cloud GTM become more standardized for ISVs. Later in this report, we’ll lay out a framework that helps set expectations around revenue attributed to this channel depending on the stage of maturity you’re in. Keep reading for the context on what good looks like!

LEARNING 2: MARKETPLACE AND CO-SELL GO HAND IN HAND

This year, we learned that about a third (31%) of survey respondents who say they have a strategic partnership with their Cloud Partner(s) don’t have a transactable listing on the Cloud Marketplace(s). This shot up a pretty big red flag for us. A strategic cloud partnership that doesn’t include Marketplace leaves a lot of opportunity on the table for these ISVs.

In addition, Marketplace is becoming a required channel for successful cloud partnerships and companies that fail to transact there will lose relevance with their partners and with buyers. The Cloud Providers themselves are betting big on Marketplace and co-sell as joint value drivers. In 2022, we saw AWS bring together its Marketplace and APN partner organizations (including co-sell teams and its ACE (AWS Customer Engagement) system) into a combined team focused on partner success. This summer, Microsoft announced that all ISV Partners must have a transactable Marketplace listing in order to unlock the richest benefits of its partner program, and ISVs are responding quickly to these kinds of changes. Over the last quarter alone, Tackle has seen a 10x increase in co-sell usage across our entire customer base and we expect to see other Cloud Providers follow similar paths to guide ISVs toward the behaviors that drive adoption and stickiness.

“[Marketplaces] are a key route for customers that we must be able to transact in. Using co-sell to get higher up with customers and using MACC/EDP budgets to speed up deal approvals are big opportunities.”

In this year’s survey, 51% of respondents listed “unlock or accelerate co-sell opportunities with Cloud Providers” as a primary reason for selling on the Marketplaces. ISVs know that Marketplace and co-sell offer complementary value props that support seamless transacting and scalable deal flow, and they’re seeing it pay off. Of the respondents who do have a transactable listing, 44% say more than 5% of their net new pipeline has been influenced or assisted by co-sell in the last 12 months—not a massive contribution yet for most ISVs, but this number is only bound to grow as both ISVs and Cloud Providers establish stronger processes and practices for the merging and operationalizing of co-sell and Marketplace. We expect to see the clouds develop programs, incentives, and requirements designed to drive behavior that enables Cloud GTM at scale through CRM integration.

As one respondent in a Cloud Alliances role at a $501M-1B+ Security ISV put it, “[Marketplaces] are a key route for customers that we must be able to transact in. Using co-sell to get higher up with customers and using MACC/EDP budgets to speed up deal approvals are big opportunities.”

Integrating with Marketplace and Co-sell

The majority of respondents (53%) said they expect more than 15% of their Marketplace deals to be influenced or assisted by co-sell in the next year, showing ISVs are starting to see a clear connection. We expect to see this increase dramatically over the next 12 months as Marketplace and co-sell integration starts to become a requirement for advancing cloud partnerships.

In addition, nearly all of those respondents (46%) said they have struggled to integrate Marketplace + co-sell into their core business systems and operational workflows. As the Cloud Providers make it clear that co-selling and Marketplace are required investments for partnership growth, driving a successful Cloud GTM at scale means no longer viewing them as isolated processes or distinct solutions. For most ISVs today, co-selling and Marketplace act as separate workflows, almost entirely manual, and disconnected from the broader go-to-market system. To reduce the amount of time spent creating, submitting, and managing co-sell opportunities and Marketplace deals, CRM integration and automation are necessary to bring these workflows closer to the sellers’ system of record and make Cloud GTM as natural as selling direct.

In a Tackle press release, Francois Grenier, Head of Partnerships at Thoropass said, “[By bringing] our co-sell and AWS Marketplace motions together and streamlining that into Salesforce, our revenue, operations, and alliance teams can operate faster to accelerate and close deals.

Support for Channel Partners

“[By bringing] our co-sell and AWS Marketplace motions together and streamlining that into Salesforce, our revenue, operations, and alliance teams can operate faster to accelerate and close deals.”

We can hear you now asking “What if I already have a channel strategy—how does that integrate into Cloud GTM?” or “I’m a channel partner—what does this mean for me?” Channel + cloud are complementary motions that can (and do!) coexist. Wiz is a fantastic example of this. Within the last year, each Cloud Provider has established programs that enable deeper merging of the two. This year, 63% of survey respondents had some sort of channel partner involvement in their Marketplace deals, and 85% expect more channel partner involvement in Marketplace deals in the coming year. This indicates a need for ISVs and channel partners to work together to plan their strategies for making cloud a central part of how they do business.

Canalys has predicted that nearly a third of total Marketplace transactions will involve channel partners by 2025, so figuring out how the channel plays a role in the Cloud GTM strategy should not be an afterthought. As Alastair Edwards, Chief Analyst at Canalys, said: “Most enterprise deals involve complex sales processes and negotiations, often with multiple partners. And as more complex technologies become available on marketplaces, customers are seeking expert partners to help them discover, procure, deploy and manage these technologies.”

LEARNING 3: EXECUTING ON CLOUD GTM, PARTICULARLY AT-SCALE, DOESN\\\\\\\'T COME WITHOUT ITS CHALLENGES

It’s clear that engaging in both Marketplace and co-sell within the cloud ecosystems is an essential part of realizing the full benefits of a cloud partnership. The problem today is much less about the “why” or “what” and more about the “how.”

The biggest roadblocks to Cloud GTM success are centered around a few areas: enabling internal teams, a lack of internal resources, and a struggle to integrate new processes with core systems.

Internal Enablement

Only 9% of respondents said more than half of their sales team had closed at least one Marketplace deal in the past year—meaning only a small percentage of the sales team is carrying the momentum for most ISVs. Engagement from the entire sales team is the cornerstone of operationalizing Cloud GTM, but 56% said that sales team training is a top challenge. Without proper education and support about how to sell with the clouds, sales teams will fail to engage with these new channels.

This year we asked which tactics ISVs are finding most effective as they build their cloud partnerships. We found that, for many respondents (41%), it took between 7 and 18 months to gain traction with their co-sell motion. Respondents said the most effective steps to gaining that traction include sales team education, dedicated resourcing, a stronger “better together” story, and enabling Cloud Partner field sellers on their offerings. In order to get buy-in and focus from your sales team, reps have to be trained not only on processes and messaging, but also on which buyers are the best-fit accounts for Cloud GTM.

This year, 35% of respondents cited not knowing which buyers to target as one of their major challenges (down just slightly from last year, which we love to see!).

One way to overcome this challenge is by providing go-to-market teams with loud buyer intent data so they can understand which accounts are most likely to buy from the Cloud Providers. With this information, sales, alliances, and marketing can work together to build targeted ABM campaigns and sales plans for existing opportunities with messaging that hits on leveraging cloud spend to purchase their software. This data also enables ISVs to have more informed discussions about their buyer as they map accounts for co-selling.

Bandwidth & Resourcing

Nearly half of respondents (49%) said that Marketplace and co-selling activities require bandwidth they don’t have. This was a top issue last year as well, and we get it—figuring out how and who to hire to lead a new go-to-market strategy is hard and prioritizing a new motion can seem overwhelming. If this motion is entirely new to the organization, we suggest starting with a single dedicated Cloud Alliances leader and a single cloud with which to build your partnership. In addition, consider automating what you can as early as you can. Internal resources shouldn’t be spending the majority of their time babysitting co-sell leads or managing Marketplace deals. You might also consider outsourcing. Many of our customers are planning for investment into additional co-sell resources and leveraging strategic services in the coming year.

Process Integration

Operationalizing a new route to market is no easy feat. In our survey, we found that nearly half of ISVs (46%) have had a difficult time integrating Marketplaces and co-sell with their core systems and processes. This number is up 31% over last year, indicating that as complexity grows, integration and scale become much harder. This is the part where we tell you not to build software to sell software. Some things require enterprise software, services, and support to do well. You wouldn’t build a CRM, you’d buy Salesforce. You wouldn’t build an ERP, you’d buy NetSuite. Building custom tooling and integrations for Cloud GTM is a misuse of resources when you can buy a single platform that integrates these systems for you. The solution to this challenge is enterprise software and a partner that has the software, services, security, and support required. Drop us a line if you want to learn more.

LEARNING 4: CLOUD GTM IS A STRATEGIC, LONG-TERM, COMPANY-WIDE COMMITMENT

In last year’s report, we noted that the number one reason why companies fail to succeed with Cloud GTM is they treat it as a tactical, departmental solution instead of a strategic long-term commitment. Cloud GTM is a multi-year business transformation and those who treat it like a revenue “easy button” that lives in one department will fail to get off the ground. It requires cross-functional collaboration, appropriate resourcing, and dedicated, continuous investment from executive leadership.

Who Owns Cloud GTM?

For half of respondents (50%), the Cloud Alliances team leads the charge when it comes to the Cloud GTM strategy. It makes sense that Cloud GTM ownership often lives in this function as the foundational strategy and initial adoption are established, but Alliances leaders require involvement and support from nearly every team to be successful, including (and most importantly) from the C-suite.

For co-sell in particular, less than a quarter of companies (23%) said their co-sell motion was a combined effort with both the Alliances and Sales team.

A co-sell motion without cross-functional support will result in significant blockers to adoption and scale. One survey respondent said, “It takes a village and the more champions you can build, the more success you will have.” Sales and Alliances teams need to be working in lock-step to identify the right deals, align with the Cloud Providers, and conduct joint outreach to win those best-fit deals.

Who Should Be Involved in Cloud GTM?

Introducing, building, and scaling cloud as a route to market requires input and involvement from across the entire organization, not just Alliances and Sales.

- C-suite – Executive leaders like the CEO, CRO, and CFO need to be bought in so they can rally the organization, assign appropriate resources, and develop a strategic, cross-functional approach to Cloud GTM to create lift off.

- Partners / Alliances – Partners and Alliances teams are the backbone of the Cloud GTM strategy. They understand the requirements from the Cloud Providers, bring in the right stakeholders like executives and sales to execute on those requirements, and cultivate Cloud Provider relationships for maximum benefit.

- Sales – Sales teams are the boots on the ground who learn how and when to bring Marketplace and co-sell into their sales conversations. They create the deal flow into these channels.

- Finance & Operations – Scale doesn’t happen without Operations team involvement. This team translates the workflows of co-sell and Marketplace into process and system integration, responsible for the automation of those workflows and helping scale sales processes.

- Marketing – Marketing collaborates with Alliances and Sales to create strategic marketing campaigns leverging cloud buyer intent data to reach the right buyers and accelerate existing opportunities. Marketing is also responsible for helping to create the better together story with the clouds, leveraging MDF for campaigns, and collaborating on joint marketing activities.

Cloud GTM is a business transformation and it’s a multi-functional strategy that cannot be successful if only one or two departments are doing the work.

Specialized Sales Teams

Some successful Cloud GTM sellers are allocating specialized resources to cloud sales to work in lock-step with Alliances and the broader sales organization. This year, 51% of respondents said they have some sort of specialized cloud sales team, overlay team, or deal desk, compared to 58% last year. Of these:

- 7% said they have a Marketplace deal desk – a cross-functional team at an ISV that ensures high volume, high value, or complex Marketplace deals are executed and signed. Sits in operations.

- 20% said they have a dedicated Marketplace sales team – a team of ISV field sellers who work in partnership with cloud partners’ field sellers. Sits in sales.

- 24% have a cloud overlay team – a team of specialists who facilitate the interactions between the ISV sales reps and the Cloud Provider to help all parties identify the right sales plays and approaches to joint solution selling. Sits in alliances/partnerships.

ISVs that are in the scale phase of their Cloud GTM are most likely to introduce these specialized teams today and we expect this will grow as the Cloud GTM playbook becomes more clear for companies at each stage of maturity (more on this later).

LEARNING 5: CLOUD GTM SUCCESS IS A JOURNEY, NOT A DESTINATION

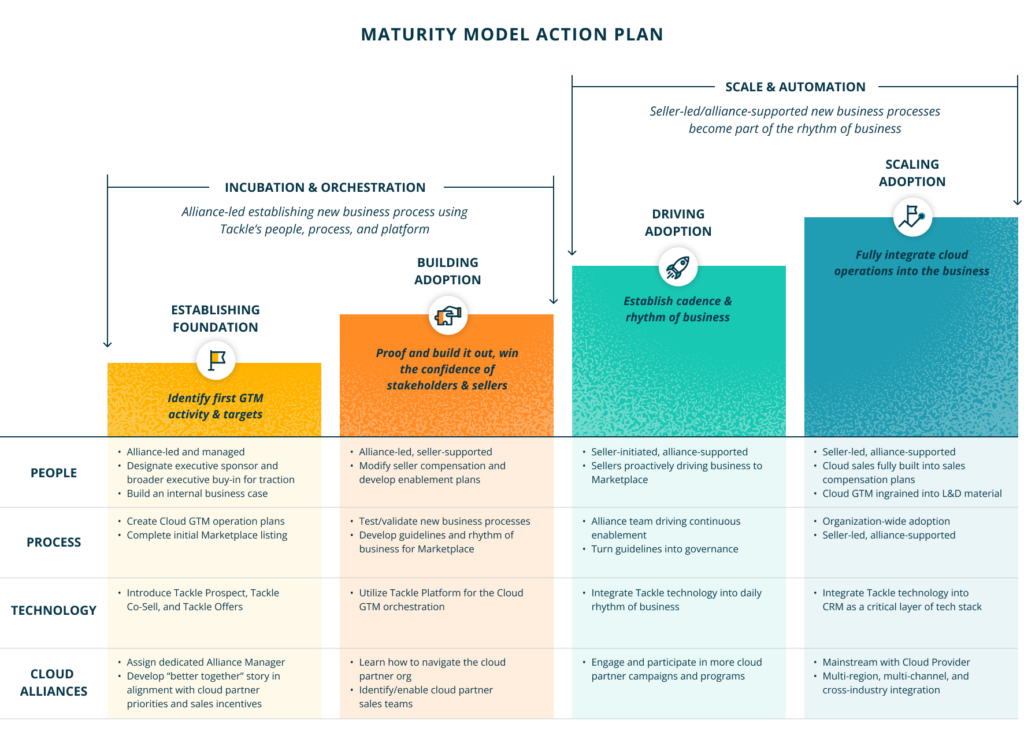

As you can see, building a Cloud GTM strategy with meaningful business impact takes time, repetition, and expertise, and it happens in phases over time. We mentioned earlier that it takes 7-18 months for most ISVs to gain traction with co-selling. Having seen this across our own customer base, we created a framework to help ISVs identify the key focus areas for each stage of their Cloud GTM journey.

Cloud GTM Maturity & Adoption Framework

The Cloud GTM Maturity & Adoption Framework was developed based on the journey we see most ISVs take. This framework should help you identify where you are in that journey and also help establish helpful guidelines around the most important steps and tactics to focus on at each stage.

- Establishing the Foundation – This is the first step to launching a Cloud GTM strategy and usually happens in the first 6 months. At this stage, you’re focused on building internal sponsorship to invest in Cloud GTM strategy, validating the value of co-selling with the hyperscalers, and identifying first GTM activity and targets. At this point, you’re seeing less than 5% of total revenue from this channel.

- Building Adoption – This is where broadening adoption comes into play. In this phase—which can take 6-18 months—you should be actively co-selling and building the muscle, winning the confidence of stakeholders and sellers. You likely require expertise, best practices, and support to scale and you’re likely seeing 5-10% of total revenue through this channel.

- Driving Adoption – As you move into this phase, you’re starting to see 10-20% of total revenue flow through this channel, making cloud most likely the single biggest channel in your routes to market. At this stage, focus on driving sales productivity and operational efficiency, and establishing the rhythm of business around Cloud GTM activities (18+ months, up to 20% of total revenue).

- Scaling Adoption – After 18+ months of building and driving adoption, you should be seeing more than 20% of total revenue through Cloud GTM channels. Operations should be fully integrated into the business and automations in place to reduce manual overhead. You may also be integrating multi-product, multi-region, or multi-channel approaches to your Cloud GTM.

Here’s a visual to help you see this journey over time.

You can see from this framework that establishing, orchestrating, and scaling Cloud GTM is an investment of time, resources, and focus. Depending on the level of effort you’re able to put in and your organization’s unique processes, you may see some phases happen faster or slower, but ultimately if you have this plan in mind as you go, you will find an easier time getting from A to Z.

2024 PREDICTIONS

There has been so much change in the last year around how Marketplace and co-sell are positioned for buyers, for ISVs, and for the Cloud Providers and we expect to see so much more evolution in the coming years. The predictions that follow are based on insights from this research, data collected from analyst reports, and our conversations with software sellers and buyers, Cloud Providers, ecosystem partners, and cloud stakeholders across the industry.

1. We will see as high as $15B in Marketplace throughput by the end of 2023 and $100B in 2026.

Today’s B2B software market is greater than $900B and we believe in this year we’ll see a small but profound 2% of the market will be fulfilled through Cloud GTM, with potential to exceed 10% in 2026. As the Cloud Providers continue to align and enrich co-sell and Marketplace programs, benefits, and supporting teams to deliver a more unified experience for software partners, the growth curve will accelerate. We’ve already seen all of the Cloud Providers double down in 2023 and we expect this will result in hitting our prediction of $50M by end of 2025 sooner than expected.

In October 2023, CrowdStrike announced that it was the first cybersecurity ISV to exceed $1 Billion in AWS Marketplace sales since bringing its platform to the AWS Marketplace in 2017. In that time, CrowdStrike has experienced:

- Rapid growth – 3,000%+ CAGR in sales

- Widespread customer success – >4,850 transactions; multiple transactions daily

- Larger transactions – on average, CrowdStrike’s transactions on AWS Marketplace are >140% larger than in its other go-to-market channels

This is an incredible milestone for our friends at CrowdStrike, and we expect to see more ISVs cross this $1B threshold in the coming year.

2. Over the next few years, finance leaders will get on board with Cloud GTM being one of the most efficient revenue channels in their business.

This year, 50% of respondents said a top reason for Cloud Marketplace selling is the ability to streamline contracting and simplify procurement, which is often one of the greatest barriers to getting deals over the finish line.

In the next year, we’ll start to see solid proof of ISVs selling bigger, faster, and cheaper, and it will become clearer and more common through Cloud Provider ROI models, analyst research, and case studies. As cloud becomes a larger percentage contribution to revenue for ISVs, finance leaders will perk their ears.

3. Five years from now, every seller in a software company will know how to win with cloud.

Today, about 5-10% of sellers understand the role cloud plays in their sales plays on some level but it’s inevitable that every salesperson will need to hone their cloud selling to be successful.

We mentioned earlier that internal training for sales teams has been a top challenge for most ISVs. To solve for this, we expect to see an industry certification around Cloud GTM introduced in the next year and we’re already starting to see some activity here.

RevOps is also a critical stakeholder in the Cloud GTM journey as they own the tooling to enable all sellers to take advantage of cloud. This requires fresh thinking and systems investments.

4. Incentives for ISVs to engage in cloud partnerships through go-to-market activities will crescendo before they phase away.

As we’re still in the early days, Cloud Providers need to drive the behaviors they want to see, and cash and cloud credit incentives help do that. At some point though, the inherent benefits of this channel will become a non-negotiable for all software companies and the Cloud Providers won’t need these incentives.

We also know new and niche Marketplaces are starting to grow in ISV interest, and as we said in 2021, those that don’t nail incentives for sellers, buyers, and the Marketplace platform will fail. Those platform providers have to answer the questions of why should buyers buy here, why should sellers sell here, how does the platform provider benefit, and how does the initial flywheel get spinning and grow organically? The hyperscalers have and continue to invest to scale this momentum, but there is a tipping point in investment where the flywheel self-sustains, and buyer demand is the greatest benefit for all engaged. We’re unclear on the timeline for this evolution to happen but we believe buyer behavior and buyer demand will ultimately trump any incentives the platform providers could put in place.

5. Customer demand to purchase solutions including multiple products and services will drive innovation from the channel.

What is currently a more singular software title buying experience through the Marketplaces will evolve as customers will require purchasing software and services bundles to create full-stack solutions. The channel should be the answer for who is going to bundle solutions, and we know there is still much innovation to be had in this space.

The Marketplaces are also getting more active around professional services listing as a precursor to enabling this. Over the coming years, we’ll start to see bigger plays from the channel here.

Growing engagement from the channel into cloud selling is a supporting element to Marketplace revenue growing to $100B in the next 3 years, as we agree with Canalys that channel could drive up to a third of Marketplace transactions by 2025.

CONCLUSION

It’s been a tough year for B2B and while the economic downturn has certainly been a shake-up, the optimism and momentum for Cloud GTM among ISVs is strong. With co-selling and Cloud Marketplaces being proven independent channels, ISVs and the Cloud Providers are leaning into a more comprehensive Cloud GTM that brings both into a streamlined methodology.

Let’s break all 8,000 words of this report into four actionable things you can do right now to get started on this journey.

Four takeaways from this report and what you can do now to make an impact:

- Establish an executive sponsor to rally the C-suite around Cloud GTM. Business transformation requires buy-in and leadership from the CEO, CRO, and CFO, and we see CROs as the most likely proponents and supporters of Cloud GTM. Getting your CRO on board is particularly important because they own revenue—they are very interested in this channel as it accelerates deals, drives higher average sale price, and opens up a path to new opportunities and budgets.

- Learning how to drive revenue through the Cloud Marketplace(s) is non-negotiable at this point and a critical part of unlocking Cloud GTM. If you’re not already listed, reach out to Tackle and let’s figure out how we can help you get there. If you are listed but aren’t seeing the kind of traction you expected, consider the Maturity Framework we shared and identify where you may need to double down on certain focus areas. You may also benefit from a Cloud GTM Readiness Review with Tackle to see how you currently stack up.

- Co-selling cannot be viewed as an opportunistic approach—it requires methodical planning and momentum building.

- To scale a Cloud GTM strategy, automation is unavoidable. If your organization is seeing momentum with co-selling and Marketplace but you’re spending a lot of hours managing the processes, consider working with your Ops team to look at what parts of the process can be automated and how to help sellers streamline their workflows.

Have questions or comments about this report, interested to have Tackle debrief you or your team on our findings, or want to be emailed when new Tackle research is available? Reach out to us at marketing@tackle.io.