Macro trends, predictions, and expert insights into the shift in go-to-market in the cloud era

Jump to a Category

Survey Methodology

In August 2020, Tackle surveyed senior leaders representing major Cloud Marketplace software sellers and buyers across multiple industries.

Respondents’ most common titles broke down as follows:

- 29% Director

- 22% Vice President

- 21% Manager

- 12% C-Suite

Cloud native was the industry with the most representation (42%). Other industries included security, manufacturing/industrial, financial services, education, small business, and healthcare and life sciences.

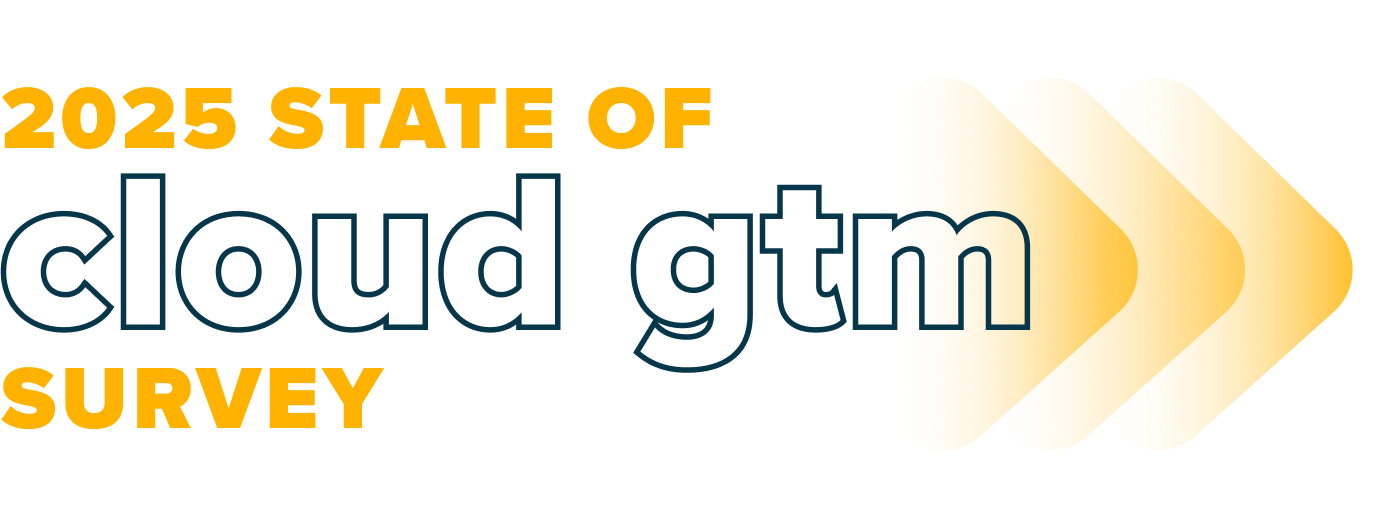

Respondents represented seven annual recurring revenue (ARR) segments, from the $0 to $10 million range through the $500 million to $1 billion range.

Foreword

From Byron Deeter, Mike Droesch, and Bob Goodman at Bessemer Venture Partners

We at Bessemer Venture Partners have had the privilege of partnering with many companies at the forefront of massive shifts in the B2B software landscape, most notably, the cloud computing revolution. Today we believe we are witnessing the emergence of another transformational shift with the rise of Cloud Marketplaces, which enable SaaS companies to sell their products more efficiently to enterprise buyers through the AWS, Azure, and GCP Marketplaces. While these Marketplaces are still in their early days, they are already processing billions of dollars in transactions and are dramatically accelerating deals for B2B SaaS vendors. Over the coming years, we expect Cloud Marketplaces to become a fundamental sales channel for enterprise software, capturing a substantial share of this $450B+ industry.

More than 35% of Cloud 100 companies are active Marketplace sellers

We have witnessed the power of Cloud Marketplaces across many of our top portfolio companies. Companies like PagerDuty, Auth0, HashiCorp, Sisense, and many more have all embraced these Marketplaces and are reaping the rewards, including access to larger budgets, accelerated deal velocity, and Cloud Provider co-sell opportunities. In addition, more than 35% of Cloud 100 companies are active Marketplace sellers. It’s no surprise to see savvy vendors quickly realizing the many Cloud Marketplace benefits, given that they enable software sellers to tap into the massive pools of committed enterprise spend that now flow into all the major public Cloud Providers (over $250B annually and growing rapidly). Yet, we believe that we are still just in the first innings of a movement that will fundamentally change how software companies build their go-to-market teams, sell products, and fulfill deals. Similarly, we think that most large software buyers are just waking up to the opportunities that these Marketplaces afford them to save precious time and money on the procurement of cloud software that they are already buying.

This is a theme that strikes a real chord with us as it represents the intersection of our deep expertise in the cloud industry and our investment thesis around the rise of B2B Marketplaces. In the 2020 State of the Cloud, Bessemer underscored how the growth of public cloud companies has continually outpaced even the most optimistic predictions, surpassing $1 Trillion in combined market cap earlier this year. In this same report, we highlighted the emerging trend of B2B transactions rapidly moving to digital Marketplaces. While the idea of B2B Marketplaces has been around since the dot-com era, this is the first time we are seeing real traction with large B2B transactions moving from traditional relationship-based ‘handshake’ deals to more efficient and transparent digital Marketplaces. This trend is accelerating across industries ranging from global shipping, to wholesale used car sales, and now enterprise software.

Over the next 10 years we expect Cloud Marketplaces to become a core part of the sales and fulfillment infrastructure for all software companies – a true third leg of the go-to-market stool, alongside direct and channel sales. We would not be surprised to see more than a quarter of B2B SaaS sales flowing through these pipes in the years to come, and potentially well more than that! In addition, we expect that there will be businesses built in the future that leverage Cloud Marketplace fulfillment to build entirely new go-to-market strategies that we haven’t even seen yet.

Fundamental shifts in the enterprise software industry come around very rarely, but when they do, most of us tend to underestimate how large of an impact they will have (ourselves included). All we know in the near term is that Cloud Marketplaces will likely exceed all our expectations, just as we have seen time and time again in this dynamic industry, and the companies that lean into Marketplaces will be best positioned to ride this wave of growth.

Introduction: Just Getting Started

The cloud has grown faster over the last decade than any other component in the tech sphere. And it’s not even close.

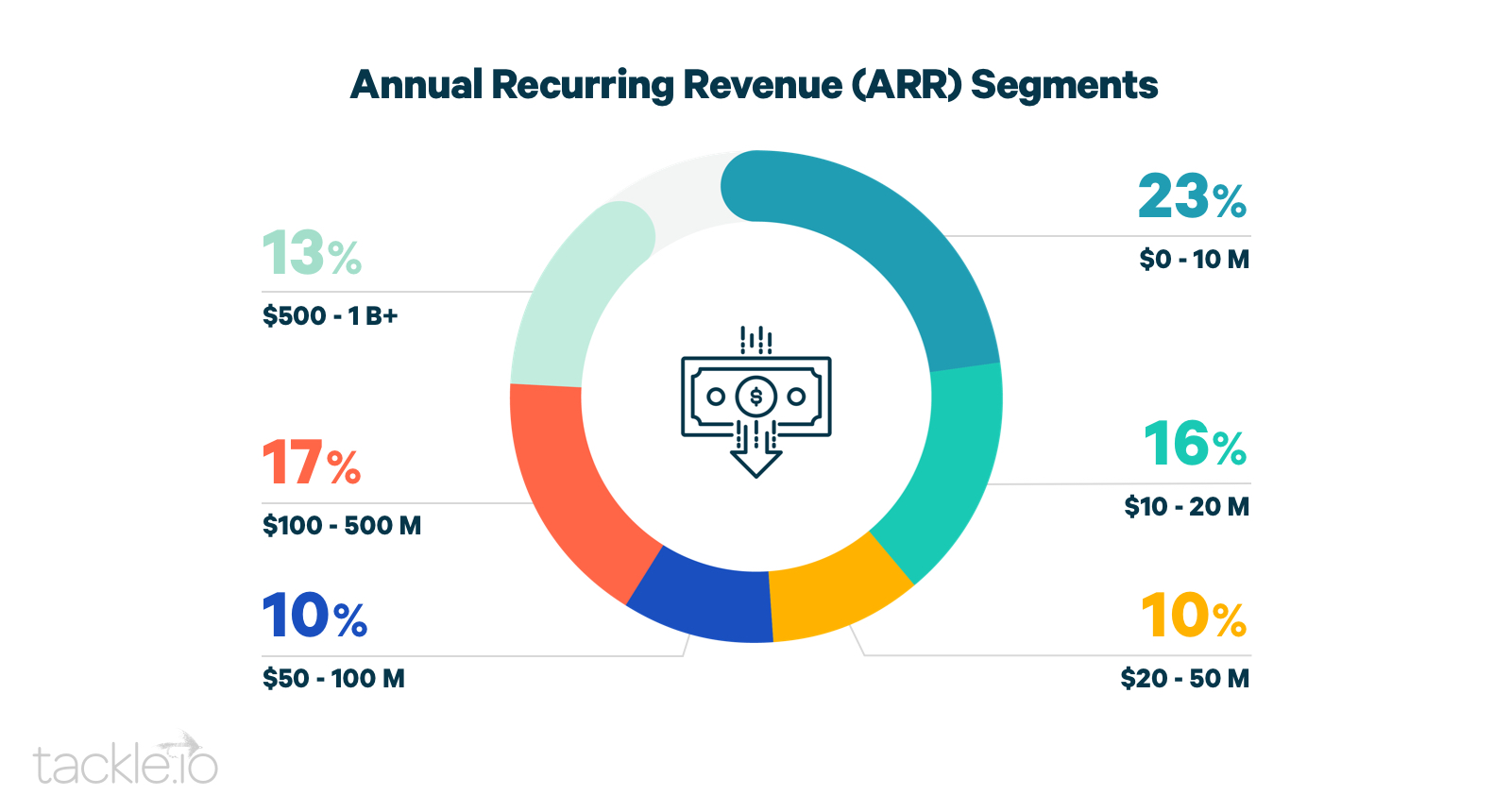

The graphic below, from Bessemer Venture Partners’ State of the Cloud 2020 report, illustrates the astonishing growth rate of private cloud companies since 2000.

Additionally, cloud computing growth statistics from ParkMyCloud indicate that the “big three” Cloud Providers are each seeing fast growth, especially due to the wake of COVID-19. According to Canalys, cloud computing market share grew 32% in Q4-2020 alone and in all of 2020, cloud infrastructure spending grew 33% to $142 billion.

Cloud Marketplaces are naturally following a similar trajectory. Marketplaces offer an ideal combination of simplicity and incentives for both software buyers and sellers—removing friction on both sides to facilitate more seamless B2B transactions.

According to Tackle’s survey, 43% of respondents have purchased software through Marketplaces in the last 12 months, and 74% say they are extremely likely or likely to make future software purchases through Marketplaces. By 2023, Forrester projects that 17% of the $13 trillion global B2B spend will flow through ecommerce and Marketplaces. That’s a shift of $2 trillion away from traditional direct sales channels. The global pandemic could condense that timeframe, as pre-COVID-19 trends kicked into a higher gear and ecommerce experienced 10 years of growth in one three-month period, according to McKinsey.

It’s easy to trace the correlation between Cloud Provider and Marketplace growth. As companies enable rapid innovation with migrations to the cloud, Marketplaces enable them to quickly and efficiently buy the tools needed to compliment that transformation.

Bigger and Better

Surges in Cloud Marketplace sales quantity also correspond to an evolution in quality. Day-one Marketplaces were little more than bulletin boards where sellers advertised short-term software usage almost exclusively for infrastructure and DevOps. Then, we saw a shift where transactions via Marketplace became possible, but support and flexibility for evolving business models was limited.

Today’s Marketplaces boast robust features including expanded functionality for research, product configuration, contracting, monitoring, reporting, and much more. Marketplaces also serve a broader variety of niche verticals, including analytics, sales and marketing tech, productivity and collaboration, education, and health. The Microsoft commercial Marketplace even offers two discovery experiences: Azure Marketplace for cloud developers and IT pros, and AppSource for business users.

Scanning the Horizon

With our first State of the Marketplaces survey and report, Tackle set out to better understand the present and future of Cloud Marketplaces. In doing so, we assessed usage, perceptions, and projections. We combined our findings with other expert insights and industry data to compile a discussion of the realities and our predictions for software companies considering or actively selling on Cloud Marketplaces.

The overarching takeaway:

Ecommerce will dominate the future of B2B software sales, with Cloud Marketplaces as a linchpin in modern go-to-market strategies.

Cloud Marketplaces: A Win-Win Channel

Sellers are drawn to Marketplaces because it offers them access to a broader pool of buyers. AWS boasts more than one million global customers, with 260,000 of those on AWS Marketplace. Microsoft sees four million monthly active users (MAUs) to its One Commercial Marketplace where it has more than 10,000 publishers.

Across the board, these customers are eager to burn down their committed cloud spend.

Marketplaces also help sellers speed up sales cycles (especially when compared to typical six-month buying cycles for first deals) while streamlining contract agreements and increasing co-selling opportunities with Cloud Providers.

Buyers using Marketplaces gain an efficient alternative to the typical sales process, allowing them to quickly procure and deploy software. Buyers leverage standard contracts and pre-allocated budget with Cloud Providers to get what they need in one place while consolidating all software and infrastructure purchases into a single invoice.

New Cloud Marketplaces continue to emerge (more on this in a bit), but the three largest Marketplaces today are AWS Marketplace (Amazon), Azure Marketplace (Microsoft), and GCP Marketplace (Google). These giants continue to lead and gain momentum because they invest heavily in buyer and seller motivation. One of the fundamentals of success for Marketplaces is being thoughtful about how to incent buyers to buy, sellers to sell, and create a foundation for frictionless workflows on both ends.

Prediction: Cloud Migrations Will Bring Buyers to Marketplaces

Companies are moving their workloads and data to the cloud to escape inefficiencies and high costs of on-premises software.

This broadening migration to cloud requires a rethinking of your entire tech stack. This, in combination with a Cloud ELA (Enterprise License Agreement) negotiation, creates an opportunity for buyers to combine software and cloud spend to maximize their contract value.

Sellers can benefit tremendously from these arrangements.

Major Cloud Providers allow buyers to apply third-party Marketplace purchases toward their spending commitment. Tackle believes this advantage alone will lead more buyers to start their software searches in Marketplaces. Some large enterprises and government agencies use Marketplaces exclusively because they have these contracts and commitments in place, especially as we see an increase in cloud-first and SaaS model mandates.

We’re noticing software verticals that have traditionally focused only on direct sales, like MarTech and Business Applications, selling more on Marketplaces to meet buyers where they have a dedicated spend.

Craving Convenience

Marketplaces also deliver what all buyers want: simplicity and convenience. Gartner found that 77% of B2B buyers say traditional direct purchases have become very difficult. However, 73% of B2B buyers report that buying through ecommerce, web direct, or Marketplaces is very convenient, according to Jay McBain, Forrester’s principal analyst of channel, partnerships, and ecosystems.

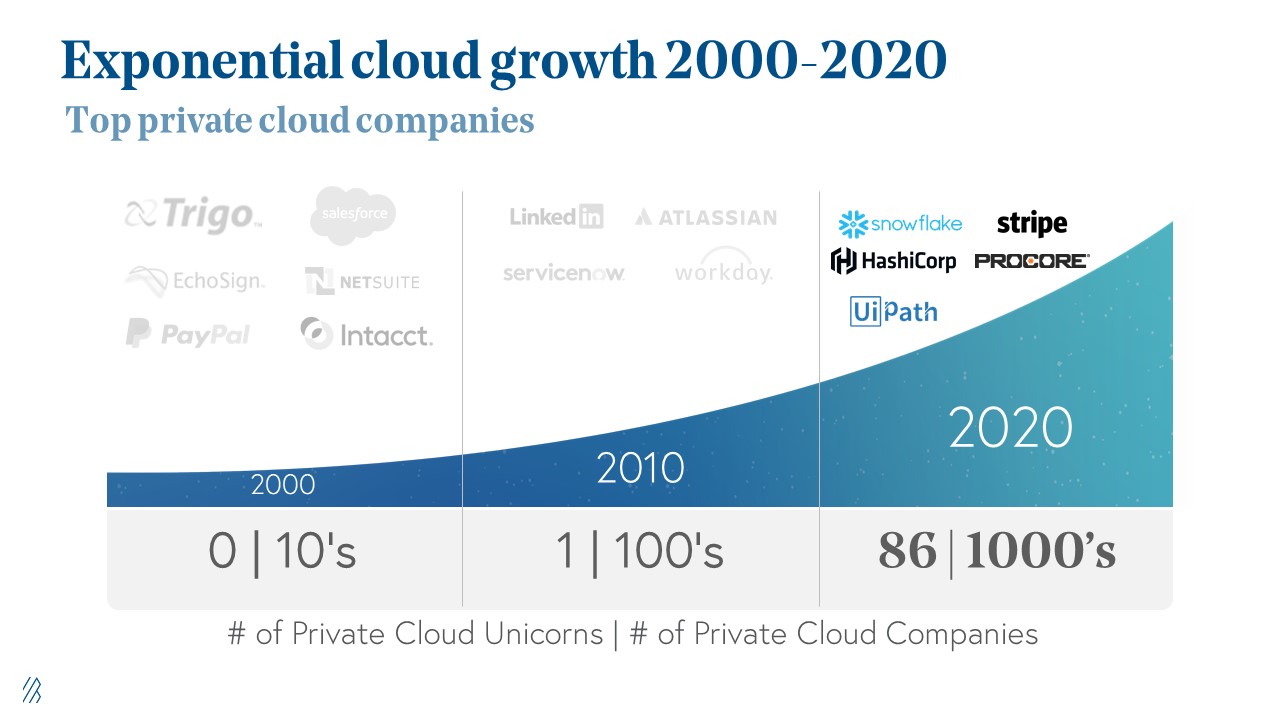

Tackle’s survey confirmed just how important convenience is to buyers as nearly half (45%) said they have considered consolidating their existing software contracts by sourcing through their Cloud Provider. The top response among buyers as to why they purchased through Marketplaces in the past year was to simplify the procurement process (68%), followed by gaining fast access to tools (55%) and consolidating their IT spend (50%).

As companies become increasingly customer-focused, 62% are leveraging Marketplace to meet buyers where their wallets already are and simplify their sales process. A full 100% of companies with ARR of $500 million to $1 billion ranked this as an extremely important priority.

Survey Voices

“Marketplaces offer reduced friction for customers looking to leverage their existing spend and increase our visibility with Cloud Providers.”

—Director, Channels/Alliances, security, $100-500M ARR

“We see value in the ease of sales that let customers buy how and where they wish.”

—Director, Channels/Alliances, cloud native, $20-50M

Prediction: The Pandemic Will Drive Buyers & Sellers to Marketplaces

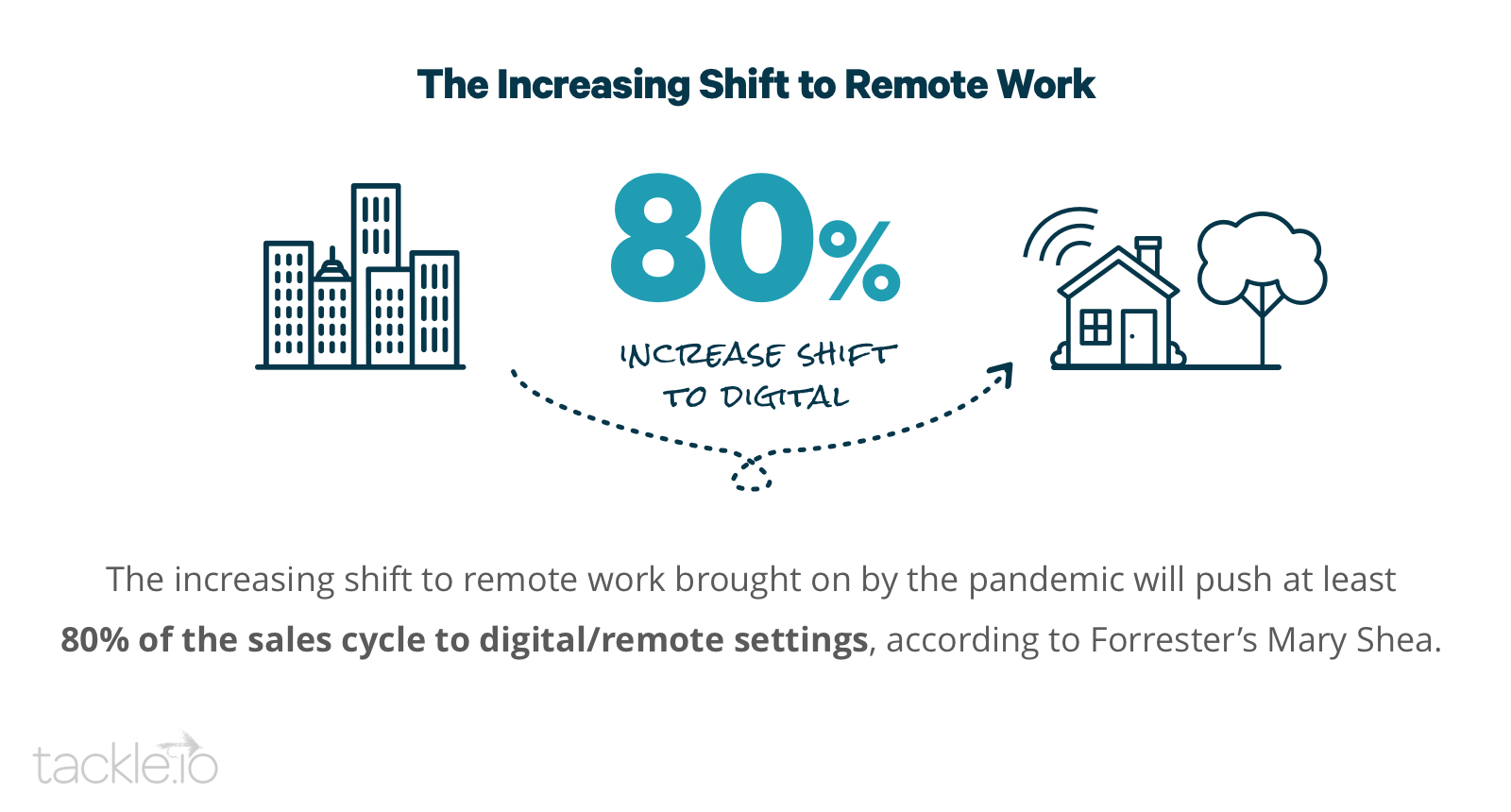

Ecommerce posted a decade’s worth of growth in just one quarter due to COVID-19.

Researchers estimate that nearly half of America’s workforce shifted to remote work due to the COVID-19 pandemic. The technology sector made major waves in this area, with 83% of tech workers saying they’ve recently done their jobs remotely, according to CNBC. Many expect this trend to continue long after the pandemic subsides.

According to Flexera’s State of the Cloud study, 59% of enterprises say they will exceed their prior plans for cloud usage as a direct result of the pandemic. Sales channels are feeling the pandemic’s influence as well. In their report, McKinsey illustrated the unprecedented rise of ecommerce penetration in the United States during several early months of the pandemic. Essentially, ecommerce experienced a decade’s worth of growth in just one quarter.

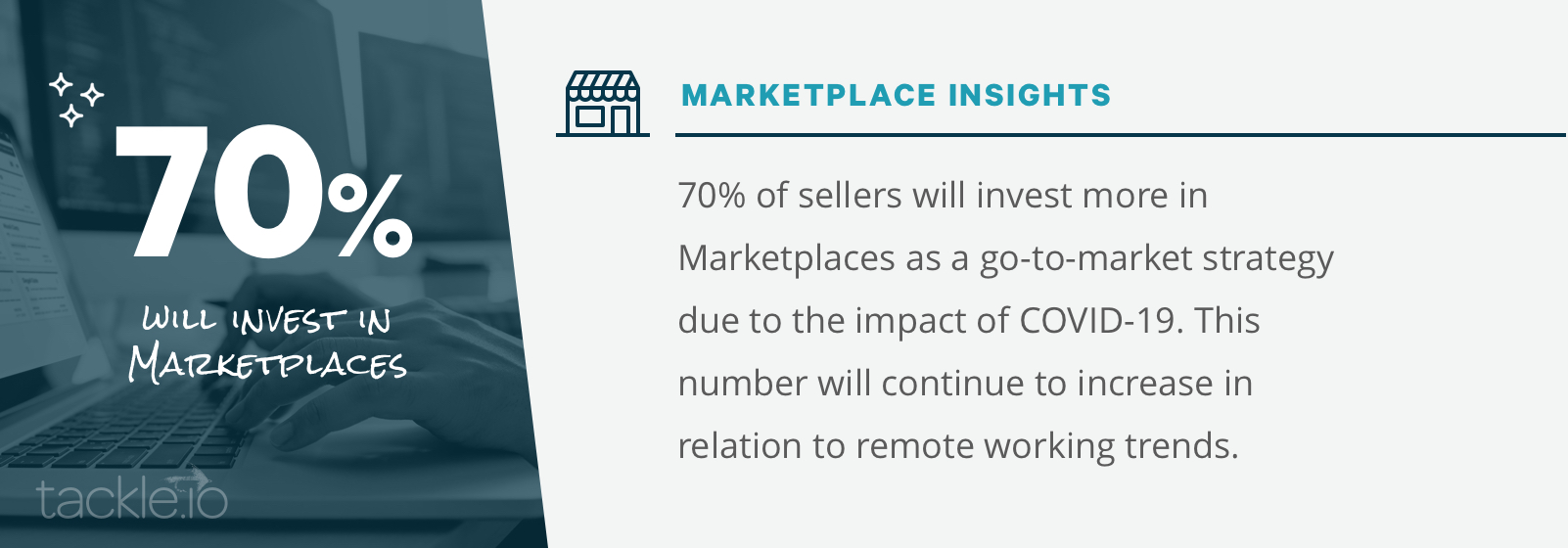

Tackle found similar results. With fewer in-person sales, almost 70% of sellers said they will have some or more focus and investment in Marketplaces as a go-to-market channel.

To maintain relevance with buyers in the remote world, more sellers will need to join the 65% who use Cloud Marketplaces as an essential, not optional, revenue channel to complement selling direct and via partners.

Prediction: More Sellers Will Soon Cross the Marketplace Chasm

65% incorporate Cloud Marketplaces into a three-pronged go-to-market strategy

Most software companies (65%) incorporate Cloud Marketplaces into a three-pronged go-to-market strategy, alongside direct sales and channel partners. However, Cloud Marketplaces in their current form are still experiencing the “chasm effect” among sellers that’s common with emerging technology.

Geoffrey Moore defined the chasm effect in his Technology Adoption Life Cycle as the gap or lull between the time when early adopters use new technology and when it wins over the more pragmatic early majority. The latter tend to put off adopting new technology until they see how it works for others or until conditions make it necessary.

According to Gartner, more than 25% of the Global 1000 companies use Marketplaces for technology purchases today, and more than 75% have tried them.

So what prevents more software sellers from making the leap and embracing Marketplaces today? Survey respondents not yet selling on Cloud Marketplaces cited two primary reasons, both of which align with Moore’s chasm theory:

- Don’t have the internal resources or bandwidth available (44%)

- Haven’t been able to translate our business model to the Cloud (28%)

Tackle is confident more sellers will, in short order, cross the Cloud Marketplace chasm lured by more eager buyers. In a Flexera study, 70% of small businesses said their data and workloads will be in the cloud in the next 12 months. More spend with the Clouds makes the shift to Cloud Marketplace buying an easier chasm to cross.

Following the Money

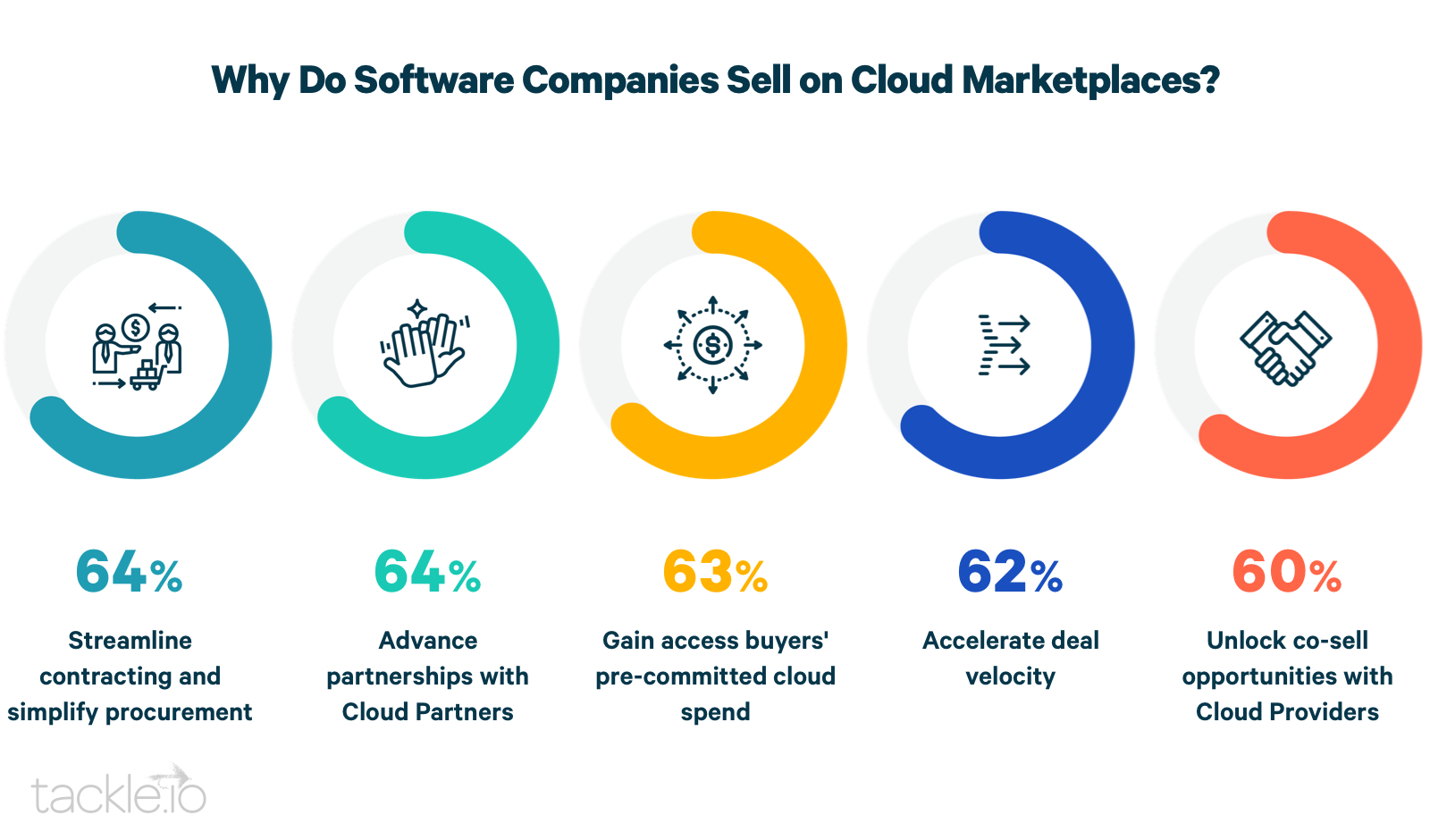

Tackle also believes lucrative revenue drivers will draw more sellers across the chasm. Marketplaces (alongside direct sales and digital discovery) already offer unmatched efficiencies compared to the traditional three-tiered distribution model of distributors, resellers, and direct sales. They’ve proven effective for reducing the cost, time, and effort of customer acquisition, accelerating the time to value for sellers and buyers.

In their Q4 2020 Earnings Call, CrowdStrike noted its sales cycle reduced by nearly half when using AWS Marketplace. Business intelligence software provider Sisense cut its sales cycle by 20% on Marketplace transactions. These are just two examples of many.

Moreover, Cloud Marketplaces empower customer-oriented sellers to reach buyers who have already committed to spend with the Cloud Providers—a feature most sellers (62%) we surveyed ranked as a top business priority. And Cloud Providers incentivize sellers with perks, including fee discounts and co-selling opportunities, as they advance through their partnership tiers.

Survey Voices

“We have definitely been able to boost sales to help our company. The Marketplace is a great tool for connecting buyers and sellers. It is a fantastic additional route for added revenue.”

—Director of Sales, small business, $0-10M ARR

“The Marketplaces give us direct access to decision makers with budget authority, removes the friction of legal and procurement, and increases co-selling opportunities with the Cloud Provider.”

—SVP Partner Management, education, $500M-1B+ ARR

Prediction: More Sellers Will Use Multiple Marketplaces

You can’t have too much of a good thing. That’s what software companies are discovering in the world of Cloud Marketplaces.

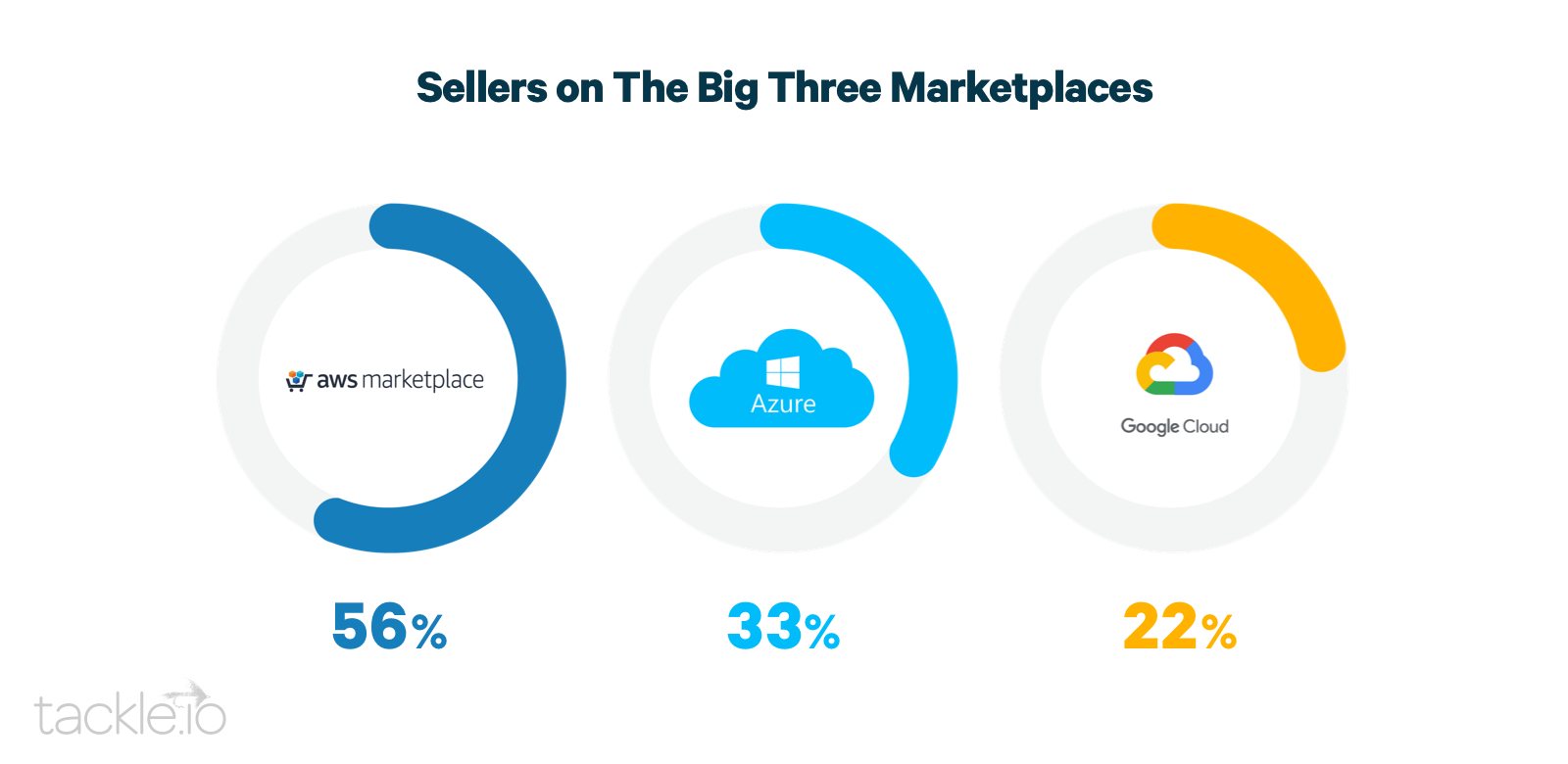

Approximately 71% of the sellers Tackle surveyed list products on at least one of the big three Marketplaces, often determined by the presence of an initial strategic relationship. Here’s how the listings break down:

Setting up shop with one major Marketplace is the first step of the journey for sellers, often starting with the Cloud Provider they already use and expanding from there into others.

The majority of our survey respondents (84%) have a strategic relationship with AWS Marketplace, while 59% have a relationship with Azure Marketplace and 41% have a relationship with GCP.

Nearly half of the sellers above from Tackle’s survey said they plan to expand their presence across additional Marketplaces in the next 12 months. That number could increase, as 38% said they would consider expansion if they see success on their current Marketplace.

Convinced? Schedule a demo to see why Tackle is the smartest way to go-to-Marketplace.

Moving Beyond the Big Three

Expansion becomes even more likely as additional Marketplace options enter the picture, especially for niche markets. Forrester’s Jay McBain says we could see 20 winners out of hundreds of vertical Marketplaces over time. The following list includes a few of the most popular Marketplaces attracting sellers and buyers today:

- AWS Marketplace

- Microsoft AppSource and Azure Marketplace

- GCP Marketplace

- Alibaba Marketplace

- Salesforce AppExchange

- VMware Cloud Marketplace

- IBM Marketplace

- Red Hat Marketplace

- Ingram Micro’s CloudBlue Marketplace

- ArrowSphere Marketplace

See a Marketplace that you’re interested in selling in or buying from?

Let us know at hello@tackle.io.

Bonus Predictions

We’ve seen how far Cloud Marketplaces have come in such a short period of time and their impact on B2B software sales. At Tackle, we see much more in store as Marketplaces pave the way for increased transactions.

Here are a few bold predictions for the not-so-distant future from the Tackle leadership team. We’ve based these insights on frequent conversations with buyers, sellers, customers, partners, and cloud stakeholders across the industry.

Cloud Marketplaces will:

- Pave the way for true self-service purchasing.

When asked what changes could make purchasing via Marketplaces more convenient, one survey respondent said, “Marketplaces would benefit from increased amenities and features that allow the buyer to move through the sales process seamlessly with minimal touches from sellers.” This is a common desire. While 100% self-service purchasing eludes us in today’s enterprise B2B space, we predict Marketplaces will continue to invest in features and programs to increase self-service consumption. - Create a new category of specialist jobs.

One common component of companies on the vanguard of Marketplace success: designated Marketplace leaders responsible for making the channel work for their business. We’re noticing an uptick in positions devoted to uniting product, sales, and partnerships as well as specialists tasked with driving product demand through cloud channels. - Enable new, creative business models.

Consumption-based models for many software products are difficult to implement. As sellers get more experience using Marketplaces, we believe the combination of contracts and metering capabilities will enable new creative business models for sellers to evolve into. - Lower your customer acquisition cost.

We’re seeing signs of this already. Fewer hands in the pot means less revenue deducted from each sale. Anecdotal evidence suggests Marketplace transactions cost sellers up to 20% less compared to the fees paid to direct sellers, resellers, and distribution partners. As Marketplaces play a larger part in go-to-market strategies, expect to see ripple effects of sellers wanting to reduce customer acquisition costs and see a closer alignment between the expense of the channel and the value received. - Attract enterprise procurement.

Not a single procurement officer responded to Tackle’s survey. This speaks volumes about the departmental nature of Marketplace use, with individual department owners dipping into Marketplace for ad hoc purchases as needed. We’re confident the advantages of buyers on Marketplaces will make their way up the enterprise chain. Many procurement professionals responsible for negotiating agreements likely don’t realize they could secure more beneficial deals by integrating their software with an enterprise cloud purchase. But they will soon. Cloud Providers are increasingly educating their sellers on how to include the Marketplace channel in discussions about enterprise agreements. Some even have teams devoted to this effort, and the Cloud Providers continue to make their incentives more universal.

Conclusion: Cloud Marketplace is a GTM Strategy

Marketplaces are creating a complimentary third leg of a go-to-market stool to existing direct sales and channel sales models. Marketplaces offer efficient paths to customers, budget, and revenue for sellers and we expect to continue to see rapid expansion in both buyers buying through Marketplace and sellers selling.

Marketplaces dramatically simplify transactions. They also introduce complexities that require specialized skills and enterprise-grade software to manage rapidly expanding businesses. More sellers will look to buy solutions to enable, expand, and scale Marketplace businesses in 2021 and beyond.

Half of the sellers Tackle surveyed said the lack of internal resources or bandwidth would hold them back from listing on one or more Marketplaces. This was the first or second reason given across all ARR levels. In addition, 17% said they didn’t have the tooling required to scale. Companies wanting to list on Marketplaces, and do so correctly, essentially have two options—a classic build vs. buy scenario: find the resources required to engineer and manage their channel presence or team up with a partner who does it for them.

Survey Voices

“Selling through Marketplace has enabled co-selling efforts and helped us tap into buyers’ already committed budget to increase sales velocity.”

—Director, Channels/Alliances, cloud native, $50-100M

Find Long-term Success Fast

A common misperception among sellers is that Marketplaces offer “set it and forget it” simplicity. But as with any sales channel, Marketplaces require upfront investments and ongoing attention.

We saw evidence of the nurturing required in survey respondents’ Marketplace transaction volume. In the last 12 months:

- 45% completed between 1 and 5 transactions—the highest percentage of any category

- 24% completed more than 21 transactions, with 19% of exceeding 41 transactions

While the remaining respondents fall somewhere in-between, most likely, these two ends of the spectrum represent sellers’ maturity in the Marketplace. Those reporting higher transaction volumes are reaping the rewards of sustained focus, while sellers toward the lower end are still finding their way.

Tackle exists to eliminate the barriers that keep software companies from selling on Cloud Marketplaces. Sellers without the time or engineering resources now tap into Tackle’s platform to build a path to Marketplace revenue.

In a matter of weeks (instead of months), Tackle can help SaaS companies establish a presence on any or all of the three major Cloud Marketplaces, operate efficiently, and scale sales. Tackle provides a single source of truth for managing your cloud software business. With our innovative platform, you can take control of your Marketplace sales with insights and visibility you can’t get anywhere else.

Get The Complete Playbook to Cloud Marketplaces to uncover best practices on how to launch, scale, and optimize your Marketplace strategy.

Cloud Marketplaces are the future of B2B commerce. Make sure you’re there to take full advantage. For more information about simplifying and maximizing your Marketplace presence, contact the team at Tackle today.