2024 Cloud Marketplace Insights and Predictions

Jump to a Category

Written by John Jahnke and Andrew Marshall

Our fifth State of Cloud GTM Report is a significant milestone. We’re thrilled to present our data, findings, and predictions in this year’s report, which remains unique in its focus on Cloud Go-to-Market (Cloud GTM). For those of you who are new to Cloud GTM, it is a business strategy that allows ISVs to unlock new revenue streams and generate revenue faster by partnering with the clouds. Cloud GTM generally includes five key jobs to be done:

- Scoring your ideal customer profile accounts, active marketing targets, and new logo and renewal pipeline to find the best-fit opportunities for both cloud marketplaces and co-selling with the clouds.

- Using cloud co-sell to grow relationships with the cloud providers by helping sellers sell side-by-side with cloud partners

- Adapting a direct sales process for marketplace deals—to meet buyers and their wallets where they are.

- Simplifying cloud seller workflows by integrating with Salesforce and other CRM tools to unlock Cloud GTM at scale across your sales force.

- Scaling operations by empowering stakeholders across your organization with multi-cloud reporting, GTM ecosystem integration, and automation.

We’re thankful for the industry leaders who contributed their expertise, the Cloud GTM thought leaders who quote and amplify the findings from this report, and our customers who are on this journey with us.

Welcome to Tackle’s 2024 State of Cloud Go-to-Market Report, a resource built to help you better understand the people, companies, processes, and technology that define Cloud GTM. We often hear that ISVs use this report to inform their strategic Cloud GTM planning, using the findings and data as a baseline for their success plans. We’re grateful for this feedback (and always open to more of it) and have shaped this year’s report with that in mind.

In this year’s report, we’ll present some key learnings such as:

- What it takes to cross the Cloud GTM “chasm”

- With co-sell, the journey is still as important as the destination

- Cloud GTM as a revenue driver doesn’t happen overnight

- Aligning with sales is a key success factor for Cloud GTM

- It is (and will be) a multi-marketplace world

- Was this the Year of the Channel?

- Why internal alignment (and investment) is essential for Cloud GTM

- What Cloud GTM leaders have to say, in their own words

- What to make of free trials, usage-based billing, and Product-Led Growth

- The healthy, constantly evolving tension between cloud providers and ISVs

As well as some predictions to keep in mind as we head into 2025:

- The clouds will publish marketplace and co-sell results publicly by the end of next year.

- Innovation and normalization will rapidly increase non-US customers transacting via cloud marketplaces.

- AI-driven cloud buyer intent data will have a broader impact across all GTM efforts, not just Cloud GTM.

- Some ISVs will use “Pay-as-you-Go” consumption-based billing models in the cloud marketplaces, while others will focus on offers and contracts. Some of the most successful ones will find a way to do both.

- Buyer behavior will continue to change, and we’ll witness the “Grand Opening” of new storefronts.

- International markets and SMBs are the next frontier of Cloud GTM.

- Distribution will continue to insert itself into the Cloud GTM conversation.

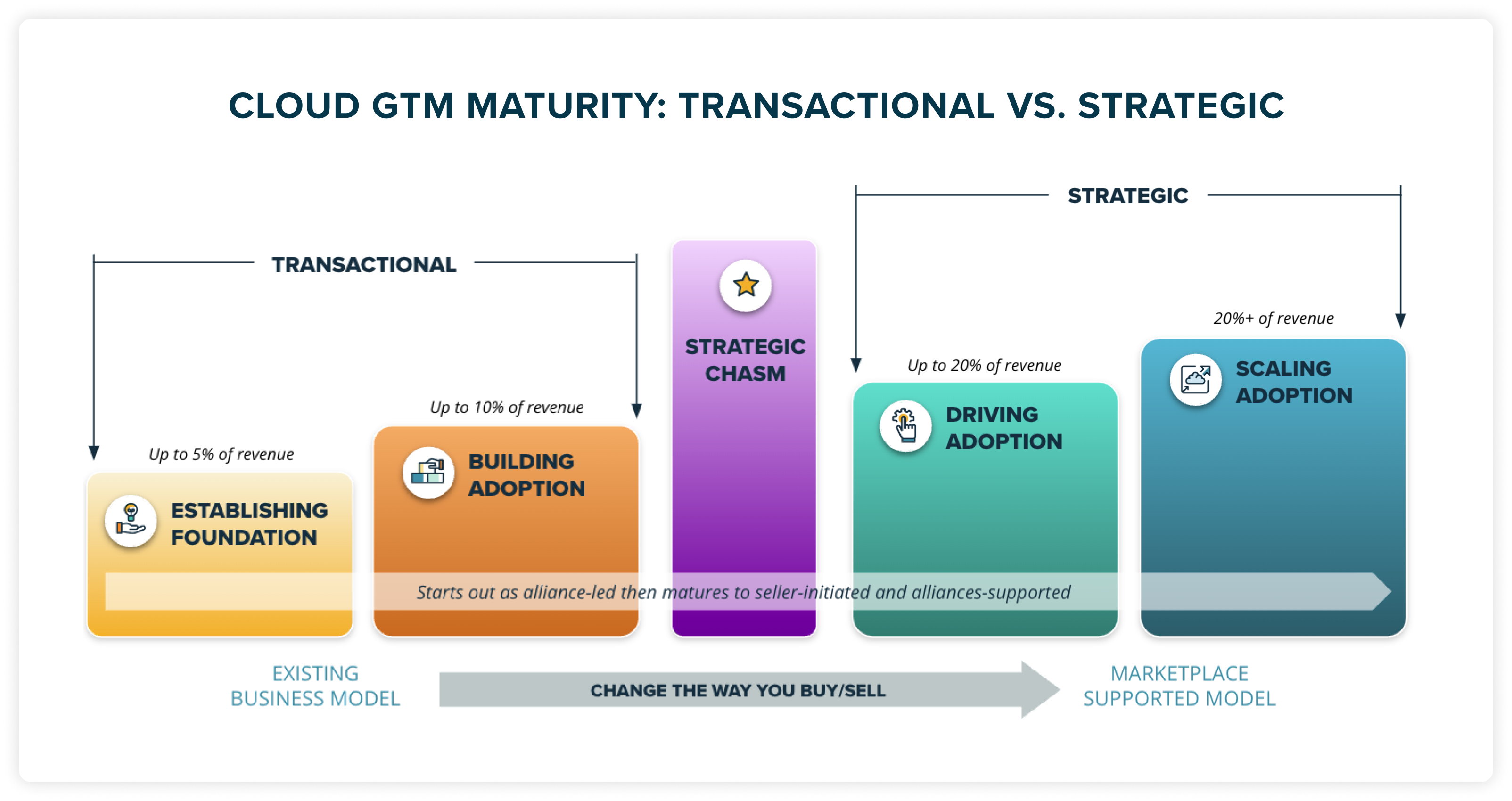

To set the table for some of this report’s analysis, you may benefit from reviewing the Cloud GTM Maturity Model. Many of the findings in this report are further contextualized by the respondents’ Cloud GTM Maturity phase, which helps illuminate the impact a Cloud GTM strategy can have as companies mature. If you haven’t done so already, it may be helpful to take Tackle’s Cloud GTM Maturity Assessment. This short, eight-question survey will determine where you’re at on your Cloud GTM journey with the people, processes, tools, and cloud alliances required to succeed at various phases.

We quote data and findings from multiple sources in this report and are thankful for the valuable insights. Special thanks to Gartner, Canalys, and Synergy Research Group for their continued and impactful industry research.

The 2024 Report marks Tackle’s fifth State of Cloud GTM effort. With half a decade of data to analyze, we can now see how opinions change over time, sometimes dramatically year over year. In the summer of 2024, Tackle surveyed many individuals who participated in Cloud GTM in some capacity. We asked these individuals to share their unique perspectives, experiences, successes, and challenges. Respondents participate in cloud marketplace selling, cloud provider co-selling, or both. As in previous years, many (69%) of these individuals identify in the Cloud Alliances and Channel/Partner Management functions—but the survey data was augmented by individuals in Product/Engineering, Sales/Revenue, and Operations.

This year, we decided to augment this survey data with another data source—the Tackle Cloud GTM Platform. Some of the insights included in this report come from aggregated marketplace transaction data. We felt that including critical learnings from this data source would complement the survey data nicely and offer a slightly different lens into the state of Cloud GTM.

Connect with John on LinkedIn.

The landscape of B2B software spending is undergoing a seismic shift. We’re witnessing a massive migration of nearly $1 trillion in annual budgets from traditional on-premise deployments to cloud-based solutions, fueled by the power of Cloud GTM (Go-To-Market) strategies. This transition extends far beyond individual software purchases. Businesses are increasingly adopting SaaS (Software-as-a-Service) solutions that run natively in the cloud while simultaneously leveraging complementary cloud-based tools to accelerate their digital transformations. This synergistic approach represents a significant opportunity for cloud providers to capture a vast pool of migrating budgets and embrace the “as-a-service” consumption model.

Gartner, Inc. reports that B2B software spending and cloud adoption are experiencing exponential trajectories, each growing at over $100B over the last year. Its research puts worldwide IT spending at $5 trillion in 2024, an increase of 6.8% from 2023. Worldwide end-user spending on public cloud services is forecast to grow 20.4% to $675.4 billion in 2024, up from $561 billion in 2023. SaaS spending is projected to grow 17.9% in 2024 to an astounding $232 billion. The expenditure on the “big three hyperscalers—Amazon Web Services (AWS), Google Cloud Platform, and Microsoft—is massive. Synergy Research Group says these cloud providers account for 73% of the public cloud market.

However, navigating this dynamic environment is challenging. Sales costs are under immense pressure, customer budgets are constantly in flux, and selling SaaS solutions has never been more competitive. According to Andresen Horowitz’s Justin Kahl, David George, and Alex Immerman, in their quite aptly named Selling Is Hard Right Now research, “The entire pie of software spend is just smaller: net-new dollars up for grabs for startups have been cut in half. Unless you’re selling cybersecurity or databases whose growth rates have remained strong, your life has gotten a lot harder.”

Fortunately, there’s a bright spot amidst these complexities—the exponential growth of marketplaces. Google, for instance, proudly boasts a 200% increase in the number of ISV (Independent Software Vendor) co-sell deals facilitated through its marketplace, alongside a remarkable 270% year-over-year growth in the overall value of deals won by its partners. Similarly, AWS reports that marketplace deals close at a phenomenal 27% higher rate, are 80% larger, and close a staggering 40% faster than traditional sales channels.

This focus on marketplaces resonates deeply with buyers. Microsoft claims a 300% increase in customers utilizing marketplaces to purchase via Master Agreements (MAs). Likewise, AWS boasts a whopping 330,000 customers who regularly utilize their marketplace platform to procure software.

In previous years, we have boldly predicted that $100B annually would flow through the three hyperscaler cloud marketplaces by 2026. Based on the current growth trajectory, we’re on track to see this prediction become a reality. However, the last year has produced a few exciting wrinkles, which we’ll discuss in our 2024 predictions.

This year’s report will delve deeper into this dynamic landscape, exploring the latest insights and predictions about how software companies drive revenue efficiently through the clouds by leveraging data, co-selling, and cloud marketplaces.

An explosion of unique marketplace buyers

The number of unique marketplace buyers has increased by an astonishing 460% over the past four years, reflecting a consistent upward trend. The number of buyers who transacted via the three major cloud marketplaces grew by 70% in the last year alone. It is no longer the sole domain of large enterprises, but it is clear from this data that smaller companies, including those that do not have a committed cloud spend, also find value in the cloud marketplaces. We expect this shift down-market to continue since any cloud customer can theoretically find value in the marketplace procurement path. Tackle coaches our customers to account for these trends when considering the business case for complementing an enterprise sales motion with a Product-Led Growth (PLG) strategy. ISVs who wish to remove any friction from the buying process should take note of this explosive growth and figure out how to “ride the wave” to utilize cloud marketplaces as a scalable channel. You can read more about the Enterprise (often contract billing) versus PLG (often usage-based billing) dichotomy in our prediction section below.

Smaller deal sizes (and that’s a good thing)

Over the past four years, the average initial purchase price of Software-as-a-Service (SaaS) subscriptions via cloud marketplaces has decreased by 80%. Similarly to Learning One, this decline speaks to a larger cohort of companies that want to buy from marketplaces. Tackle views this positively, suggesting that smaller organizations, in addition to large enterprises with established cloud commitments, small and medium-sized businesses (SMBs) increasingly utilize cloud marketplaces to purchase SaaS solutions.

Transaction sizes are not just decreasing due to the growing participation of mid-market and SMBs. The increasing adoption of Product-Led Growth (PLG) strategies and the intersection of that model with the cloud marketplaces make software more accessible to end users. We should note that PLG remains a highly debated concept in the context of marketplaces, where user-driven discoverability is useful only if it leads to seamless transactions. Not all software needs to be delivered instantly or be usage-based to satisfy the requirements of business buyers. Consequently, the understanding of PLG is expanding within the marketplace context. We’ll dig into this a little more in our predictions section.

We’re seeing indicators that point to increasingly smaller companies negotiating a cloud spend commit with at least one cloud. We believe this is a combination of the minimum spend threshold for these agreements declining and marketplace purchases counting towards these commits. This marketplace component gives ISVs a hedge against their commitments in the early days if they are not on track to consume as much as expected. This trend will likely continue and may directly correlate to a potential step-function change in cloud marketplace growth.

Here come the Biz Apps!

For the first time in the history of this report, the majority of ISVs surveyed were classified as providers of business applications, representing 32% of the total respondents. This fact supports the ongoing trend of cloud marketplace purchasing becoming mainstream at the buyer level. Finance and procurement increasingly take ownership of cloud budgets and purchases, supporting this trend.

Any B2B software is suitable for cloud marketplaces, and we think vertical software is poised to be the next big frontier. Take, for example, Salesforce, which in July 2024 announced the ISV Fast Track program. Through their partnership with AWS, Salesforce ecosystem ISVs have access to various program benefits and accelerated onboarding to the AWS Marketplace. Salesforce is bringing its ecosystem with it. Will other business applications follow?

I’m excited to share our findings with you as we continue this Cloud GTM journey together.

What it takes to cross the Cloud GTM “Chasm”

After introducing the Cloud GTM Maturity Model in last year’s report, we have found this framework to be highly effective at identifying the characteristics of ISVs at different stages of internal adoption (which you can do for yourself here). As we share our findings from this year’s data, we’ll use the maturity framework to benchmark companies across four categories: people, process, technology, and cloud alliances.

It’s early days for many ISVs. This year, 36% of respondents identified themselves in the Establishing Foundation stage of Tackle’s Cloud GTM Maturity Model. Organizations in this stage typically generate no more than 5% of their revenue through Cloud GTM. In this cohort, the alliance team (or lead) is responsible for all co-selling activities and managing private offers within the marketplace. As you can imagine, these orgs focus on maintaining a listing(s) to enhance visibility and engage potential buyers. They leverage buyer data to inform their strategic decisions, ensuring that their offerings align with market demands. Additionally, each organization in this stage is supported by a dedicated Alliance Manager, fostering a strong relationship between the alliance team and the sales processes.

Moving to the Building Adoption stage, 37% of respondents identified themselves here, where organizations can achieve up to 10% of their revenue through Cloud GTM. This stage is characterized by an alliance-led, seller-supported model. Alliances play a critical role in providing guidance to the sales teams, enabling sellers to utilize the marketplace and participate in co-sell activities effectively. The combination of alliance support and seller engagement helps to build a more robust presence in the marketplace, ultimately driving adoption among potential customers.

Separating the Building Adoption and Driving Adoption stages is a barrier we’ve called the “Strategic Chasm.” This symbolic (no physical Cloud GTM chasms exist, to our knowledge, thankfully) barrier tends to separate strategic sellers from earlier adopters. Here are five of the top things we’ve seen these strategic sellers do to cross this chasm:

- Use a predictive model to assess buyer intent. Understanding an individual account’s likelihood to transact separates early-stage and late-stage Cloud GTM practitioners. For advanced sellers, wasting time positioning the wrong cloud marketplace is a non-starter.

- Automate and integrate with Salesforce. The easier it is for sellers to sell with and through the clouds daily, the more likely it will be adopted. RevOps and Finance teams who can automate Cloud GTM reporting and forecasting through existing processes save time and are more likely to help it grow.

- Deliver a highly aligned product roadmap. Without a clear product strategy, Cloud GTM can quickly stall out or require a rapid redeployment of technical resources. The “how” a buyer buys is as important as the “why.”

- Create compelling Cloud GTM better together stories, templates, and assets. Why should a customer pair your solution with cloud services? Advanced sellers can articulate the value of a joint solution, which also helps co-sell teams immensely.

- Build a plan for consistent and predictable co-sell operations. What is the repeatable process needed to weave co-sell into your GTM strategy? Individual heroics are incredible, but a documented process separates those who have crossed the chasm and those who have yet to.

In the Driving Adoption stage, 16% of respondents reported operating in this phase, with potential revenue contributions of up to 20%. Here, the model shifts to a seller-initiated, alliance-supported approach. Sellers take the lead in driving business to the marketplace, benefiting from co-sell guidance provided by alliances. This proactive strategy helps to establish a stronger foothold in the market, as sellers work closely with alliance teams to maximize their outreach and effectiveness in attracting customers.

Finally, 10% of respondents identified themselves in the Scaling Adoption stage, where organizations can generate 20% or more of their revenue. In this phase, the model is seller-led and alliance-supported, with sellers owning the end-to-end process for driving business to the marketplace and engaging in co-selling with cloud partners. Successful scaling involves organization-wide adoption of strategies and processes alongside the integration of Cloud GTM technology into Customer Relationship Management (CRM) systems. This comprehensive approach ensures that all stakeholders are aligned and equipped to maximize the benefits of their marketplace engagements.

It is also interesting to look at this data from a cloud marketplace Gross Merchandise Value (GMV) perspective. According to Tackle platform data, the top 10% of our customers currently make up 75%+ of the GMV done through our platform. For these ISVs, the benefits of making it to the Scaling Adoption stage are evident. However, we anticipate that this trend will shift based on the changing dynamics of the typical marketplace buyer (i.e., the number of buyers increasing and deal sizes decreasing). Additionally, we expect new marketplace entrants and, in some situations, perhaps even “relaunches” of previously unsuccessful initiatives based on this dynamic and maturation of the cloud marketplaces.

73% of ISVs reported being in the Transactional stages of establishing a foundation or building adoption, which validates the difficulty of crossing this Strategic Chasm.

With co-sell, the journey is

still as important as the destination

The ideal state is, obviously, that every cloud provider is actively selling your product. This represents the dream of cloud co-sell, but unfortunately, it’s not that simple. With hundreds of direct services in their cloud catalog, you need a clear plan to break through the noise and position your solution (and company) as worth the cloud seller’s time and effort.

The upside related to co-selling with the clouds is, to say the least, massive. For ISVs that have cracked the product value proposition code, the prospect of having the cloud behemoths send you leads is the dream. A streamlined and efficient co-sell process with one or more cloud providers can provide the step-change needed to unlock new growth and scale. It’s a worthy goal on the Cloud GTM maturity journey.

But is that reality? In his keynote at Tackle’s Cloud GTM XP event, Tackle CEO John Jahnke outlined how ISV expectations for co-sell are often misaligned with realities. It turns out that co-sell is complex and potentially frustrating for several reasons:

1) There are real people involved (and three parties in a transaction)

2) System misalignments will slow you down at best and cost you money at worst

3) Co-selling doesn’t necessarily mean you’ll get leads (but if you do it right, you will)

Not all sunshine and rainbows, and our survey data supports this. According to our survey, co-selling efforts have a limited impact on the net new pipeline, with 70% of respondents indicating that co-selling affected less than 30% of their deals. Specifically, 22% of participants reported that co-selling did not influence net new pipeline, while 33% observed a modest impact, influencing only 1-5% of the pipeline. The influence was more substantial for a smaller group, with 16% seeing a 6-15% effect, 10% noting a 16-30% impact, and 3% stating that co-selling influenced more than 50% of their deals.

We also asked how cloud co-selling impacts marketplace deals.

Most report modest levels of influence. Specifically, 18% indicated that co-selling influenced 1-5% of their marketplace deals, while 25% observed a slightly higher impact of 6-15%. A similar proportion, 24%, reported co-sell influence in the 16-30% range. Fewer respondents experienced more significant effects, with 16% noting a 31-50% influence on marketplace deals and 10% seeing 51-75%.

Only 6% stated that co-sell efforts influenced more than 75% of their marketplace deals. For these ISVs, the co-selling flywheel is in motion, and the Cloud GTM value proposition is clear.

With this many respondees still waiting to see the value, it’s worth asking: is co-sell really worth it? After all, many see inbound leads as the nirvana state for cloud co-sell, and 57% of respondents disagreed or completely disagreed that cloud providers offer valuable leads or referrals. Only 16.5% agreed, highlighting a significant gap in lead generation value.

However, measuring co-selling efforts purely through the lens of the volume of inbound leads may paint only part of the picture. B2B software buyers often value solutions validated by the clouds in some way, shape, or fashion. When this happens during the sales cycle, you may see shortened deal cycles, which, in the aggregate, may have a massive impact on revenue. The more of these ISV-sourced deals you push through with the clouds, the more likely you will strengthen your posture with them for possible inbound leads.

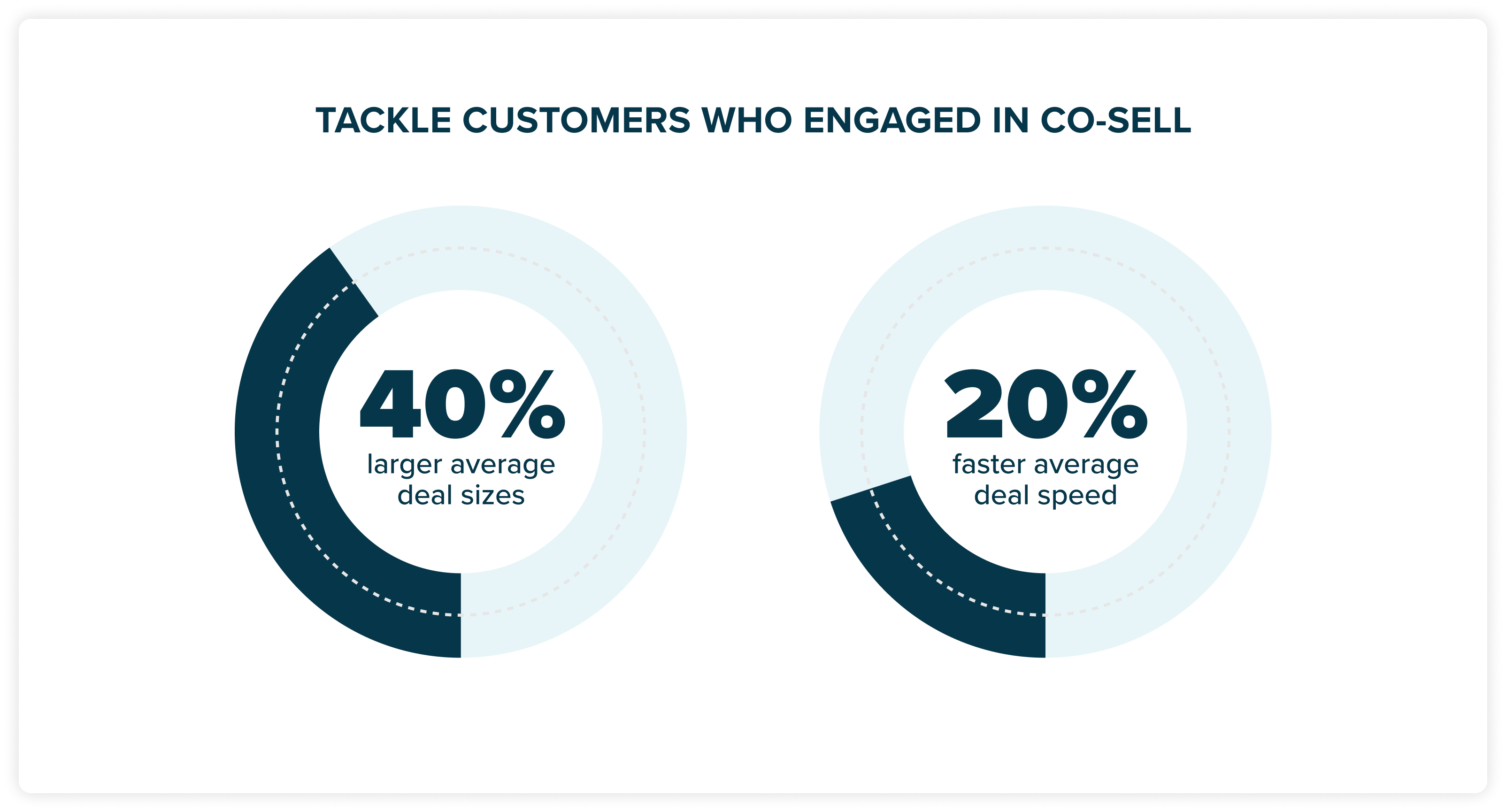

We also see material benefits for co-selling on a deal-by-deal basis. Tackle customers who engaged in co-sell saw 40% larger average deal sizes than those who did not. Similarly, deals closed 20% faster among co-sellers. These sales velocity stats indicate the co-sell’s efficacy and the overall investment’s value.

So, what should we take away from this? We continue to observe significant investments from cloud providers—for example, refinements to the AWS ISV Accelerate Program and Microsoft’s Azure consumption commitments (MACC)—as they seek to enhance co-selling efforts and top-of-funnel support for ISVs. While this remains an area for improvement, and each cloud will map a slightly different path, we believe that ISVs who approach co-selling strategically will achieve superior results compared to those who do not. As cloud co-sell matures, so do the associated best practices.

Cloud GTM as a revenue driver

doesn’t happen overnight

It takes time for Cloud GTM to become a real revenue driver. As a Senior Director of Technology Alliances for a leading data discovery platform put it, “It’s a marathon. We will do more marketplace revenue this month than we did in our first 18 months on marketplace. It builds on itself. You have to put in the time.”

In Learning One, we defined the Establishing Foundation stage of the Tackle Cloud GTM Maturity Model as driving less than 5% of revenue through marketplaces. A significant 35.3%of respondents reported that less than 1% of their total revenue is transacted through cloud marketplaces, while 25% indicated that 1-5% of their total revenue flows through these platforms. Notably, 60.3% of all respondents fit into the Establish Foundation maturity stage, at least strictly by revenue definitions.

A smaller group, 7.4%, reported 6-10% of their revenue came from transactions through cloud marketplaces, many of which likely align with the Building Adoption stage of the Cloud GTM Maturity Model. These companies have not yet crossed the Strategic Chasm but have established an internal process that would lay the foundation for doing so.

Meanwhile, 10.3% of respondents stated that 11-20% of their total revenue was transacted via cloud marketplaces, aligning with the Driving Adoption stage of the Cloud GTM Maturity Model. For these ISVs, Cloud GTM is already a significant factor in revenue growth and an established—if not fully scaled—sales channel.

Looking ahead, 21% of respondents expect cloud marketplace sales to account for more than 10% of their total revenue in the next 12 months. Notably, this reflects a decline in expectations compared to previous years. Last year, 26% of respondents expected this same level of engagement, indicating shifting expectations or changes in marketplace dynamics. In 2022, 44% of respondents anticipated that more than 10% of their revenue would be transacted through cloud marketplaces the following year. The realities of Cloud GTM maturation are likely better known now than in previous years, as expected with an emerging segment.

Aligning with sales is a key

success factor for Cloud GTM

In the year since our last report, sales teams have seen progress in adopting cloud marketplaces as a new sales channel. This year, only 30% of respondents reported that less than 5% of their sales team had closed at least one deal through a cloud marketplace, a notable decrease from 2023 when 56% of respondents reported the same. This figure is not too far from the 36% of respondents who identified themselves in the Establishing Foundation stage of Tackle’s Cloud GTM Maturity Model, and it makes sense, since the Building Adoption cohort attaches up to 5% of its revenue from cloud marketplaces. For ISVs to advance in their Cloud GTM maturity, more sellers must be comfortable transacting through marketplaces.

We also asked companies about the different approaches to sales compensation alignment for Cloud GTM. A total of 38% of our survey respondents have modified their sales compensation plans or introduced additional incentives to promote engagement with cloud marketplaces, while an equal percentage (38%) indicated they have no plans to make such modifications. There’s no single path here, and it largely depends on the structure of your sales team. In previous surveys, most ISVs employed a neutral compensation model—meaning they compensate sellers on marketplace deals the same as direct deals instead of penalizing them for leveraging marketplace. Often, comp-neutral models shorten sales cycles and increase revenue growth. It will be interesting to watch how this changes next year. Here’s an example from one of our customers, a category-leading analytics and BI ISV. They adopted a comp-neutral model and, as a result, shortened their sales cycle by at least four months. They are experiencing 100% revenue growth year-over-year, even while still relatively early in their Cloud GTM journey.

Several challenges were identified as barriers to sales teams’ adoption of cloud marketplace transactions. The most prominent issue, cited by 58.2% of respondents, is that sales team members are either unwilling to adopt or lack adequate training to engage with cloud marketplaces. Additionally, 34.3% of respondents expressed concerns about competition with cloud providers and the potential for these providers to “steal leads.” This is down from 42.4% last year, supporting the notion that trust with the cloud providers is growing, albeit slowly.

These concerns primarily point to enablement gaps and/or internal alignment issues, which are recurring themes and present a significant challenge for Cloud Alliance leads. Internal influence, enablement, and the ability to level-set sellers are major catalysts for Cloud GTM maturity.

Other significant challenges include accounting for marketplace fees (32.8%) and a lack of alignment in sales compensation or inadequate incentives (also 32.8%). While these also seem to point to internal alignment, they are clearer cut and more addressable by sales structures.

We asked respondees how they plan to address these sales alignment challenges, and they identified several key strategies. Consistent education and enablement on Cloud GTM processes was seen as the most effective step, supported by 28.4% of respondents. Integrating co-sell and marketplace activities with customer relationship management (CRM) systems was also highlighted, with 22.4% of respondents citing it as a solution. Finally, 13.4% of respondents found that adjusting the sales compensation model and/or aligning quota retirement with cloud marketplace transactions effectively drove adoption.

It is (and will be) a multi-marketplace world

It’s always interesting to analyze which marketplaces ISVs are focused on. Sometimes, a solution has an obvious match to a particular cloud ecosystem, making that specific cloud marketplace an obvious entry point to a more significant Cloud GTM effort. Other times, the application itself is built on a particular cloud platform, making that marketplace a good entry point. This year, we asked respondents what cloud marketplaces they sell in and which they plan to add in the next twelve months. As in previous years, AWS Marketplace led the charge for existing listings (76%), followed by Microsoft commercial marketplace (54%) and Google Cloud Marketplace (34%).

It’s interesting to compare this data to Gartner’s Worldwide IaaS Public Cloud Services Market Share report, which reports AWS (39.0%), Microsoft (23.0%), and Google (8.2%) infrastructure-as-a-service (IaaS) market shares. Despite only accounting for a combined 31.2% share of IaaS last year, a significant number of our respondees were listed in Microsoft and/or Google marketplaces. ISVs may have existing co-sell relationships with certain clouds or know that they complement that particular IaaS stack meaningfully for customers.

The number of ISVs who transact in multiple marketplaces was more interesting. First and foremost, the product dependency required to be in multiple marketplaces is highly non-trivial. Not every ISV will be at the company or product maturity level needed to support multi-marketplaces. If you want to sell in multiple marketplaces, you need a strategy for effectively managing workloads across various clouds. The data indicates that more ISVs have adopted this approach earlier.

That’s why it stood interesting that 49% of responses sold in more than one of the “big three” marketplaces, signaling a greater intent to meet customers where they buy and not “leave money on the table” by missing out on customers who only provision through a particular marketplace(s). Reaching this point in their Cloud GTM journey often means an ISV has found their product/market fit, built an Ideal Customer Profile (ICP), and, most importantly, is maturing across the Cloud GTM Maturity Model. We found that 78% of respondents who had “crossed the strategic chasm” (Driving Adoption or Scaling Adoption) sell in multiple cloud marketplaces. This multi-marketplace data correlation is interesting and one we’ll continue to monitor and use to augment our Maturity Model.

Finally, 28% of all respondents were listed on all three marketplaces. When we look at the Scaling Adoption cohort only, that number jumps to 71%. We’ll also follow this data point in the coming years to see if the multi-marketplace inflection point moves on the Maturity Model.

Was this the Year of the Channel?

Last year, one of our predictions was, “Customer demand to purchase solutions, including multiple products and services, will drive innovation from the channel.” With the hyperscalers launching new programs like Microsoft’s Multiparty Private Offers and Google’s Marketplace Channel Private Offers, that prediction came true in a major way and 2024 has become “the year of the channel.”

In the past 12 months, 60% of respondents reported that some transactions involved channel partners. In their recent “Now and next for hyperscaler marketplaces” report, Canalys looked at it from a different angle: surveying global channel partners. They noted that 65% of channel partners surveyed say their customers are buying through hyperscaler marketplaces.

Monitoring this growth from both ISV and channel partner vantage points will be intriguing. Companies like Accenture, Deloitte, DoIT, Insight, Presidio, and Sada have all announced strategic alliances with one of the clouds. ISVs are taking note. In the coming year, 87% of our survey respondents anticipate channel partners will play a role in transactions. Additionally, 50% of ISVs indicated that the channel is already critical to their Cloud GTM strategy.

Canalys predicts that by 2027, “over half of all marketplace business will flow through partners (via channel partner offers, etc.) with an even greater share ‘influenced’ by services and systems integrator players.” Clearly, channel growth in Cloud GTM should be expected.

Another wrinkle is the role distribution plays with channel partners. We’ll examine that in our predictions section.

Internal alignment (and investment)

remains key for Cloud GTM

We’ve been tracking who “owns” Cloud GTM efforts in software companies for several years, and a noticeable shift occurred last year. As we discuss in the Cloud GTM Maturity Model, ownership can directly contribute to how steep your maturity growth vector is.

According to the data, 31% of respondents reported an alliance-led and managed model versus 59% the previous year. Finally, 18% indicated a seller-initiated, alliance-supported approach, where sellers are more proactive and drive business to the marketplace with guidance from alliances. This is far from the 15% who reported using this model last year.

The hybrid approach is gaining momentum versus more discrete ownership in sales, RevOps or alliance teams. Perhaps this indicates the expertise needed to vet potential cloud deals and the alliance role’s inherent value. Since the shift mostly came from “alliance-led” to hybrid, this could also indicate a general maturation of Cloud GTM efforts among our respondents. An alliance team (or, much more likely, a single alliance leader) is hired to incubate the Cloud GTM process. As the model is proven, execution is shared between a Cloud GTM subject matter expert (SME) and an associated sales leader who can implement it into a broader GTM strategy.

But what about executive support and alignment for Cloud GTM? This year, we asked respondents about that as well. Just over half of them (53%) said they have “full” executive sponsorship and alignment for Cloud GTM. When we viewed this question with only the Driving Adoption and Scaling Adoption maturity cohorts, this figure rose to 83%. That’s unsurprising, as executive buy-in is strongly associated with those levels and key to a successful Cloud GTM strategy. However, the fact that half of all respondents feel aligned with executives is somewhat surprising since only 26% of our survey respondents had crossed the Strategic Chasm. This delta bodes well for more companies to join the more mature stages of Cloud GTM next year—since the executive alignment layer is already in place.

We also track the tooling required to drive Cloud GTM efforts and fully integrate them into the sales process. A total of 40% have invested in a Cloud GTM platform, while 14.1% used a third-party tool to get listed. Roughly half of the respondents have not yet invested in Cloud GTM tools—of that percentage, 34% have not invested, and 11.3% have engaged service providers for advice on the marketplace and co-sell operations. As the Cloud GTM software category matures, this “tools vs. service provider vs. no investment” ratio will be worth monitoring. Revenue, and not the listing itself, per se, is the fundamental value proposition for ISVs. That reality may not have been as clear several years ago, when VC capital flowed more liberally and software companies adopted a “get listed and figure it out on our own” mindset. As our 2022 State of Cloud GTM Report indicated, “about 15% of companies attempting to launch a Cloud GTM fail in their first year.” Many of these companies went the DIY route and failed to reach escape velocity without a strategy.

What Cloud GTM leaders have to say, in their own words

Data is helpful, but we also allow respondents to tell us about their Cloud GTM journey in their own words. We asked: How would you summarize the value of selling with and through the clouds?

For newer partners, primarily those who had yet to cross the Strategic Chasm, many reiterated that understanding the cloud providers’ organizational structure and building relationships through trust and collaboration was essential. Crafting a “better together” narrative, establishing a niche, and creatively distinguishing themselves from competitors were often called the keys to success. You have to play to win.

Many explained the tangible value of cloud marketplaces, with benefits including access to cloud budgets, faster deal cycles, larger deal sizes, and streamlined procurement. Many discussed the challenges, especially around co-sell processes, competition, and evolving relationships with the hyperscalers.

What to make of free trials,

usage-based billing, and Product-Led Growth

Software decision-makers who choose to transact through cloud marketplaces come in various forms, including individual developers, line-of-business leaders, and various CxOs. Some solutions necessitate an enterprise sales approach, while others fit better into a Product-Led Growth (PLG) sales model. ISVs leveraging PLG often aim to capture a “magic moment” during a free or low-cost trial. Notably, 34% of those surveyed consider a free trial an integral part of their buying journey. But how does this apply to cloud marketplaces?

27% of respondents express concern about linking their Cloud GTM strategies to a PLG sales motion. Successfully driving Cloud GTM growth may involve elegantly transitioning the product usage experience into a cloud marketplace contract, essentially a private offer. Software vendors must master PLG, identifying the right moment for customers to shift from a free/freemium or pay-as-you-go model to a paid contract. 36% of respondents use these types of usage-based billing models. For these ISVs, aligning the “consumerization” of B2B software with cloud marketplaces poses a challenge. Companies utilizing tools like Orb for usage-based billing will likely seek to convert these agreements into enterprise-level, ideally multi-year contracts. In our predictions section, we’ll explore how ISVs can bridge this gap.

“Old Man Yells at Cloud:” The healthy, constantly evolving tension between cloud providers and ISVs

If we’re being honest, the relationship between the hyperscalers and ISVs has always been “interesting.” The cloud providers are, quite naturally, going to ask, “Why is your application not built on our cloud services?” which can be an awkward conversation. The clouds may view some solutions as more specific to a rival cloud provider than theirs, and therefore, they’d need to think long and hard about the value of a marketplace relationship. To what extent is supporting a robust software category on the marketplace preferable to supporting one giant category leader?

The equation is even more dynamic from the ISV’s perspective. Many of us have worked for these software companies that, by necessity, were constantly vigilant about one or more cloud provider announcing a “good enough” version of their software. Plenty of software leaders have entered [insert your favorite large cloud conference] with a detailed PR plan that outlines what to do and say if a hyperscaler announces a service that even looks like theirs. This is the reality of working with the clouds. They have (relative to ISVs) “unlimited” engineering resources, a hyper-competitive market to compete in, and a stated desire to support end users with the technology they need.

So, how does that well-established dynamic inform Cloud GTM?

When we asked what challenges their sales team experienced when adopting cloud marketplaces and/or co-selling, some responses focused on their difficulties working with the cloud marketplaces. Specifically, 31% listed marketplace fees as a challenge. In January 2024, AWS Marketplace announced simplified and reduced listing fees for sellers, including 3% for public SaaS subscriptions and between 1.5-3% for private offers (and 1.5% for private offer renewals). Both Microsoft and Google charge similar rates. It will be interesting to see how these rates evolve in the coming years as competition heats up. For now, about one in three cloud leaders are inclined to evoke Abe Simpson regarding fees (and perhaps other things, depending on how [cloud event] went).

On the co-sell side, this healthy ISV/cloud tension manifested in 34% of our respondees telling us they have a “fear of competition with cloud providers or fear of cloud providers stealing leads,” which we discussed in Learning Four. While this figure decreased from 42% last year, the skepticism isn’t surprising because the public clouds often offer solutions that overlap with ISV offerings.

Coopetition is everpresent and constantly evolving in this complicated IaaS/SaaS ecosystem. If you don’t have a unique product value proposition that aligns with each cloud and clearly demonstrates why your product is superior to native services, you need one. Does a strong Cloud GTM relationship help reduce some of the business risks associated with the ISV/cloud dynamic? That is almost certainly true to some extent, but how much it is can be debated. It will be interesting to see how each cloud provider addresses this perception in the coming year. There may be room for innovation or better-defined partnerships in the near future.

Ultimately, this will come down to the evolution of buyers’ buying preferences and your clarity on your differentiation in an ever-evolving multi-cloud world.

As in previous years, our 2023 report included a series of predictions by Tackle’s Cloud GTM leaders. Let’s look at these predictions and see how close we got.

Prediction 1: We will see as high as $15B in Marketplace throughput by the end of 2023 and $100B in 2026.

Today’s B2B software market is greater than $900B and we believe in this year we’ll see a small but profound 2% of the market fulfilled through Cloud GTM, potentially exceeding 10% in 2026.

As in previous years, we forecasted a significant increase in cloud marketplace sales in our 2023 report. We’re on track to reach this figure, but what will 2025 and beyond look like? Our forecasts for Cloud GTM growth next year are in the predictions section.

Other industry data seems to support our claim as well. Canalys reported $16B in enterprise software sales through hyperscaler cloud marketplaces in 2023. Gartner noted that the B2B software market grew to $974B in 2023, up 11.5% year-over-year. Using these figures, Cloud GTM is hovering around 1.5 to 2% of the overall software market.

Prediction 2: Over the next few years, finance leaders will embrace Cloud GTM as one of their business’s most efficient revenue channels.

This prediction, as written, was somewhat on the money. We surmised that finance leaders would pay closer attention to Cloud GTM as it became a significant percentage of ISV revenue. We didn’t quite account for how much the “do more with less” approach would impact software companies, including GTM teams. Finance leaders had additional reasons to pay attention: larger deal sizes, shorter deal cycles, faster collections, and a higher payment likelihood. It turns out that a successfully implemented Cloud GTM strategy is a great way to “do more with less.”

However, it wasn’t the finance role that made the most significant leap into the Cloud GTM world; it was Revenue Operations (RevOps).

Sitting squarely in the middle of Alliance/Cloud GTM and revenue operations, the RevOps role has become significant in how ISVs transact with and through the clouds. The same “larger/faster” deal dynamics apply to them and, arguably, are how they measure success. Factor in reduced sales team headcount; you now have a very interested party in Cloud GTM. The most forward-looking RevOps leaders will invest in the marketplace and co-selling skills, which are scarce. Not doing so could significantly impede scale as ISVs add more sellers.

We expect this trend to continue, with more and more RevOps leaders playing a significant role in how ISVs work with the cloud. Educating these teams on Cloud GTM maturity will be critical for the clouds and third-party integrators, and we expect plenty of peer-to-peer best practices exchanges.

Prediction 3: Five years from now, every seller in a software company will know how to win with cloud.

The data suggests that not much has changed in the last year. In our 2024 survey, 30% of respondents said less than 5% of their sellers had closed at least one deal through a cloud marketplace versus 32% last year. However, several other market trends indicate this is starting to happen. We have four years to go on this one, but let’s look at a few factors that may shed some light on this prediction.

As best practices begin solidifying in an emerging segment, the rise of coaching resources from various expert providers is a significant factor in how ISVs win with the cloud. Companies like Partner Insight offer a Cloud GTM Leader cohort consisting of 10+ courses aimed at accelerating revenue with AWS, Google, and Microsoft. Partnership Leaders delivers educational assets, training, and meet-ups to their network of nearly 2,000 members, many of whom focus on Cloud GTM. UltimatePartner creates informational media assets, hosts events, and advises companies on their Cloud GTM strategy.

Just as interesting is the marriage of Cloud GTM strategy with existing gold-standard sales methodologies like MEDDICC. We’re seeing Cloud GTM, including marketplaces and co-sell best practices, included in this curriculum (for example, this from MEDDICC), which is a very exciting development. Industry leaders like UltimatePartner also offer comprehensive Cloud GTM resources and training events. This implies that more sellers will “speak cloud” and that sales leaders feel the need to standardize Cloud GTM.

The availability of these resources is a leading indicator that more sellers are making “learning the cloud” a significant part of their role. Will sales leaders eventually surpass alliance leaders in utilizing these resources in the next few years? We’re on that path.

Prediction 4: Incentives for ISVs to engage in cloud partnerships through go-to-market activities will crescendo before they phase out.

This prediction takes a pretty long-term view, but let’s investigate where we see signs that this could happen. First, there has been a general erosion of fees across the hyperscalers, settling in the 3%/1.5% (new/renewal) range. There’s simply not as much room to incentivize at this stage of cloud marketplace maturity. We’ve seen evidence that the clouds scrutinize the underlying architectures of marketplace software solutions and note if they are built using the cloud provider’s platform. If a particular software category has three significant solutions and only one underpinned by their cloud technology, why wouldn’t they focus incentives on that one?

Ultimately, ISVs will concentrate on the “better together” story and how to maximize the joint-buyer impact with clouds. Cloud incentive program requirements will become increasingly explicit about their criteria. As buyer behavior evolves and more leads come from buyer-led interest, will this initiate further rethinking of fees and potentially an increase if the clouds are able to deliver even more value? High-quality leads are precious in the era of GTM efficiency. It’s safe to say we’ve not yet fulfilled this prophecy, but it will be interesting to see how these factors develop.

Prediction 5: Customer demand to purchase solutions, including multiple products and services, will drive innovation from the channel.

This year, we saw significant channel-centric innovation from the hyperscalers, launching new programs like Microsoft’s Multiparty Private Offers and Google’s Marketplace Channel Private Offers. The Clouds couldn’t have launched these new programs without deep collaboration and advice from channel players. In the past twelve months, 60% of our survey respondents reported that some transactions involved channel partners, and 87% say they will next year. According to Canalys research, 65% of channel partners see their customers buying through hyperscaler marketplaces. This one seems to come true, and you can read more about “the year of the channel” in our Key Learnings section.

Prediction 1: The clouds will publish marketplace and co-sell results publicly by the end of 2025.

We’ve observed a growing number of ISVs—companies like Salesforce, CrowdStrike, Varonis, and others—discussing their success with cloud marketplaces during earnings calls.

For the past five years, we’ve been making predictions about cloud marketplace throughput, which analysts have begun to take note of. We projected $100B by 2026. Canalys estimated $85B by 2028 but later indicated they might have underestimated it. We believe reaching $100B is feasible, especially with more large vendors joining the movement.

So this year, we’ll split the difference and target $100B in hyperscaler marketplace throughput between 2026 and 2027.

Ultimately, the cloud providers are the only ones who will truly know the answers. The question remains: when will they start disclosing marketplace results that matter to buyers, ISVs, and channel partners? How impactful will it be when the hyperscalers share this type of data:

- Total Volume (Annual Contracts and Total Contracts)

- Growth Rates

- Business Mix Across Categories (ISVs) and Industries (Buyers)

- Business Mix by Buyer Size (SMB, Mid-Market, Enterprise, Global)

- Business Mix by Usage Type (Private Offer vs. PLG)

- Geographic Mix

As mentioned at the beginning of this report, cloud providers have become more proactive in publishing statistics. Presenting this data and the insights they gather will further drive growth for buyers, sellers, and channel partners as Cloud GTM becomes increasingly significant. We’re excited to see how this next-level, data-driven partnership could unfold.

Prediction 2: Innovation and normalization will rapidly increase non-US customers transacting via cloud marketplaces.

The growth in cloud marketplace usage has mirrored the adoption of the cloud (IaaS) in some ways. In the early days of IaaS, some large enterprises had policies that prevented the use of public cloud, were not operationally set up to make the transition, and often had a completely different view of how IT budgets should be spent (i.e., CapEx vs. OpEx). It took a while for the public cloud to become ubiquitous in the United States, and Europe lagged in adoption for several years. There are many cultural, regulatory, and business reasons for this, but Europe has since caught up. New data from Eurostat reveals that 45% of European organizations bought cloud services in 2023 versus 48% in the US. According to Synergy Research Group, the cloud market continues to grow worldwide. When measured in local currencies, Synergy reports that the APAC region had the most substantial growth, with India, Japan, Australia, and South Korea growing at 25%+. In Europe, the UK and Germany are the most significant cloud markets, but the markets with the highest growth rates are Ireland, Italy, and Spain.

We expect cloud marketplace transactions to follow a similar course for several reasons. First, cloud providers will continue to innovate marketplace functionality that better accommodates non-US customers. The ability to transact in various foreign currencies reduces friction for end users and allows them to avoid currency fluctuations. We also expect the channel partner ecosystem to evolve to fill geographic “gaps,” allowing more non-US customers to transact via marketplaces.

Prediction 3: AI-driven cloud buyer intent data will have a broader impact across all GTM efforts, not just Cloud GTM.

As we write this, AI and Machine Learning still dominate the technology news cycles, as every business seeks to determine when and how to implement AI technologies practically. The Cloud GTM category already benefits from predictive buyer intent models that match prospects to likely cloud marketplaces based on several factors. This use of AI will continue to grow, with Gartner predicting that by 2026, 75% of businesses will use generative AI to create synthetic customer data, up from less than 5% in 2023. Cloud GTM will ride this wave in the coming year.

As the Cloud GTM software category matures, so do its connections to the broader GTM tech stack ecosystem. An AI model is only as good as the datasets that underpin it, so combining data points from across a typical GTM tech stack will greatly enhance predictive models like buyer intent. As a result, this cloud buyer intent data will move “upstream” in a sales cycle, including sales territory and territory planning, account-based marketing, general demand generation, RevOps, and sales. You may see software buyers opting in to share data to provide vendors with a more accurate view of their business needs. This may radically change how ISVs determine their Ideal Customer Profile (ICP) and use it to drive GTM efforts.

Prediction 4: Some ISVs will use “pay-as-you-go” consumption-based billing models in the cloud marketplaces, while others will focus on offers and contracts. Some of the most successful ones will find a way to do both.

The clouds offer a consumption-based “pay-as-you-go” listing type and subscription model. They allow an ISV to set up a listing where a buyer can subscribe without a contract commitment, paying the (publicly available) usage-based pricing as they use the software. While this process has technical challenges, many end users expect this pricing model, especially in the lower-end offerings (think serverless databases, for example).

As the buyer onboards and uses the product, the ISV tracks this usage and bills the buyer through metering services. ISVs bill daily, monthly, weekly, or however they prefer. For many ISVs, this scenario is far inferior to a fixed contract booked via the cloud marketplaces. Contracts allow for greater predictability and less churn.

In the coming year, more innovative ISVs will likely find a way to use product usage signals to convert PayGo customers to fixed contracts via the cloud marketplaces. These ISVs will essentially find the “best of both worlds”: accommodating usage-based consumption for new customers plus the predictability of longer-term contracts. Cloud GTM platforms will help them transition, possibly using buyer intent algorithms. While this may make up a small portion of overall revenue, we expect most ISVs will have a combination of listing types by the end of 2025.

Prediction 5: Buyer behavior will continue to change, and we’ll witness the “Grand Opening” of new storefronts.

We have witnessed massive growth in the number of cloud marketplace buyers. As we highlighted earlier, we’ve seen nearly 500% growth over the last four years, and we predict this growth will continue. So, what stands in the way of cloud marketplaces becoming the primary way to buy software? The clouds are still somewhat disconnected from the standard purchasing flow most ISVs have created. While they are rapidly becoming the most significant channel in a company, with up to 20% of revenue flowing this way, 80% is still flowing other ways.

Buyer behavior is complicated and more distributed than ever, and it will require marketplace purchasing to emerge as an option in more and more places to capture an even more significant percentage of the wallet share. In large organizations, there is often a point of aggregation for purchases, and policy can be implemented to drive buyer behavior change. Still, moving outside of large organizations will come down to what is easiest and most cost-efficient and how people get what they need and want when required.

We believe marketplaces will account for 20% of B2B software over the next five years. Reaching 50% + will require innovation, substantial transformation of GTM systems, and evolution of buyer behavior. We expect B2B software storefronts to be a part of this evolution.

In our consumer lives, we’re all exposed to an increasing number of new storefronts. Thanks to companies like Shopify (and their associated ecosystem), the complexity of setting up and running a digital storefront shrank dramatically.

We think we’re in the earliest days of B2B software storefronts being a reality, but we see this trend continuing.

What will a storefront look like? It will likely be a place where you can guide specific types of buyers into custom buying “actions.” Cloud marketplaces offer new opportunities for buyers to start their journeys. However, discovery within these marketplaces remains limited. How can we bring the concept of marketplaces closer to where buyers are already exploring?

In the past, cloud providers created custom landing pages with links to specific listings. Over the next few years, these storefronts will evolve significantly. They will feature broader ecosystems of products, often include channel partners, offer product and service bundles, and become more closely aligned with ISV top-of-funnel campaigns.

Some may be skeptical of this prognostication. After all, many have tried to set up a marketplace, but few have succeeded. We predict that this next generation of marketplaces and storefronts will shatter the expectations of a typical marketplace transaction by combining technology ecosystems and marketplace infrastructure to help buyers get what they need, how and when they need it. When Shopify launched, few believed there would be as many storefronts for consumers as today. Or that Amazon, the online bookseller, would eventually dominate consumer purchasing. Now valued at $100B, Shopify continues to see dramatic evolution in discovery and purchasing. We anticipate a similar development with cloud marketplaces.

The clouds are rapidly changing the nature of a marketplace and redefining the expectations of buyers, ISVs, and marketplace operators.

Prediction 6: International markets and SMBs are the next frontier of Cloud GTM.

As Cloud GTM’s steam train continues to build global momentum, it is looking for any and all growth opportunities. Strategic ISVs are mastering the private offer motion, integrating channels into this motion, and evolving their PLG strategies with the clouds. It’s fair to ask what comes next.

Two new chapters are emerging for strategic sellers. First, for US-based software companies, there’s a distinct focus on international markets. Second, we see more alignment around how to support downmarket segments of the businesses.

International:

The international evolution will reflect the standard adoption curve seen in North America, where enterprise private offers transition to channel models. That said, channels will become an increasingly vital part of the growth narrative internationally. While certain capabilities are still needed for a truly international marketplace movement to succeed, this remains a priority for cloud providers to address. We will closely monitor this evolution over the coming year.

SMB:

Over the past four years, we’ve witnessed a significant shift from enterprise to mid-market transactions, particularly in streamlining renewals. However, SMBs present a different challenge for many ISVs, marking a new frontier for Cloud GTM. PLG and SMB strategies are not the same. Most SMBs are not tech-forward, lack developers driving adoption, and rely heavily on partners to integrate solutions. The narrative around SMBs and the marketplace movement is just beginning to take shape—as ISVs struggle with the economics of supporting SMB segments directly and cloud commitments continue to evolve down market.

Prediction 7: Distribution will continue to insert itself into the Cloud GTM conversation.

Distribution is increasingly aligning with the channel’s cloud-forward club and embracing cloud marketplaces like never before.

The key question is whether the financial model of distribution and cloud marketplaces can align for long-term success. As the era of GTM efficiency progresses and margin pressure in distribution remains a reality, the classic value proposition of hardware integration still holds. However, what role will distribution play as marketplaces expand globally, improve foreign currency handling and local taxation, and extend channel reach through direct cloud programs? Will the repatriation of cloud workloads for AI provide new opportunities for the traditional business model, or will ongoing margin erosion and revenue decline necessitate further reinvention?

At the recent Canalys Forum, Jay McBain forecasted that by 2027, over 95% of distributors will struggle to secure funding to participate in the AI era, further noting that the platform of distribution takes billions of dollars of investment in digital marketplaces [and] ecosystem orchestration. He suggested that close to 500 global distributors will not have the capital and credit facilities, leading to massive consolidation in this space.

Currently, 44% of survey respondents indicated that distribution is part of their strategy, predominantly among medium and large companies. While many large distributors continue to invest in and promote their cloud strategies, we believe that the role of distribution in the Cloud GTM era is still evolving and not yet fully defined.

We’re entering an exciting period of Cloud GTM growth and market maturation. Innovation is happening across the clouds, which leads to better ISV and software buyer experiences. We’re excited to see how channel, distribution, and third-party GTM consultants will continue to shape how companies transact through the clouds. Still, each ISV has to blaze its own Cloud GTM trail, requiring plenty of work. We see five critical attributes as indicators of ISV Cloud GTM maturity.

First, an “appetite to go all in” reflects the importance of stakeholder alignment across various departments, including revenue, operations, partnerships, finance, and product organizations. That last group, product organizations (or business units), is worthy of further analysis. Smaller ISVs, or even rapidly growing startups, may have one or, at most, a handful of products, so aligning on a Cloud GTM strategy is more manageable. However, for larger enterprises with dozens of product lines or more, stakeholders must be committed and aligned. It’s then much easier to make decisions, react quickly, and, most importantly, sell effectively.

Next is what we call the “product-cloud fit,” which reflects your willingness to evolve your product to match innovation in Cloud IaaS and services to ensure mutual benefits for customers. This adaptability is essential for aligning with cloud providers and effectively meeting market demands.

Third, your enablement capabilities play a significant role. ISVs must be able to roll out ongoing enablement initiatives that educate their teams on how to co-sell effectively with cloud partners. This includes training and resources that empower the field to engage with cloud solutions confidently. Think of this as an ongoing process rather than an occasional thing, and you’ll thank us later.

Fourth, your revenue operations (RevOps) maturity is critical, as it reflects an organization’s willingness and ability to adopt advanced tools within its finance, sales, and account technology stack. This technological integration facilitates streamlined operations and enhances overall efficiency. RevOps leaders are instrumental in “connecting the dots” for sellers and building best practices and processes.

Finally, product sales velocity is a critical attribute. It’s no surprise that sellers tend to note when sales volume through and with the clouds becomes significant. Getting to this point of critical mass is tricky, and false starts are a risk. But once you get the Cloud GTM flywheel rolling, you should unlock new revenue and associated scale soon after.

Businesses can significantly accelerate their journey toward Cloud GTM maturity by focusing on these attributes.

Have questions or comments about this report? Interested in having Tackle debrief you or your team on our findings, or do you want to be emailed when new Tackle research is available? Reach out to us at marketing@tackle.io.