Leveraging data to build out a more robust ideal customer profile

When it comes to B2B software sales, the only constant is change. Cloud Marketplaces have exploded in the last few years—and we expect to see as much as $100B in Marketplace throughput by 2026. In a relatively short time, we’ve seen Cloud GTM become a preferred revenue channel for software companies.

That’s why creating and scaling a Cloud GTM strategy is paramount for ISVs—and the best way to identify the right buyers and partners with which to build your Cloud GTM is with data. After all, targeting the right customers is not only a pillar of Cloud GTM, it’s sound business practice. Starting with data—knowing who your buyers are and where/how they like to buy—is the first step toward Cloud GTM success.

Reaching those buyers at the right time with the right message is the bread and butter of an ISV’s sales team, and an ideal customer profile (ICP) is one of the primary tools that helps a company build a solid Cloud GTM motion.

Reaching those buyers at the right time with the right message is the bread and butter of an ISV’s sales team, and an ideal customer profile (ICP) is one of the primary tools that helps a company build a solid Cloud GTM motion.

Although an ICP is a tried and tested concept for sales, creating one for Cloud GTM is a bit different. A Cloud GTM ICP not only incorporates firmographic data (a company’s business sector, funding level, revenue, and so on), but also focuses on critical information such as whether the customer has made purchases via Marketplace in the past, which Cloud Provider(s) they have a strategic partnership with, if they are engaged in co-sell activities, and cloud maturity (laggard, leader, or hybrid.) This Marketplace and cloud-specific data is what sets the Cloud GTM ICP apart.

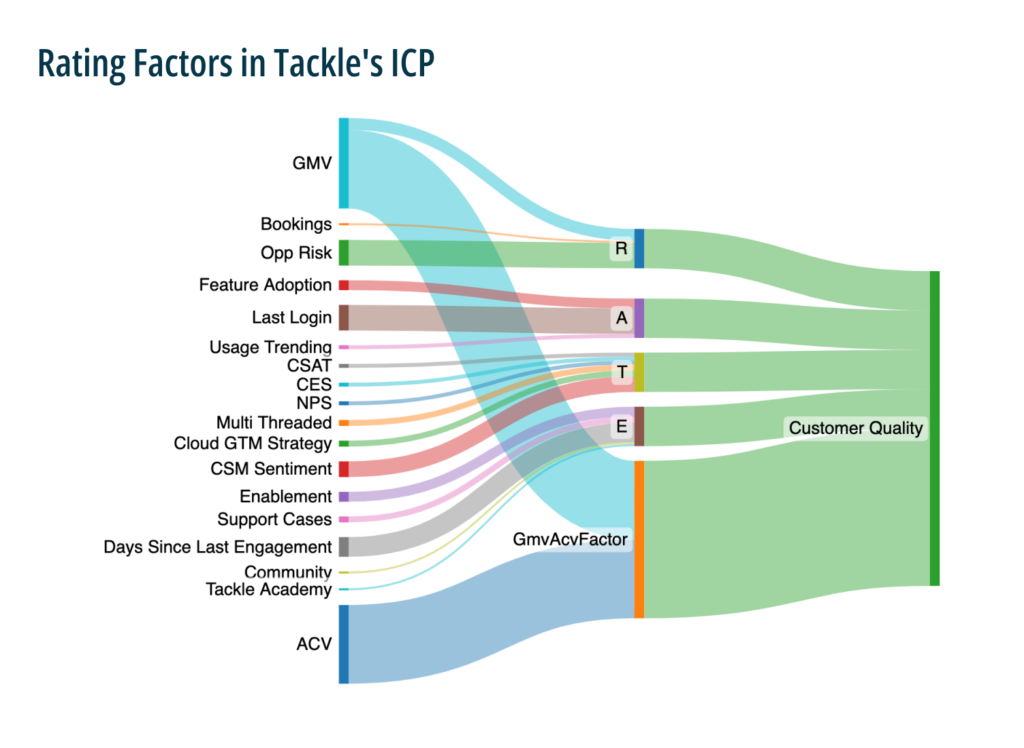

Doug Felteau, Tackle’s VP of Solutions Engineering, dove into revamping the ICP for Tackle—with firmographic, account-specific, and cloud-driven data as the foundation. Here’s what makes a data-driven Cloud GTM ICP work, and how Tackle went about the process.

Be sure to also check out our Tackle on Tackle blog series in which we cover how Tackle leverages Cloud GTM to drive revenue, how we use a data-driven approach to super-charge our Cloud GTM strategy, and how that Cloud GTM strategy even underpins our accounting, legal, and HR functions.

What exactly is an ICP?

First, what do we mean by “ideal customer profile?” Simply, an ICP is a detailed representation of a hypothetical company that would derive maximum benefit from your products or services. Yes, this is a customer who might be likely to purchase your software, but the key element here is that this hypothetical customer is a good fit for your product. In other words, their own business would see significant ROI from purchasing your product.

For sales, alliances, marketing, and product teams, an ICP helps to create a targeted list of prospects that are predicted to be successful customers and partners for the company. “Prospects within the ICP should provide the best ROI for customer acquisition,” said Doug. “This allows the sales team—and the rest of the ISV for that matter— to concentrate on the best prospects and not spend time on sales, marketing, and partnership efforts with lower-tiered customers who are not a good fit for your product.” It’s all about efficiency.

In a nutshell, here are the basics of what an ICP entails:

- It’s not a real company

- It’s a composite sketch based on attributes of real companies

- It leverages characteristics of real companies, such as ARR or Cloud Marketplace activity

- It is focused on high-value customers

For developing a strong ICP, it’s also crucial to include attributes from companies that understand the value proposition of your company’s products and services. These companies, which may have a higher customer lifetime value (CLV) or might be promoters of your brand, for example, would be considered not only a good fit for your product and services, but also solid partners who would, in turn, enhance your ISV’s own brand value. “There’s more to building an ICP than just looking at companies you’d like to target,” said Doug. “It’s more involved and complicated than that, and the companies you do have your sights on must be a good fit for your product and be a good partner for future growth.”

What an ICP is NOT

An ICP is often confused with a “buyer persona,” which is a semi-fictional representative of an ideal customer. A buyer persona includes pain points, behaviors, and trends to paint a picture of your potential customer. An ICP and a buyer persona may be close cousins, but they’re not twins.

Although a buyer persona is also based on market research and real data, an ICP is distinct from a buyer persona in that it’s a broader categorization focused on highest value customers, not just any potential customers. With a buyer persona, you’re looking at the motivations of any and all potential customers, whereas an ICP targets and profiles only those customers that are most likely to buy and are ideally suited for your product. And when coupled with data, an ICP can provide deep insight into who that best-fit customer is.

Data: The special sauce that elevates an ICP

Generally speaking, with a traditional ICP formulation, the procedure looks something like this for most companies:

- Examine customer base and choose the perceived best customers (usually those who have spent the most)

- List their key characteristics

- Look for commonalities

- Use common attributes as the ICP

That’s pretty straightforward, and companies have been doing it that way for a long time. However, the traditional approach outlined above has a few notable flaws. This approach can lead to heavy bias and a skewed ICP because it relies on intuition and assumptions, along with shallow analysis. Using this approach, you’ll develop an ICP—but certainly not a very dependable one.

For Tackle, doing it that way just wasn’t going to cut it. Our goal was to build a more robust ICP that takes our unique Cloud GTM strategy into account and is based on data, not intuition and assumptions:

Building a data-driven ICP for Cloud GTM

- Pull the customer dataset (i.e. a Salesforce report of all current customers}

- Enrich customer dataset using internal and external data sources (internal data might include customer health and ARR spend with your company, and external data might include firmographic data, ABM engagement data, and Tackle Prospect scoring)

- Analyze the above data to discover the best customers

- Analyze data to discover most important customer characteristics

- Test identified characteristics against known customers and churned customers to validate

For Tackle (and any ISV looking to replicate the process), the benefits of leaning on data are clear: it provides a comprehensive, more accurate, and efficient process with little to no bias. “We were looking at mapping various features of companies for firmographics—what type of company, revenue—and enriching it with other data, such as which Marketplaces they were on and the kind of deals they made,” said Doug.

Along with the basic firmographic data, Doug’s team also incorporated ZoomInfo, Intricately, Tackle Prospect data, and additional data to form the backbone of the ICP.

How the process unfolded

At a high level, Tackle’s ICP process proceeded along these lines:

1. Define success in customers

Using Tackle’s internal data and insights about our customers, determine most impactful attributes that represent a successful customer.

2. Determine attributes related to success

Using third party data sources, determine divergent attributes, then score and weight those attributes. Doug also grouped all of the companies into quadrants—poor, fair, good, excellent—to better visualize which companies were best to target.

“Using the quadrants of our customers, I first used statistics then moved to machine learning to understand which attributes are the most different from poor to excellent customers,” said Doug. “The attributes with the biggest difference received a higher weighting, the attributes that were not as divergent received a lower weighting or were removed altogether if there was no difference.”

Examples of those attributes could include employee count, total revenue, how much co-selling a company does, or Tackle Prospect data on whether a company has purchased through one or more Cloud Marketplaces. “Once the weighting was determined, I then used that weighting to score the current customers so I could then validate against what we know churned and what we think would churn,” said Doug.

3. Validate assumptions against churn

Using the score and weight, validate assumptions against churned ISVs over the past 4 quarters, current quarter, and churn forecast for the next 2 quarters

4. Use attributes to score pipeline

Using validated weighted attributes and scores, score the current pipeline and prospects to target and validate with internal teams.

5. Discover new prospects to target

Using validated weighted attributes and scores and using third party data, discover new prospects that match our successful customers

For Tackle’s ICP, Doug and his team developed a scoring system (0 to 100) based on the data, with companies less likely to fit the ICP scoring lower, and best-fit companies scoring closer to 100. “You’ve got to determine your own threshold,” said Doug. “Is it 50? Do you pursue companies scoring 50 and above? You have to take a step back and really think about that.” Tackle elected to only pursue those companies that scored very well, at 80 or above.

“We want to target those customers that are on the upper end of the scale and have a better chance of being successful, because if they’re successful, so are we,” said Doug, “It’s more economical to acquire a successful customer and maintain that relationship than to acquire a customer that might not succeed.”

Some caveats to keep in mind

Some caveats to keep in mind

No sales tool is perfect, and that’s certainly true of an ICP, no matter how well built. There are limitations, as well as a few things to keep in mind.

Although a data-driven Cloud GTM ICP is far more accurate than a traditional ICP, it’s only as good as the data you use. If the third-party data has issues, then your ICP may be slightly skewed. Some of those issues may include outdated or incorrect attributes, or attributes that do not always exist for newer companies—such as a track record for making regular purchases on a Cloud Marketplace, inaccurate ARR data, or lack of firmographic information. On that last point, it should be noted that if information does not exist for a data source, it could artificially inflate or deflate an ICP score.

Perhaps the most important issue to note is that market conditions change (remember what we said at the beginning about the only constant being change?). That means your ICP will need to roll with the punches—revisit your process and rebuild the ICP periodically. “We’ll be looking at trying to make this process as easy as possible,” said Doug. “We’re starting to revisit the ICP every quarter and even looking into automating much of the process.”

Making an ICP work for you

Every company is different, and no two organizations will approach an ICP in exactly the same way. But Doug recommends that all companies—regardless of size or vertical—invest adequate time in the ICP process. “You’ll want to clearly understand what a successful company really means to you, and validate the data against that,” he said. “In the end, your defined ICP should represent who would be your best partners so your sales team does not waste your company’s time and resources on pursuing the wrong opportunities.”

Take our three-minute Cloud Go-to-Market Readiness Review to see where your business is on its Cloud GTM journey.