What we got right, what we got wrong, and what new trends are emerging halfway through 2025

When industry predictions meet market reality

When we released Tackle’s 2024 State of Cloud GTM Report last year, we made several bold predictions about where the industry is heading in 2025. Now, halfway through the year, we’re doing a reality check on how accurate our predictions were.

Spoiler alert: many of these predictions aren’t just coming true—they’re accelerating faster than we anticipated. At the same time, new trends that we didn’t expect are emerging that will shape the future of Cloud GTM.

Prediction 1: The clouds are opening their books

Last year we predicted that cloud providers would begin publishing marketplace and co-sell results publicly by the end of 2025. While we’re not there yet, we’re seeing the first real validation of this trend taking shape.

Google leads the charge by sharing marketplace results on their earnings calls—the first major cloud provider to do so. Additionally, AWS is increasingly vocal about marketplace success stories, and we expect them to share more concrete data soon. Microsoft has openly discussed growth rates in its marketplace business, signaling a shift toward greater transparency.

What’s particularly exciting is that we’re not just seeing cloud providers share these metrics, but also billion-dollar ISVs are now following suit. Companies like Salesforce and CrowdStrike are discussing their cloud marketplace success more publicly, demonstrating that marketplace transparency isn’t just good for the ecosystem; it’s a competitive advantage.

As cloud providers and ISVs become more transparent with marketplace performance, the industry needs more than volume and growth metrics—we need better insights into how buyers actually behave.

Prediction 1 Grade: B

Prediction 2: Global expansion is accelerating

Our prediction that international markets and SMBs are the next frontier of Cloud GTM is definitely coming true.

So far this year, Google has announced massive expansions in Indonesia, South Africa, Thailand, and Malaysia. AWS has already announced plans to add 12 more AZs and four regions in Chile, New Zealand, Saudi Arabia and in the AWS European Sovereign Cloud. They’ve also already opened new regions in Taiwan, Thailand, and Mexico. Not to be outdone, Microsoft announced new Azure regions and expansions in Italy, Spain, and Saudi Arabia.

How does this compare to past years? Take AWS for example: by mid 2025 they already have three new international regions online, compared to just one new region in 2024 and three new regions in all of 2023 (source).

Given all of this, it should come as no surprise that AWS has released support for foreign currencies (a critical prerequisite for global business) and we’ve observed growth in international participation across all major cloud providers.

We’re also seeing the channel partner ecosystem evolving to fill geographic gaps, making it easier for non-US customers to transact via marketplaces. It’s clear that global marketplace momentum is accelerating across regions, with international growth now playing a central role in shaping cloud GTM strategies.

Prediction 2 Grade: A

Prediction 3: Sellers will require novel forms of buyer intelligence data

Perhaps our most significant prediction was that AI-driven cloud buyer intent data would impact all GTM efforts, not just Cloud GTM. This has become our fastest-growing product area here at Tackle, but what we’re seeing is something bigger: a fundamental gap in how we understand modern B2B buying behavior.

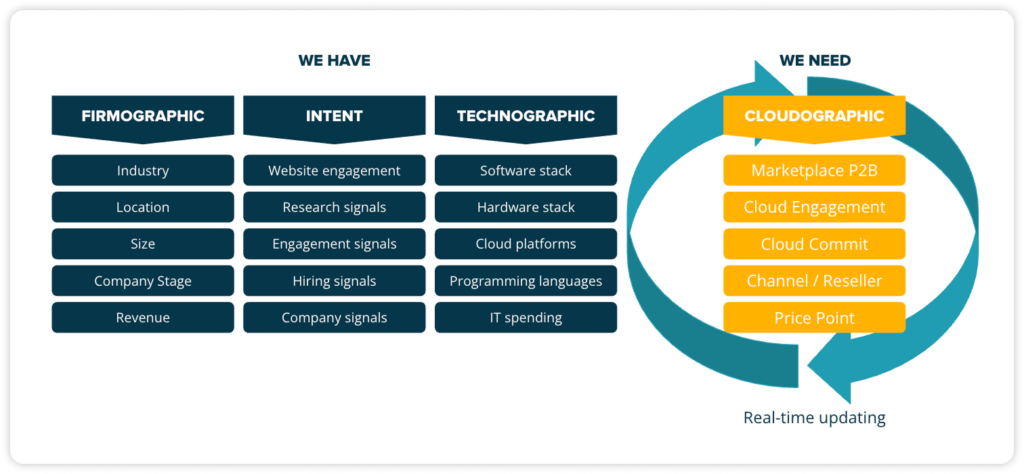

RevOps teams already have plenty of firmographic data (industry, size, location) and intent data (website engagement, research signals), but there’s a missing piece of the puzzle. As sales cycles grow longer and buying committees more complex, sellers need a new layer of insight into how companies make technology decisions.

Recognizing this, Tackle introduced a new category of buyer intelligence: Cloudographic data. This approach captures how companies engage with and commit to cloud platforms—surfacing signals like marketplace buying behavior, cloud commit levels, channel and reseller relationships, and price sensitivity across platforms.

What makes Cloudographics especially valuable is that it reflects action-based intent, not just interest. Signals like growing cloud commitments or shifts in reseller strategy help sellers understand not just who a buyer is, but how they buy in today’s cloud-driven landscape.

We expect Cloudographics to emerge as a critical signal that complements the GTM tech stack, bridging the gap between identity and behavior in the cloud.

Prediction 3 Grade: A

Prediction 4: The PayGo-PLG in marketplace, a new business reality

Last year we predicted that the most successful ISVs would embrace both consumption-based billing and fixed contracts., Not only is this coming true, but it’s also revealed something deeper about the fundamental shift happening in B2B software.

Pay-as-you-go (PayGo) and Product-Led Growth (PLG) have become prerequisites for selling AI software—every AI company born today is fundamentally PLG, creating a forcing function where even existing ISVs are rethinking their entire business models.

But here’s what you need to ask yourself: do you have a true PLG business strategy or are you simply offering PayGo as a billing model?

The distinction between these approaches determines marketplace success. Nailing PLG early sets companies up to succeed as marketplaces evolve into storefront-style experiences with more complex transactions. We recently explored how ClickHouse exemplifies this approach, automating everything from purchase-to-product onboarding to usage-based billing across multiple marketplaces.

The reality is that if you don’t solve the fundamental PLG execution challenge first (think metering problems, product instrumentation, self-service customer, and user onboarding that drives organic adoption), the cloud marketplaces become just another distribution channel rather than a growth accelerator.

We’re seeing that PLG has evolved beyond just a go-to-market motion and is becoming the foundation for everything that comes next in cloud commerce, from AI-enabled buying experiences to the sophisticated B2B storefronts that will define the next phase of marketplace evolution.

Prediction 4 Grade: A-

New trends on the horizon

Beyond our original predictions, we’re tracking emerging developments that will shape the next chapter of Cloud GTM:

- Distributors must evolve or die. The clouds have redefined how entire ecosystems work, forcing distributors and channel partners to reinvent their value propositions. As Jay McBain noted, by 2027, over 95% of distributors may struggle to secure funding to participate in the AI era. What does the future hold for distributors? McBain warns that if they don’t build platforms and come into the forefront, they risk becoming irrelevant in the next era of cloud GTM.

- The rise of agentic co-sell. Perhaps most intriguingly, we’re seeing the emergence of agentic co-sell—the use of AI agents to drive scale and efficiency in partner ecosystems. This represents a fundamental shift from manual co-selling processes to automated, intelligent partnership orchestration. As agent technologies mature, we expect to see dramatic improvements in partner identification, deal qualification, and collaborative selling motions.

We’re also closely monitoring the broader impact of AI agents on marketplace behavior. As automation capabilities expand, how will it change the way buyers discover, evaluate, and purchase software through cloud marketplaces? This could be the next major disruption in an already rapidly evolving landscape.

The path forward

One thing is clear: we’re witnessing a fundamental transformation of how B2B software is bought and sold. The companies that recognize and adapt to these shifts today will be the ones that thrive tomorrow.

Our 2025 State of Cloud GTM Survey is now live, and we’re eager to hear from practitioners across the ecosystem about the trends they’re seeing. We will release the resulting report in September 2025, and we expect it will reveal insights that shape our industry’s trajectory for years to come.

The future of Cloud GTM is accelerating, and we’re just getting started.

Ready to contribute to the industry’s most comprehensive Cloud GTM research? Take our 2025 State of Cloud GTM Survey and help us uncover the trends that will define the next chapter of cloud commerce.