State of Cloud GTM 2025: Committed Spend, Engagement, and the New Marketplace Landscape

Our first two blogs in the series explored how marketplace revenue is gaining speed and how co-sell has shifted into an organized, multi-cloud routine for many teams. Those findings already signaled that Cloud GTM is no longer an experiment lane. It has become a structured part of planning and revenue design.

The third and final set of learnings adds a fresh dimension to that picture. They highlight where sellers gain the most reliable advantage, where friction still slows progress, and where partner ecosystems are expanding faster than many anticipated. Together, Learnings 5, 6, and 7 outline how Cloud GTM execution is broadening, and they point to several priorities that revenue, alliance, and operations leaders need to consider for 2026.

You can access the full 2025 State of Cloud GTM Report here, with all seven learnings as well as predictions for 2026.

Learning 5: Committed spend is the most bankable marketplace advantage

Learning 5 at a glance:

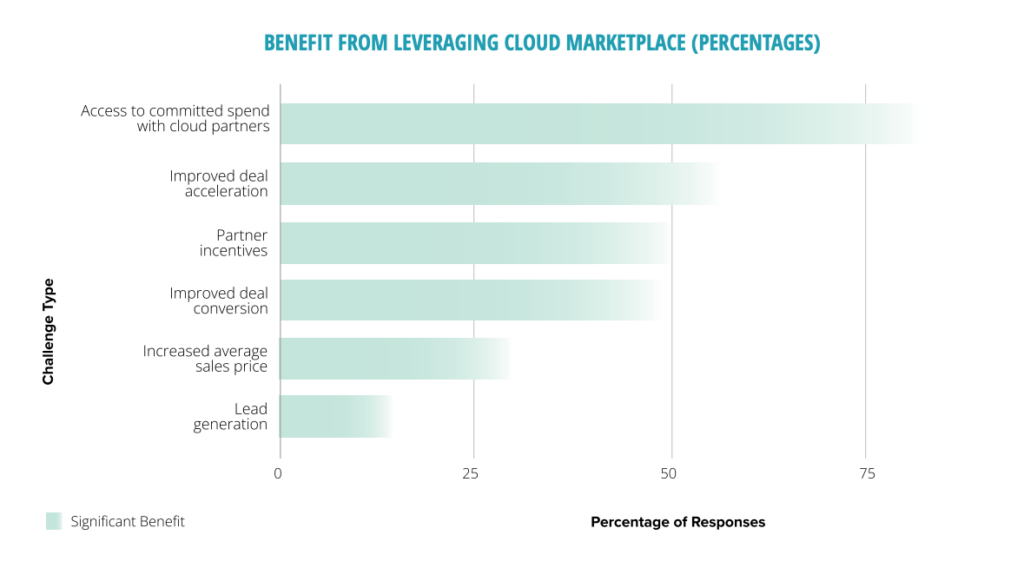

- 74% of respondents cited access to committed spend as a significant benefit

- Cloud commitments are projected to exceed 460 billion dollars in 2025

- Smaller firms expect 75% of next year’s revenue to originate from marketplace transactions

- Overcommitment trends continue to push buyers toward marketplace routes

Across all seven findings, committed spend stands out as one of the clearest signals of marketplace value. Seventy-four percent of respondents described access to committed cloud spend as a significant benefit. Customers with multi-year agreements often need to fulfill those commitments before the term resets, which makes marketplace purchasing an efficient path for procurement teams under deadline pressure.

That dynamic is accelerating. Canalys estimates that global cloud commitments will reach more than 460 billion dollars in 2025, creating a large pool of obligated spend across industries and buyer segments. When a customer approaches the end of a commitment cycle and still has budget to draw down, marketplace purchases become a natural consideration.

Small and mid-sized firms have leaned into practice the most. Respondents in these categories expect an average of 75% of next year’s revenue to originate from marketplace transactions. Their teams often move quickly, and the predictability of committed spend gives them a reliable path to forecast bookings and streamline cycles.

Despite these advantages, respondents still noted persistent hurdles with cloud provider engagement. That friction shows up in several ways, including inconsistent collaboration with field sellers and difficulty accessing partner development managers.

For leaders planning the next phase of Cloud GTM, the takeaway is straightforward. Committed spend remains one of the strongest levers available. Teams that understand how to identify customers with remaining commitments, guide them through marketplace routes, and establish repeatable internal workflows will be positioned to capture a larger share of cloud-directed purchasing.

Learning 6: Provider engagement is the central bottleneck

Learning 6 at a glance:

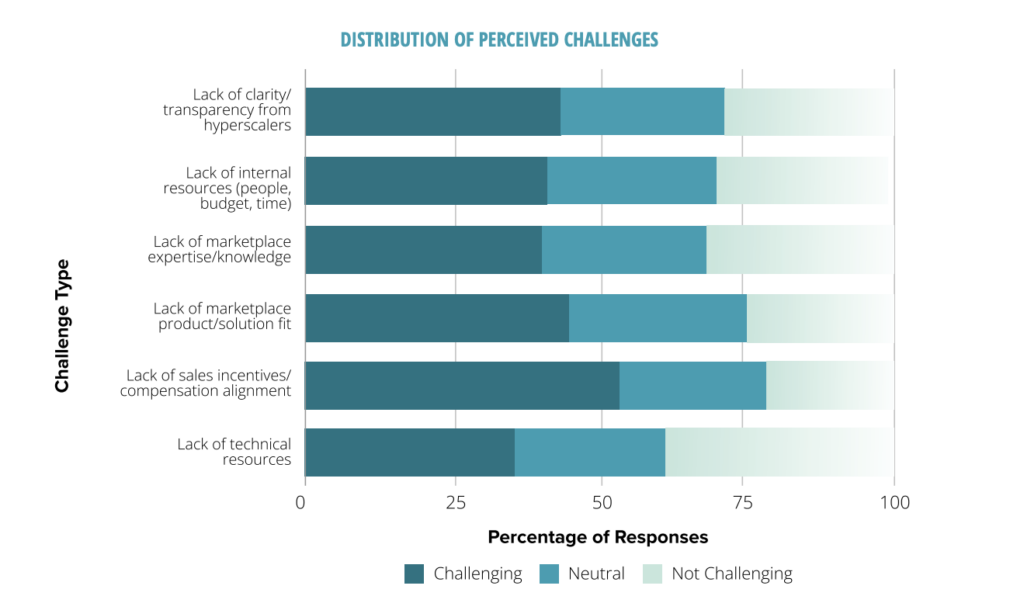

- 31% rated provider engagement extremely challenging

- 46% rated access to partner development managers extremely challenging

- Organizations forecast a 60% increase in marketplace revenue in 2026

- Resource allocation shifts inside hyperscalers contribute to inconsistent support

While committed spend is the clearest advantage, provider engagement remains the most persistent obstruction. Organizations expect their marketplace revenue to rise by 60% in 2026, but the survey shows that engagement from hyperscaler teams has not kept pace.

When participants ranked marketplace and co-sell challenges, provider engagement received the highest difficulty rating. 31% called it extremely challenging. Access to partner development was even more strained with 46% marking it extremely challenging. These scores reflect a pattern that many alliances teams encounter throughout the year. A relationship may be productive for one quarter and far less accessible the next, despite strong alignment on paper.

Survey commentary suggests that this inconsistency is not solely tied to individual relationships. Many respondents pointed to systemic factors inside the hyperscalers. Field resources frequently shift toward the largest partners or toward major strategic accounts, which can create attention gaps for everyone else. As priorities move, smaller teams often struggle to maintain visibility, even when they bring strong alignment or readiness.

This engagement gap affects multiple groups inside selling organizations. Seller support becomes unpredictable. Deal routing becomes harder to plan. Forecasts become more volatile. Taken together, these pain points create a bottleneck that limits the influence cloud providers can have on pipeline, even when intentions are aligned.

Teams that have strengthened their Cloud GTM programs often address this challenge through structure rather than improvisation. They develop internal roles that focus on hyperscaler management, maintain clear documentation for field teams, and adapt to engagement surges or slowdowns without losing momentum.

For leadership teams, this learning highlights the importance of resilience. Cloud GTM programs must be built with enough internal stability to navigate resource shifts at the hyperscalers while still capturing the upside of co-sell and marketplace activity. The organizations that invest in this discipline will have more predictable outcomes.

Learning 7: Multi-party transactions are rising across the marketplace ecosystem

Learning 7 at a glance:

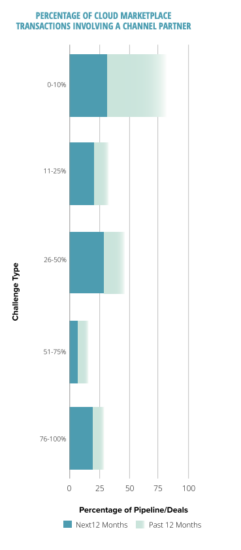

- 27% of marketplace transactions in the past year involved a channel partner

- That share is expected to reach 37% in the next 12 months

- 59% anticipate greater channel partner influence next year

- 33% consider channel partners mission-critical and 27% consider them critical

The final learning sheds light on a trend that has gathered steady momentum: the rise of channel partners in marketplace transactions. In the past 12 months, respondents reported that channel partners were part of an average of 27% of their marketplace deals. Over the next year, they expect that figure to climb to 37%.

This 10 point increase signals a broader shift in how marketplace transactions unfold. Buyers often involve trusted channel partners to coordinate the evaluation and purchasing process. These channel partners play varied roles, including contract guidance, budget interpretation, and fulfillment support.

Over half of respondents expect channel partner influence to increase next year, and they anticipate an average of 20% more opportunities to include a channel partner in their marketplace transactions. The survey data shows this rising importance clearly. When participants ranked partner types by strategic value, 33% described channel partners as mission-critical to their go-to-market strategy, and another 27% labeled them as critical. The only partner category that ranked higher was the cloud providers themselves.

This shift reflects a broader change in Cloud GTM maturity. As more organizations normalize marketplace purchasing, they are also expanding the ecosystem that supports those motions.

For companies building or refining their Cloud GTM programs, this learning suggests that marketplace strategy should incorporate channel alignment from the beginning. Teams that develop consistent playbooks for channel collaboration will find it easier to guide buyers through procurement steps, coordinate with hyperscaler teams, and strengthen the overall execution of marketplace deals.

What these three learnings mean for the year ahead

Taken together, Learnings 5, 6, and 7 reveal how Cloud GTM is widening in scope. Committed spend continues to provide the most reliable marketplace advantage. Provider engagement remains the biggest operational restraint. Channel partners are rising as essential participants in marketplace transactions.

These findings highlight where teams can gain immediate traction and where they may need to manage expectations in the future. The organizations that combine clear internal workflow design with strong partner alignment will be positioned to benefit most as marketplace and co-sell activity expands.

To explore the entire dataset and see how these findings connect to the first four learnings, you can review the full 2025 State of Cloud GTM Report here.